Question: Answer all questions and problems appearing on this examination under rules governing federal income taxation. Unless instructed otherwise, assume the relevant year to be 2

Answer all questions and problems appearing on this examination under rules governing federal income taxation. Unless instructed otherwise, assume the relevant year to be

truefalse statements appear below. You must answer all of them. For each statement you answer, insert T or F in the appropriate space on the separate answer sheet. A small cash stipend, $ for example, given by an employer to an employee at Christmas must be reported as gross income by the recipient employee.

Dividends received in excess of the cumulative amount of net premiums paid on a fully paid up life insurance policy generally are included in gross income of the policy holder..

To be classified as a "qualifying child, an individual must have the same place of abode as the taxpayer parent for the full tax year in question.

The exclusion for interest earned on US savings bonds used to finance higher education of the taxpayer is available only to the individual who purchased the bond.

An individual's excess capital loss amount may be carried over only for a period of five years.

The constructive receipt doctrine only applies to cash basis taxpayers.

The additional standard deduction for age will be allowed for an individual who dies before attaining age of if the individual would have been age before the close of the year of death.

If boot is received in an otherwise qualifying likekind exchange, the transaction will no longer qualify for exclusion.

A cash basis taxpayer who writes off a $ account receivable as a bad debt may claim a deduction on Form in the year of the writeoff.

A kickback or bribe is never deductible, even if the taxpayer can show that the payment meets the IRC tests for deductibility such as being both ordinary and necessary.

Under the "qualifying relative" test, a taxpayer is allowed a dependency deduction for each otherwise qualifying dependent whose gross income for the year is less than the exemption amount.

An IRC election is available for purchases of new or used otherwise qualifying property

The Internal Revenue Service operates under the Ombudsman Act, under which relief is provided to taxpayers who encounter procedural problems when dealing with IRS personnel.

The Fifteenth Amendment to the U S Constitution, addressing the direct tax controversy, was proposed by Congress in and ratified in

Charitable contributions of noncash property in excess of $ value are deductible only up to $ in amount.

A limited deduction maximum deduction of $ "from AGI" is permitted for a cash contribution to one of the two national Republican and Democrat political parties.

For purposes of the exclusion of gain on the sale of a principal residence, the two year period of residence must be continuous, with no extended gap periods.

The National Taxpayer Advocate is appointed by the Secretary of the Treasury

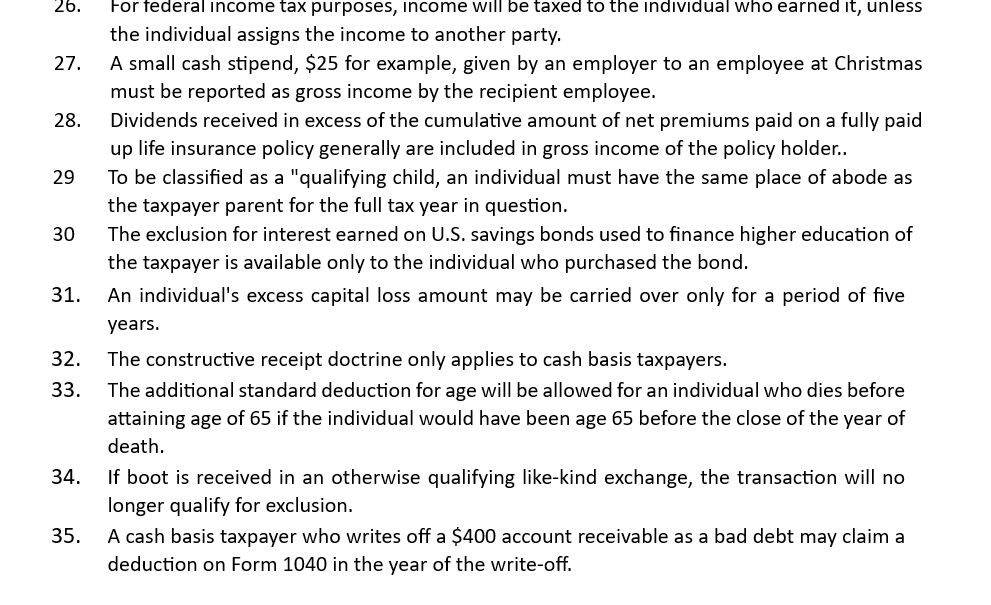

An employee may exclude from gross income all of the employer's PS premium cost of a group term life insurance policy if the policy face amount does not exceed $ For federal income tax purposes, income will be taxed to the individual who earned it unless the individual assigns the income to another party.

A small cash stipend, $ for example, given by an employer to an employee at Christmas must be reported as gross income by the recipient employee.

Dividends received in excess of the cumulative amount of net premiums paid on a fully paid up life insurance policy generally are included in gross income of the policy holder..

To be classified as a "qualifying child, an individual must have the same place of abode as the taxpayer parent for the full tax year in question.

The exclusion for interest earned on US savings bonds used to finance higher education of the taxpayer is available only to the individual who purchased the bond.

An individual's excess capital loss amount may be carried over only for a period of five years.

The constructive receipt doctrine only applies to cash basis taxpayers.

The additional standard deduction for age will be allowed for an individual who dies before attaining age of if the individual would have been age before the close of the year of death.

If boot is received in an otherwise qualifying likekind exchange, the transaction will no longer qualify for exclusion.

A cash basis taxpayer who writes off a $ account receivable as a bad debt may claim a deduction on Form in the year of the writeoff. A kickback or bribe is never deductible, even if the taxpayer can show that the payment meets the IRC tests for deductibility such as being both ordinary and necessary.

Under the "qualifying relative" test, a taxpayer is allowed a dependency deduction for each otherwise qualifying dependent whose gro

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock