Question: Answer All Questions. (50 MARKS) Question 1 (25 marks) Weena Beauty Ltd was established on 30 June 2013 selling beauty products and giving beauty consultation.

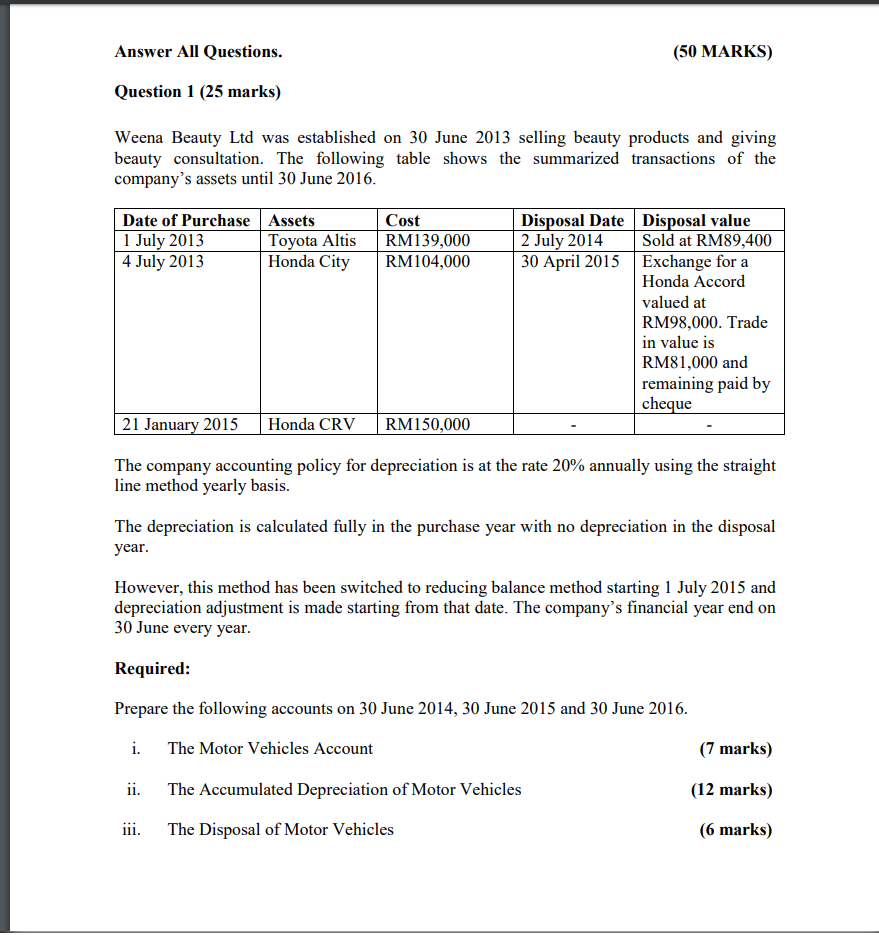

Answer All Questions. (50 MARKS) Question 1 (25 marks) Weena Beauty Ltd was established on 30 June 2013 selling beauty products and giving beauty consultation. The following table shows the summarized transactions of the company's assets until 30 June 2016. Date of Purchase Assets 1 July 2013 Toyota Altis 4 July 2013 Honda City Cost RM139,000 RM104,000 Disposal Date Disposal value 2 July 2014 Sold at RM89,400 30 April 2015 Exchange for a Honda Accord valued at RM98,000. Trade in value is RM81,000 and remaining paid by cheque 21 January 2015 Honda CRV RM150,000 The company accounting policy for depreciation is at the rate 20% annually using the straight line method yearly basis. The depreciation is calculated fully in the purchase year with no depreciation in the disposal year. However, this method has been switched to reducing balance method starting 1 July 2015 and depreciation adjustment is made starting from that date. The company's financial year end on 30 June every year. Required: Prepare the following accounts on 30 June 2014, 30 June 2015 and 30 June 2016. i. The Motor Vehicles Account (7 marks) (12 marks) ii. The Accumulated Depreciation of Motor Vehicles The Disposal of Motor Vehicles iii. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts