Question: Answer all questions completely. Marks will be given for clarity and intuition Q.1 Sketty plc is planning to raise additional capital to fund a major

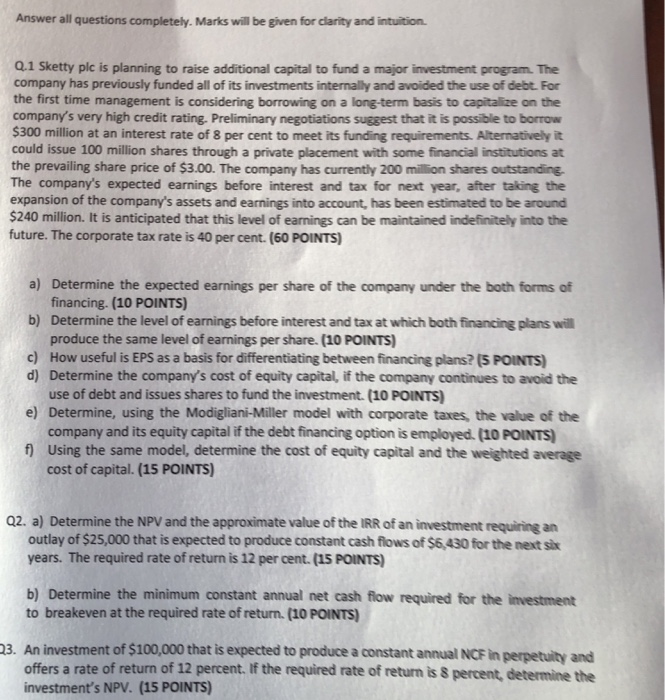

Answer all questions completely. Marks will be given for clarity and intuition Q.1 Sketty plc is planning to raise additional capital to fund a major investment program. The company has previously funded all of its investments internally and avoided the use of debt. For the first time management is considering borrowing on a long-term basis to capitalize on the company's very high credit rating. Preliminary negotiations suggest that it is possible to borrow $300 million at an interest rate of 8 per cent to meet its funding requirements. Alternatively it could issue 100 million shares through a private placement with some financial institutions at the prevailing share price of $3.00. The company has currently 200 million shares outstanding The company's expected earnings before interest and tax for next year, after taking the expansion of the company's assets and earnings into account, has been estimated to be around $240 milion. It is anticipated that this level of earnings can be maintained indefinitely into the future. The corporate tax rate is 40 per cent. (60 POINTS a) Determine the expected earnings per share of the company under the both forms of b) c) How useful is EPS as a basis for differentiating between financing plans? (S POINTS financing. (10 POINTS) Determine the level of earnings before interest and tax at which both financing plans will produce the same level of earnings per share. (10 POINTS d) Determine the company's cost of equity capital, if the company continues to avoid the e) Determine, using the Modigliani-Miller model with corporate taxes, the value of the f) Using the same model, determine the cost of equity capital and the weighted average use of debt and issues shares to fund the investment. (10 POINTS company and its equity capital if the debt financing option is employed. (10 POINTS) cost of capital. (15 POINTS Q2. a) Determine the NPV and the approximate value of the IRR of an investment requiring an outlay of $25,000 that is expected to produce constant cash flows of $6430 for the next six years. The required rate of return is 12 per cent.(15 POINTS) b) Determine the minimum constant annual net cash flow required for the investment to breakeven at the required rate of return. (10 POINTS) 03. An investment of $100,000 that is expected to produce a constant annual NCF in perpetuity and offers a rate of return of 12 percent. If the required rate of return is S percent, detemine the investment's NPV. (15 POINTS Answer all questions completely. Marks will be given for clarity and intuition Q.1 Sketty plc is planning to raise additional capital to fund a major investment program. The company has previously funded all of its investments internally and avoided the use of debt. For the first time management is considering borrowing on a long-term basis to capitalize on the company's very high credit rating. Preliminary negotiations suggest that it is possible to borrow $300 million at an interest rate of 8 per cent to meet its funding requirements. Alternatively it could issue 100 million shares through a private placement with some financial institutions at the prevailing share price of $3.00. The company has currently 200 million shares outstanding The company's expected earnings before interest and tax for next year, after taking the expansion of the company's assets and earnings into account, has been estimated to be around $240 milion. It is anticipated that this level of earnings can be maintained indefinitely into the future. The corporate tax rate is 40 per cent. (60 POINTS a) Determine the expected earnings per share of the company under the both forms of b) c) How useful is EPS as a basis for differentiating between financing plans? (S POINTS financing. (10 POINTS) Determine the level of earnings before interest and tax at which both financing plans will produce the same level of earnings per share. (10 POINTS d) Determine the company's cost of equity capital, if the company continues to avoid the e) Determine, using the Modigliani-Miller model with corporate taxes, the value of the f) Using the same model, determine the cost of equity capital and the weighted average use of debt and issues shares to fund the investment. (10 POINTS company and its equity capital if the debt financing option is employed. (10 POINTS) cost of capital. (15 POINTS Q2. a) Determine the NPV and the approximate value of the IRR of an investment requiring an outlay of $25,000 that is expected to produce constant cash flows of $6430 for the next six years. The required rate of return is 12 per cent.(15 POINTS) b) Determine the minimum constant annual net cash flow required for the investment to breakeven at the required rate of return. (10 POINTS) 03. An investment of $100,000 that is expected to produce a constant annual NCF in perpetuity and offers a rate of return of 12 percent. If the required rate of return is S percent, detemine the investment's NPV. (15 POINTS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts