Question: Answer all questions below: 1. Consider the following information: - Bank A gives the following quote: E:S1.2010-1.2060 Bank B gives the following quote: E:S

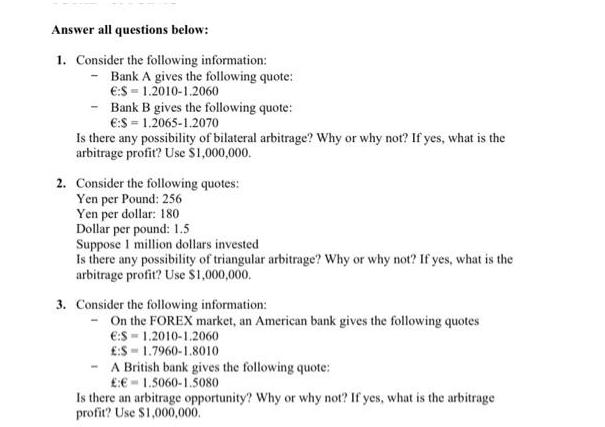

Answer all questions below: 1. Consider the following information: - Bank A gives the following quote: E:S1.2010-1.2060 Bank B gives the following quote: E:S 1.2065-1.2070 Is there any possibility of bilateral arbitrage? Why or why not? If yes, what is the arbitrage profit? Use $1,000,000. 2. Consider the following quotes: Yen per Pound: 256 Yen per dollar: 180 Dollar per pound: 1.5 Suppose 1 million dollars invested Is there any possibility of triangular arbitrage? Why or why not? If yes, what is the arbitrage profit? Use $1,000,000. 3. Consider the following information: - On the FOREX market, an American bank gives the following quotes E:S1.2010-1.2060 E:S 1.7960-1.8010 A British bank gives the following quote: 1.5060-1.5080 Is there an arbitrage opportunity? Why or why not? If yes, what is the arbitrage profit? Use $1,000,000.

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts