Question: Answer all problems related to the question and explain answers. Jeff, an individual, owns all of the outstanding common stock in Macon Utilities Corporation. Jeff

Answer all problems related to the question and explain answers.

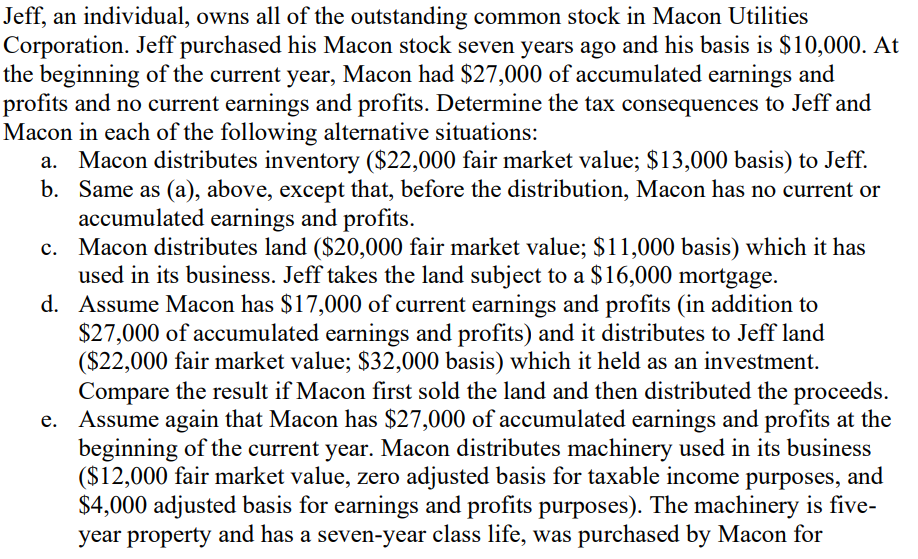

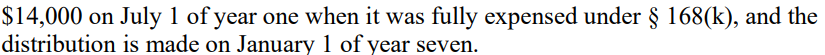

Jeff, an individual, owns all of the outstanding common stock in Macon Utilities Corporation. Jeff purchased his Macon stock seven years ago and his basis is $10,000. At the beginning of the current year, Macon had $27,000 of accumulated earnings and profits and no current earnings and profits. Determine the tax consequences to Jeff and Macon in each of the following alternative situations: a. Macon distributes inventory ($22,000 fair market value; $13,000 basis) to Jeff. b. Same as (a), above, except that, before the distribution, Macon has no current or accumulated earnings and profits. c. Macon distributes land ($20,000 fair market value; $11,000 basis) which it has used in its business. Jeff takes the land subject to a $ 16,000 mortgage. d. Assume Macon has $17,000 of current earnings and profits (in addition to $27,000 of accumulated earnings and profits) and it distributes to Jeff land ($22,000 fair market value; $32,000 basis) which it held as an investment. Compare the result if Macon first sold the land and then distributed the proceeds. e. Assume again that Macon has $27,000 of accumulated earnings and profits at the beginning of the current year. Macon distributes machinery used in its business ($12,000 fair market value, zero adjusted basis for taxable income purposes, and $4,000 adjusted basis for earnings and profits purposes). The machinery is five- year property and has a seven-year class life, was purchased by Macon for $14,000 on July 1 of year one when it was fully expensed under 168(k), and the distribution is made on January 1 of year seven

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts