Question: answer all Problem 8-24 Payback, Discounted Payback, and NPV (LO1, 3) A firm is considering the following projects. Its opportunity cost of capital is 11%.

answer all

answer all

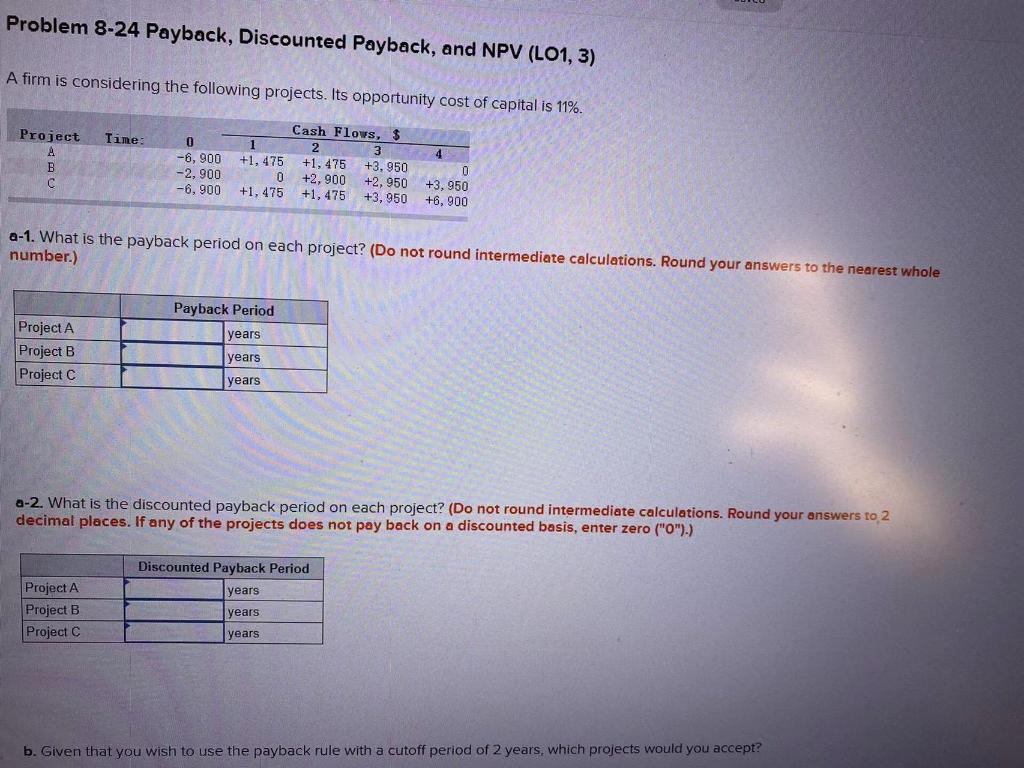

Problem 8-24 Payback, Discounted Payback, and NPV (LO1, 3) A firm is considering the following projects. Its opportunity cost of capital is 11%. Time: Project A B C 0 -6, 900 -2, 900 -6, 900 Cash Flows, $ 1 2 3 +1, 475 +1, 475 +3,950 0 +2,900 +2,950 +1, 475 +1, 475 +3,950 4 0 +3,950 +6,900 a-1. What is the payback period on each project? (Do not round intermediate calculations. Round your answers to the nearest whole number.) Payback Period years Project A Project B Project C years years a-2. What is the discounted payback period on each project? (Do not round intermediate calculations. Round your answers to 2 decimal places. If any of the projects does not pay back on a discounted basis, enter zero ("O").) Discounted Payback Period Project A Project B Project C years years years b. Given that you wish to use the payback rule with a cutoff period of 2 years, which projects would you accept? b. Given that you wish to use the payback rule with a cutoff period of 2 years, which projects would you accept? c. If you use a cutoff period of 3 years with the discounted payback rule, which projects would you accept? A d. Which projects have positive NPVs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts