Question: answer all questions 1. Problem 8.01 (Expected Return) eBook A stock's returns have the following distribution: Demand for the Company's Products Probability of this Rate

answer all questions

answer all questions

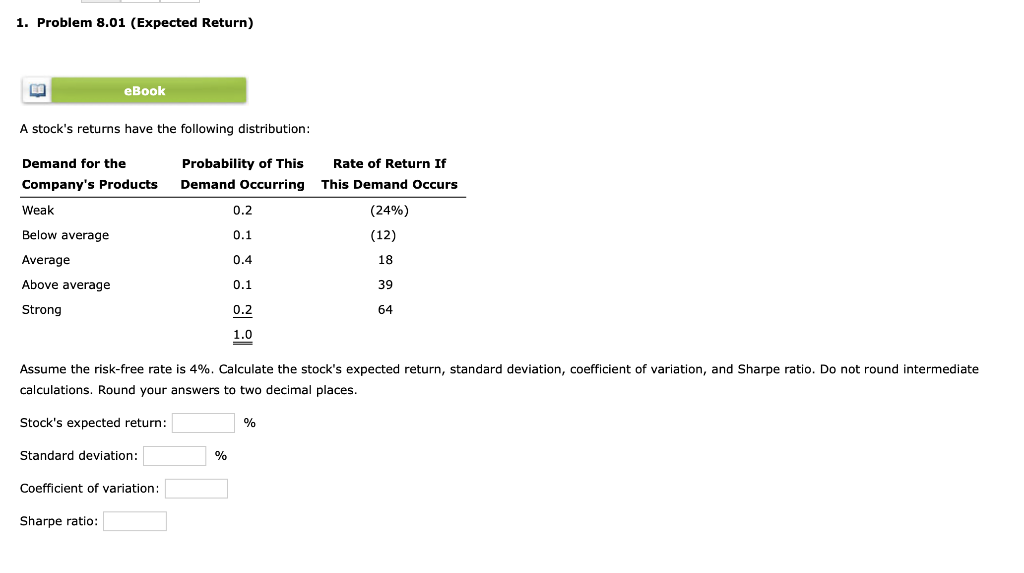

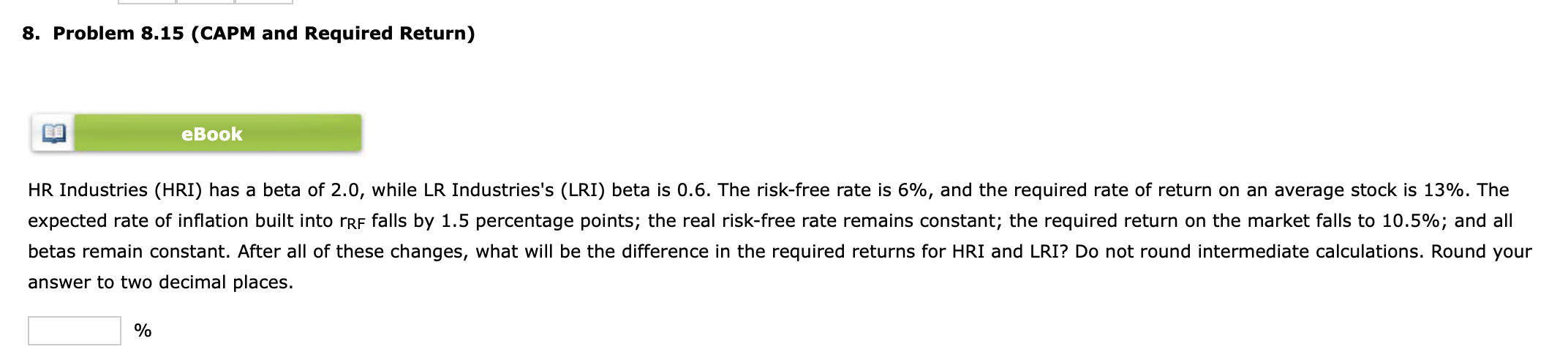

1. Problem 8.01 (Expected Return) eBook A stock's returns have the following distribution: Demand for the Company's Products Probability of this Rate of Return If Demand Occurring This Demand Occurs (24%) (12) Weak 0.2 Below average Average Above average Strong 0.2 1.0 Assume the risk-free rate is 4%. Calculate the stock's expected return, standard deviation, coefficient of variation, and Sharpe ratio. Do not round intermediate calculations. Round your answers to two decimal places. Stock's expected return: % Standard deviation: % Coefficient of variation: Sharpe ratio: 8. Problem 8.15 (CAPM and Required Return) eBook HR Industries (HRI) has a beta of 2.0, while LR Industries's (LRI) beta is 0.6. The risk-free rate is 6%, and the required rate of return on an average stock is 13%. The expected rate of inflation built into rri falls by 1.5 percentage points; the real risk-free rate remains constant; the required return on the market falls to 10.5%; and all betas remain constant. After all of these changes, what will be the difference in the required returns for HRI and LRI? Do not round intermediate calculations. Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts