Question: ANSWER ALL QUESTIONS (100 MARKS) 1. Compare and contrast foreign currency options and futures. Assess the situations when you may prefer one vs, the other

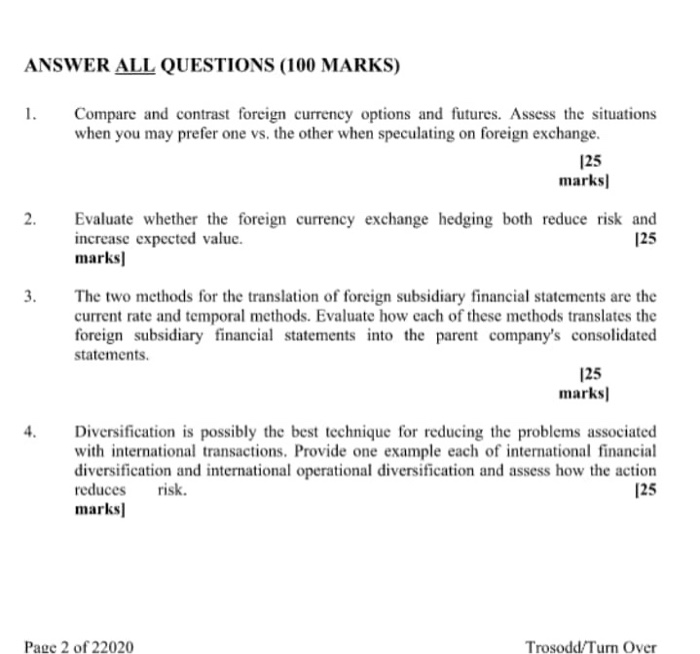

ANSWER ALL QUESTIONS (100 MARKS) 1. Compare and contrast foreign currency options and futures. Assess the situations when you may prefer one vs, the other when speculating on foreign exchange. 125 marks] Evaluate whether the foreign currency exchange hedging both reduce risk and increase expected value. 125 marks) 2. 3. The two methods for the translation of foreign subsidiary financial statements are the current rate and temporal methods. Evaluate how each of these methods translates the foreign subsidiary financial statements into the parent company's consolidated statements. 125 marks 4. Diversification is possibly the best technique for reducing the problems associated with international transactions. Provide one example each of international financial diversification and international operational diversification and assess how the action reduces risk. [25 marks) Page 2 of 22020 Trosodd/Turn Over

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts