Question: Answer all questions. All questions carry equal points. Your answer MUST NOT BE more than five lines for each question. Answers more than five lines

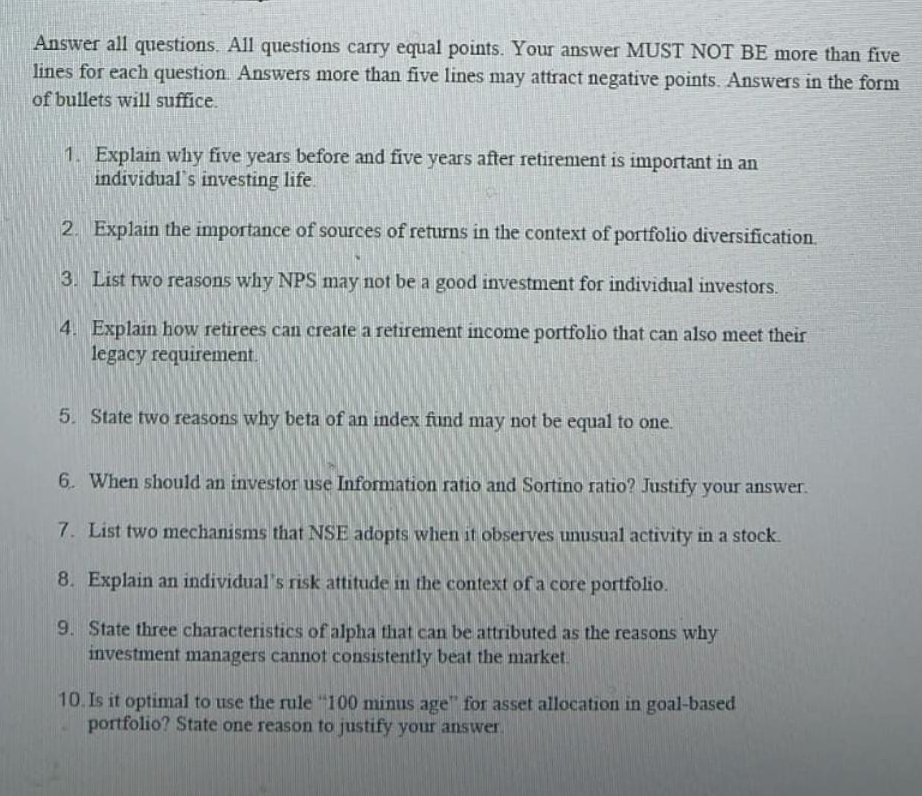

Answer all questions. All questions carry equal points. Your answer MUST NOT BE more than five lines for each question. Answers more than five lines may attract negative points. Answers in the form of bullets will suffice.

Explain why five years before and five years after retirement is important in an individual's investing life.

Explain the importance of sources of returns in the context of portfolio diversification.

List two reasons why NPS may not be a good investment for individual investors.

Explain how retirees can create a retirement income portfolio that can also meet their legacy requirement.

State two reasons why beta of an index fund may not be equal to one.

When should an investor use Information ratio and Sortino ratio? Justify your answer.

List two mechanisms that NSE adopts when it observes unusual activity in a stock.

Explain an individual's risk attitude in the context of a core portfolio.

State three characteristics of alpha that can be attributed as the reasons why investment managers cannot consistently beat the market.

Is it optimal to use the rule minus age" for asset allocation in goalbased portfolio? State one reason to justify your answer

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock