Question: answer all questions correctly for a like. Question 2 (0.2 points) What's the present value of a perpetuity that pays $5000 per year if the

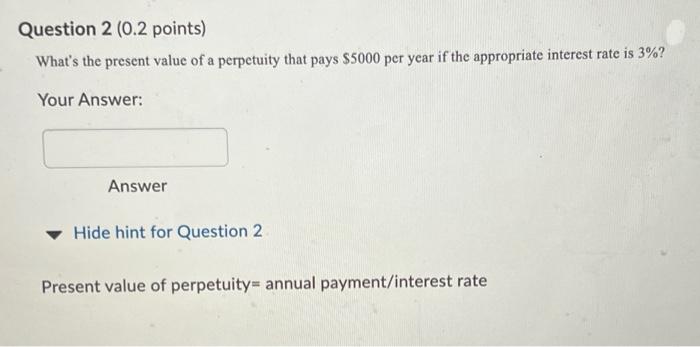

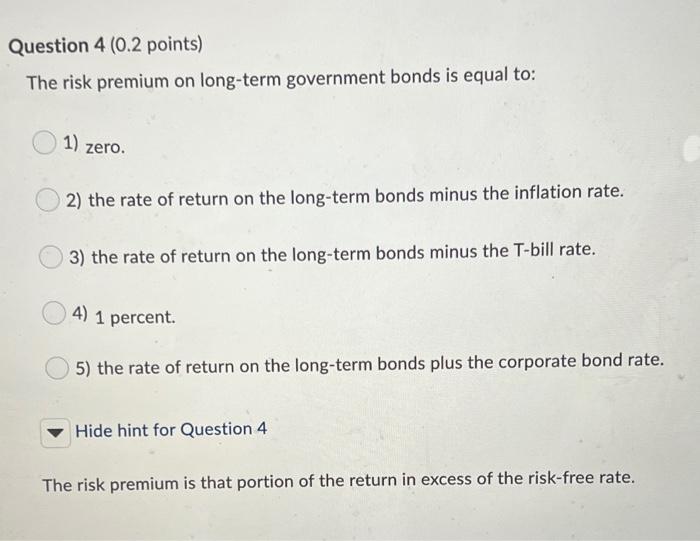

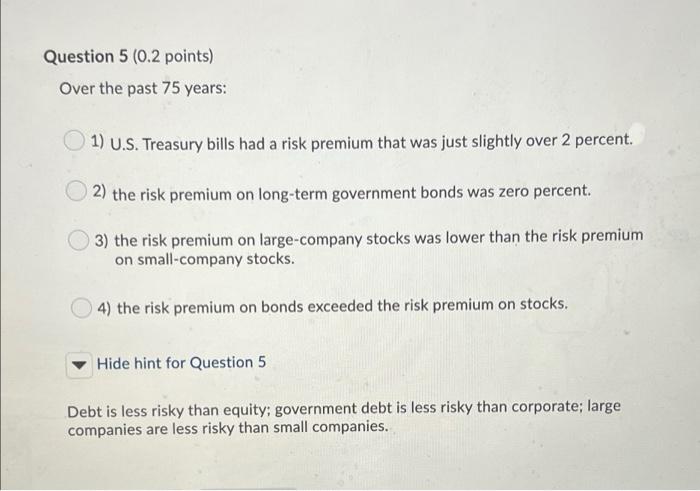

Question 2 (0.2 points) What's the present value of a perpetuity that pays $5000 per year if the appropriate interest rate is 3%? Your Answer: Answer Hide hint for Question 2 Present value of perpetuity= annual payment/interest rate Question 4 (0.2 points) The risk premium on long-term government bonds is equal to: 1) zero. 2) the rate of return on the long-term bonds minus the inflation rate. 3) the rate of return on the long-term bonds minus the T-bill rate. 4) 1 percent. 5) the rate of return on the long-term bonds plus the corporate bond rate. Hide hint for Question 4 The risk premium is that portion of the return in excess of the risk-free rate. Question 5 (0.2 points) Over the past 75 years: 1) U.S. Treasury bills had a risk premium that was just slightly over 2 percent. 2) the risk premium on long-term government bonds was zero percent. 3) the risk premium on large company stocks was lower than the risk premium on small-company stocks. 4) the risk premium on bonds exceeded the risk premium on stocks. Hide hint for Question 5 Debt is less risky than equity; government debt is less risky than corporate; large companies are less risky than small companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts