Question: answer all pleasw with solution 4,000,000 500,000 5,000,000 700,000 Problem 7-18 (AA) On December 31, 2020, Tamia Company showed the following balances: Bonds payable-6% Discount

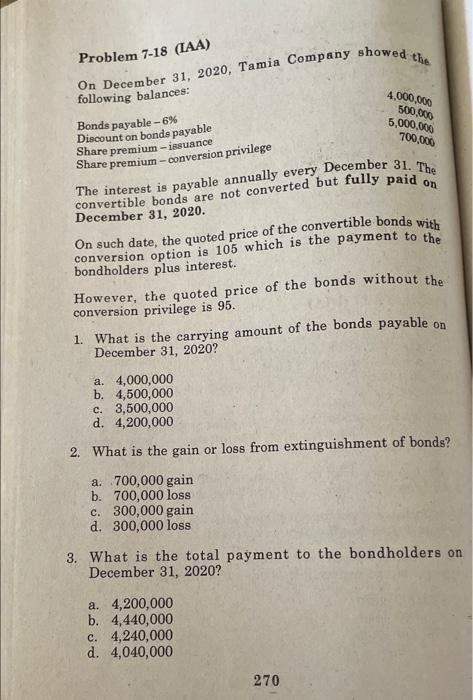

4,000,000 500,000 5,000,000 700,000 Problem 7-18 (AA) On December 31, 2020, Tamia Company showed the following balances: Bonds payable-6% Discount on bonds payable Share premium - issuance Share premium-conversion privilege The interest is payable annually every December 31. The convertible bonds are not converted but fully paid on December 31, 2020. On such date, the quoted price of the convertible bonds with conversion option is 105 which is the payment to the bondholders plus interest. However, the quoted price of the bonds without the conversion privilege is 95. 1. What is the carrying amount of the bonds payable on December 31, 2020? a. 4,000,000 b. 4,500,000 c. 3,500,000 d. 4,200,000 2. What is the gain or loss from extinguishment of bonds? a. 700,000 gain b. 700,000 loss c. 300,000 gain d. 300,000 loss 3. What is the total payment to the bondholders on December 31, 2020? a. 4,200,000 b. 4,440,000 c. 4,240,000 d. 4,040,000 270

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts