Question: answer all pls. will give thumbs up! ***** JULI PULSE. 3 points Save Answer Roger is considering buying an XYZ AA rated 7-year, 4.5% coupon

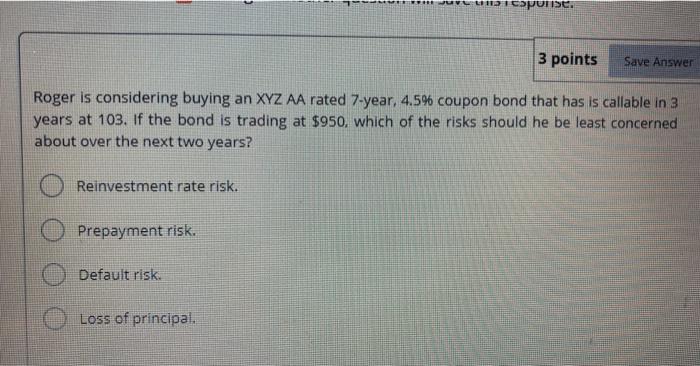

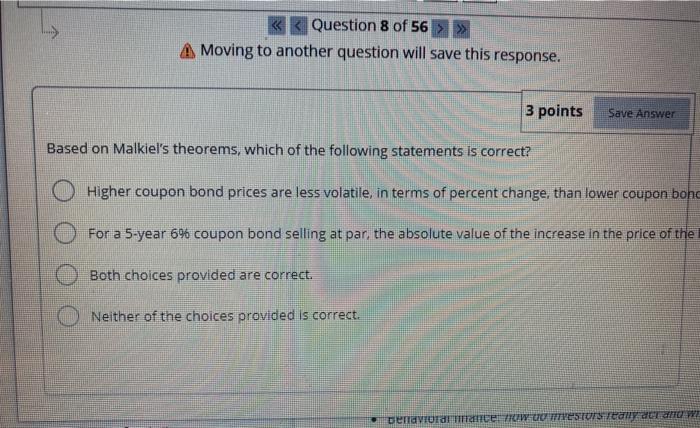

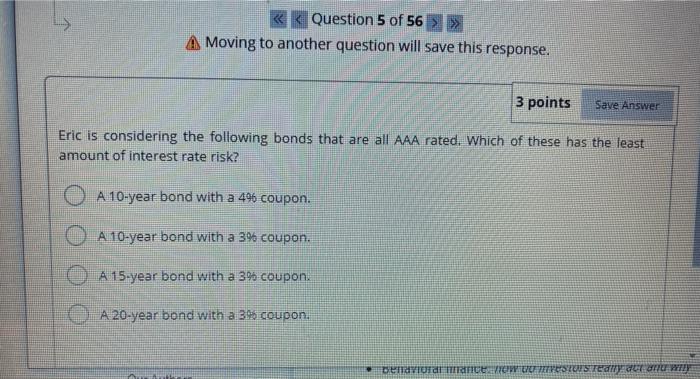

***** JULI PULSE. 3 points Save Answer Roger is considering buying an XYZ AA rated 7-year, 4.5% coupon bond that has is callable in 3 years at 103. If the bond is trading at $950, which of the risks should he be least concerned about over the next two years? Reinvestment rate risk. Prepayment risk. Default risk Loss of principal >> Moving to another question will save this response. 3 points Save Answer Based on Malkiel's theorems, which of the following statements is correct? O Higher coupon bond prices are less volatile, in terms of percent change, than lower coupon bond For a 5-year 6% coupon bond selling at par, the absolute value of the increase in the price of the Both choices provided are correct. Neither of the choices provided is correct. Demavitace ITUWCO VESTUSE TOWY Question 5 of 56 > >> Moving to another question will save this response. 3 points Save Answer Eric is considering the following bonds that are all AAA rated. Which of these has the least amount of interest rate risk? A 10-year bond with a 49 coupon. O A 10-year bond with a 3% coupon. A 15-year bond with a 39 coupon. A 20-year bond with a 30 coupon. Demiura TECIPUICHTPOSTOS TEU DI WIE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts