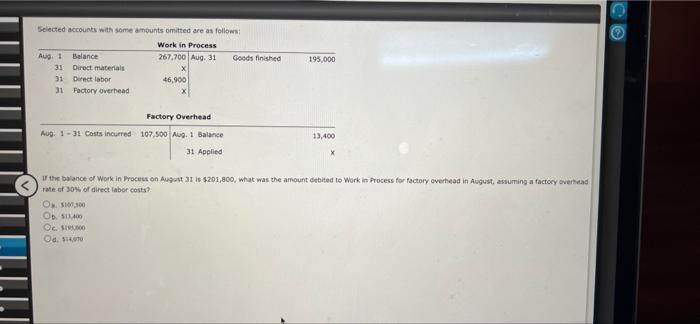

Question: answer all prompts correctly for a like. Selected accounts with some amounts omitted are as follows: Work in Process Aug. 1 Balance 267,700 Aug. 31

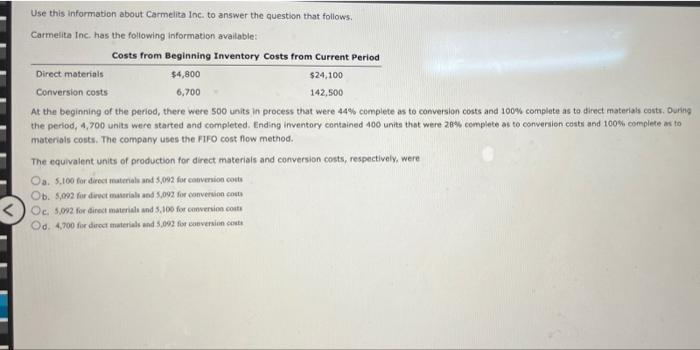

Selected accounts with some amounts omitted are as follows: Work in Process Aug. 1 Balance 267,700 Aug. 31 195,000 31 Direct materials 31 Direct labor 46,900 31 Factory overhead Factory Overhead Aug. 1-31 Costs incurred 107,500 Aug. 1 Balance 13,400 31 Applied If the balance of Work in Process on August 31 is $201,800, what was the amount debited to Work in Process for factory overhead in August, assuming a factory overhead rate of 30% of direct labor costs? O. $107,300 Ob. $13,400 Oc. $15,000 Od. $14,00 Goods finished Use this information about Carmelita Inc. to answer the question that follows. Carmelita Inc. has the following information available: Costs from Beginning Inventory Costs from Current Period Direct materials $4,800 6,700 $24,100 142,500 Conversion costs At the beginning of the period, there were 500 units in process that were 44% complete as to conversion costs and 100% complete as to direct materials costs. During the period, 4,700 units were started and completed. Ending inventory contained 400 units that were 20% complete as to conversion costs and 100% complete as to materials costs. The company uses the FIFO cost flow method. The equivalent units of production for direct materials and conversion costs, respectively, were Oa. 5,100 for direct materials and 5,092 for conversion costs Ob. 5,092 for direct materials and 5,092 for conversion costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts