Question: answer all questions #13-15 Question 13 (1 point) What is true about lending rates for development projects? There are lower interest rates for borrowing during

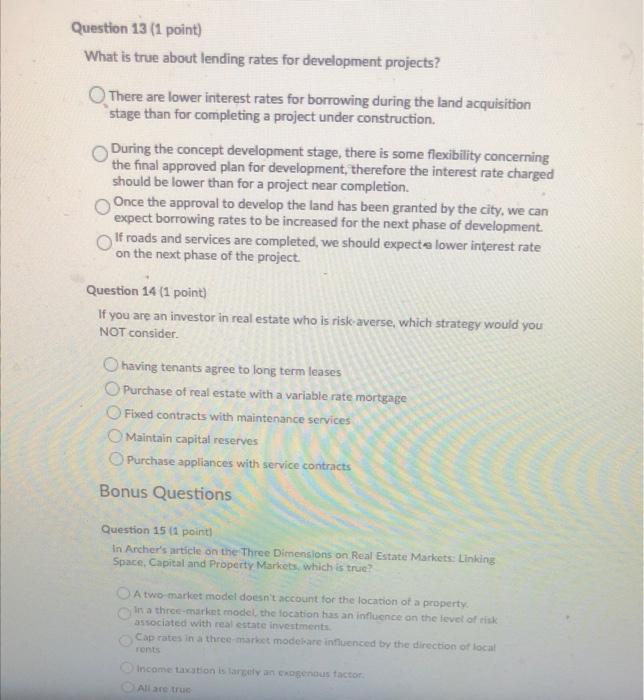

Question 13 (1 point) What is true about lending rates for development projects? There are lower interest rates for borrowing during the land acquisition stage than for completing a project under construction. During the concept development stage, there is some flexibility concerning the final approved plan for development, therefore the interest rate charged should be lower than for a project near completion Once the approval to develop the land has been granted by the city, we can expect borrowing rates to be increased for the next phase of development If roads and services are completed, we should expecte lower interest rate on the next phase of the project. Question 14 (1 point) If you are an investor in real estate who is risk-averse, which strategy would you NOT consider having tenants agree to long term leases Purchase of real estate with a variable rate mortgage Fixed contracts with maintenance services Maintain capital reserves Purchase appliances with service contracts Bonus Questions Question 15 11 point) In Archer's article on the Three Dimensions on Real Estate Markets: Linking Space, Capital and Property Markets which is true? A two market model doesn't account for the location of a property in a three-market model the location has an influence on the level of risk associated with real estate investments Caprates in a three market modelare influenced by the direction of local rents Income taxation is largely an xogenous factor All are true

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts