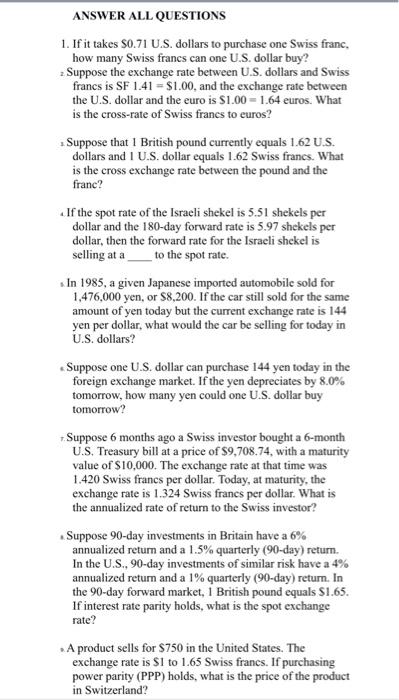

Question: ANSWER ALL QUESTIONS 1. If it takes $0.71 U.S. dollars to purchase one Swiss franc how many Swiss francs can one U.S. dollar buy? Suppose

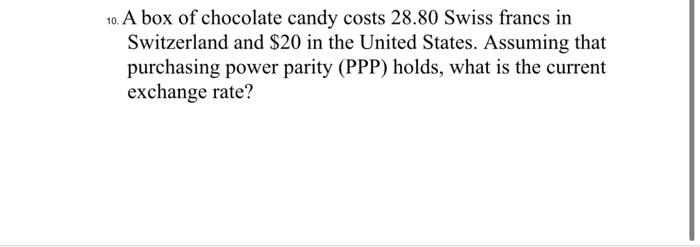

ANSWER ALL QUESTIONS 1. If it takes $0.71 U.S. dollars to purchase one Swiss franc how many Swiss francs can one U.S. dollar buy? Suppose the exchange rate between U.S. dollars and Swiss francs is SF 1.41 = $1.00, and the exchange rate between the U.S. dollar and the euro is $1.00 = 1.64 euros. What is the cross-rate of Swiss francs to euros? Suppose that 1 British pound currently equals 1.62 U.S. dollars and I U.S. dollar equals 1.62 Swiss francs. What is the cross exchange rate between the pound and the franc? If the spot rate of the Israeli shekel is 5.51 shekels per dollar and the 180-day forward rate is 5.97 shekels per dollar, then the forward rate for the Israeli shekel is selling at a to the spot rate. In 1985, a given Japanese imported automobile sold for 1,476,000 yen, or $8,200. If the car still sold for the same amount of yen today but the current exchange rate is 144 yen per dollar, what would the car be selling for today in U.S. dollars? Suppose one U.S. dollar can purchase 144 yen today in the foreign exchange market. If the yen depreciates by 8.0% tomorrow, how many yen could one U.S. dollar buy tomorrow? Suppose 6 months ago a Swiss investor bought a 6-month U.S. Treasury bill at a price of $9,708.74, with a maturity value of $10,000. The exchange rate at that time was 1.420 Swiss francs per dollar. Today, at maturity, the exchange rate is 1.324 Swiss francs per dollar. What is the annualized rate of return to the Swiss investor? Suppose 90-day investments in Britain have a 6% annualized retum and a 1.5% quarterly (90-day) return. In the U.S., 90-day investments of similar risk have a 4% annualized retum and a 1% quarterly (90-day) return. In the 90-day forward market, 1 British pound equals $1.65. If interest rate parity holds, what is the spot exchange rate? A product sells for $750 in the United States. The exchange rate is $1 to 1.65 Swiss francs. If purchasing power parity (PPP) holds, what is the price of the product in Switzerland? 10. A box of chocolate candy costs 28.80 Swiss francs in Switzerland and $20 in the United States. Assuming that purchasing power parity (PPP) holds, what is the current exchange rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts