Question: answer all pretty please Using the data in the following table, which project adds the most value to the firm? 1) A 2) B 3)

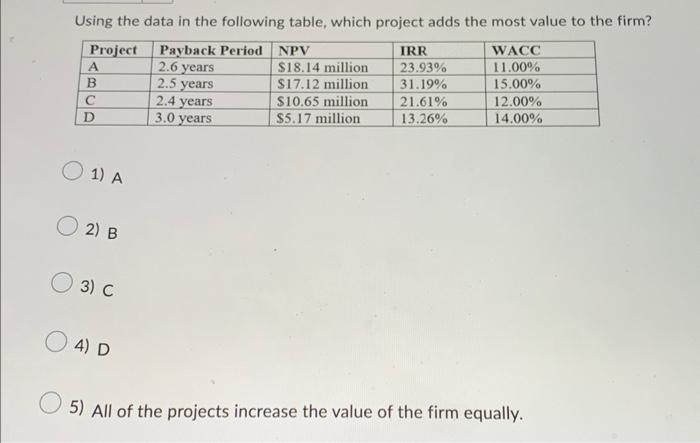

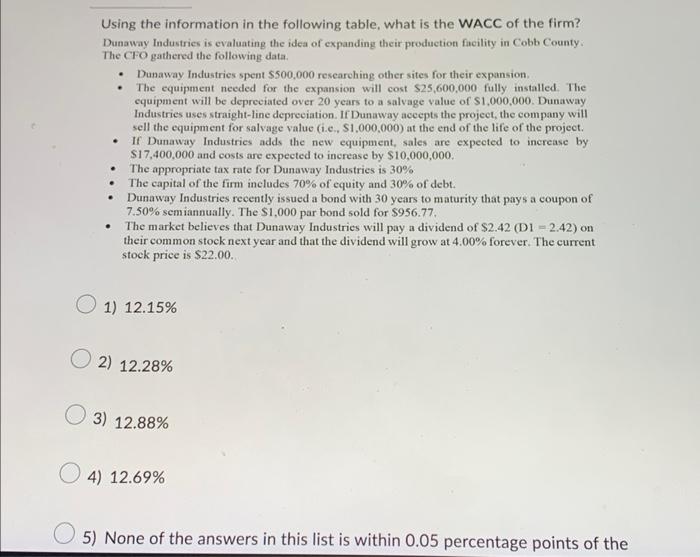

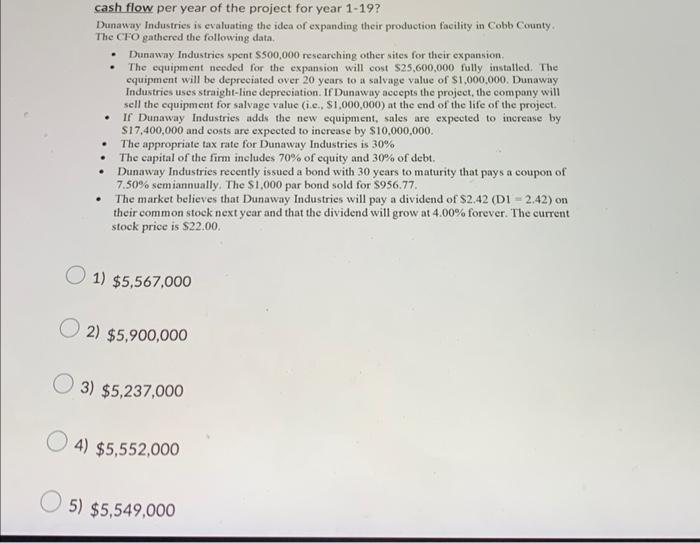

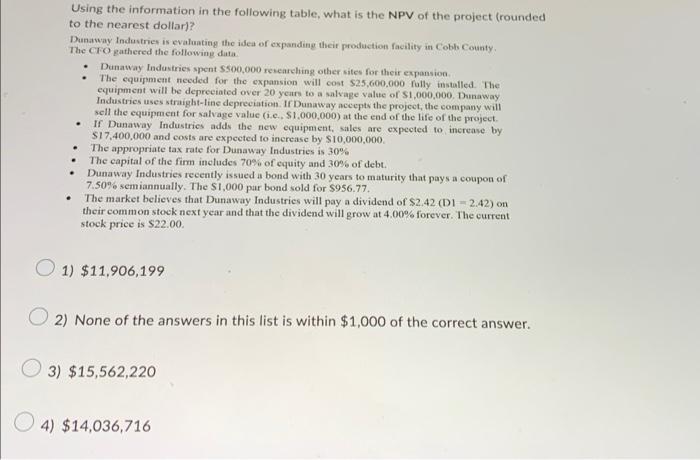

Using the data in the following table, which project adds the most value to the firm? 1) A 2) B 3) C 4) D 5) All of the projects increase the value of the firm equally. Using the information in the following table, what is the WACC of the firm? Dunaway Industrics is evaluating the idea of expanding their production facility in Cobb County. The CFO gathered the following data. - Dunaway Industries spent $500,000 researching other sites for their expansion. - The equipment needed for the expansion will cost $25,600,000 fully installed. The equipment will be depreciated over 20 years to a salvage value of $1,000,000. Dunaway Industries uses straight-line depreciation. If Dunaway aceepts the project, the company will sell the equipment for salvage value (i.e., S1,000,000) at the end of the life of the project. - If Dunaway Industries adds the new equipment, sales are expected to increase by $17,400,000 and costs are expected to increase by $10,000,000. - The appropriate tax rate for Dunaway Industrics is 30% - The capital of the firm includes 70% of equity and 30% of debt. - Dunaway Industries recently issued a bond with 30 years to maturity that pays a coupon of 7.50% semiannually. The $1,000 par bond sold for $956.77. - The market believes that Dunaway Industries will pay a dividend of $2.42(D1=2.42) on their common stock next year and that the dividend will grow at 4.00% forever. The current stock price is $22.00. 1) 12.15% 2) 12.28% 3) 12.88% 4) 12.69% 5) None of the answers in this list is within 0.05 percentage points of the cash flow per year of the project for year 1-19? Dunaway Industries is evaluating the idea of expanding their production facility in Cobb County. The CFO gathered the following data. - Dunaway Industries spent $500,000 researching other sites for their expansion. - The equipment needed for the expansion will cost $25,600,000 fully installed. The equipment will be depreciated over 20 years to a salvage value of $1,000,000. Dunaway Industries uses straight-line depreciation. If Dunaway aceepts the project, the company will sell the equipment for salvage value (i.e., $1,000,000 ) at the end of the life of the project. - If Dunaway Industries adds the new equipment, sales are expected to increase by $17,400,000 and costs are expected to increase by $10,000,000. - The appropriate tax rate for Dunaway Industrics is 30% - The capital of the firm includes 70% of equity and 30% of debt. - Dunaway Industries recently issued a bond with 30 years to maturity that pays a coupon of 7.50% sem iannually. The $1,000 par bond sold for $956.77. - The market believes that Dunaway Industries will pay a dividend of $2.42(D1=2.42) on their common stoek next year and that the dividend will grow at 4.00% forever. The current stock price is $22.00. 1) $5,567,000 2) $5,900,000 3) $5,237,000 4) $5,552,000 5) $5,549,000 Using the information in the following table, what is the NPV of the project (roundec to the nearest dollar)? Dunaway industrics is evaluating the idea of expanding their production facility in Cobls County. The CFO gathered the following data. - Dunaway Industries spent $500,000 researeling other sites for their expansion - The equipment neoded for the expansion will cost $25,600,000 folly installed. The equipment will be depreciated over 20 year to a salvage value of $1,000,000. Dunaway Industries uses straight-line depreciation. Ir Dunaway acepts the project, the company will sell the equipment for salvage value (i.e., $1,000,000) at the end of the life of the project. - If Dunaway Industries adds the new equipment, sales are expected to increave by $17,400,000 and costs are expected to increase by $10,000,000. - The appropriate tax rate for Dunaway Industrics is 30% - The capital of the firm includes 70% of equity and 30% of debt. - Dunaway Industries recently issued a bond with 30 years to maturity that pays a coupon of 7.50\% semiannually. The $1,000 par bond sold for $956.77. - The market belicves that Dunaway Industries will pay a dividend of $2.42 (D1 2.42) on their common stock next year and that the dividend will grow at 4.00% forever. The current stock price is $22.00. 1) $11,906,199 2) None of the answers in this list is within $1,000 of the correct answer. 3) $15,562,220 4) $14,036,716

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts