Question: answer all questions correctly for a like. Question 6 (0.2 points) Over the past 75 years, which one of the following investment classes had the

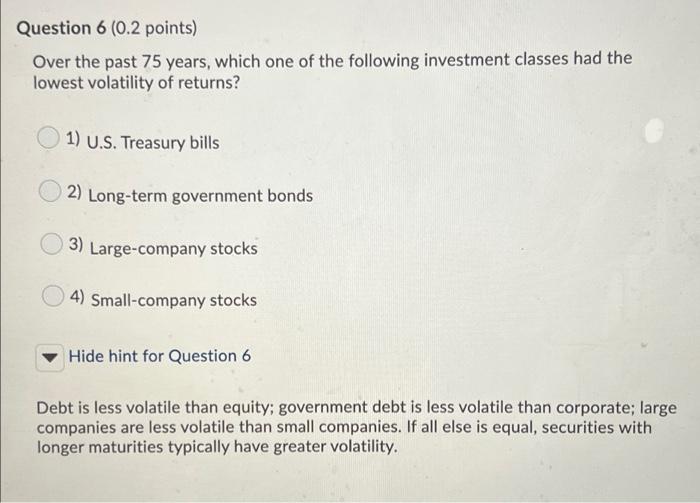

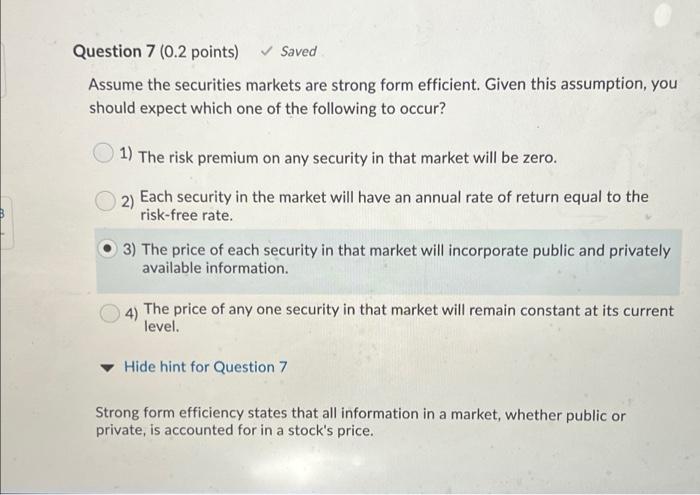

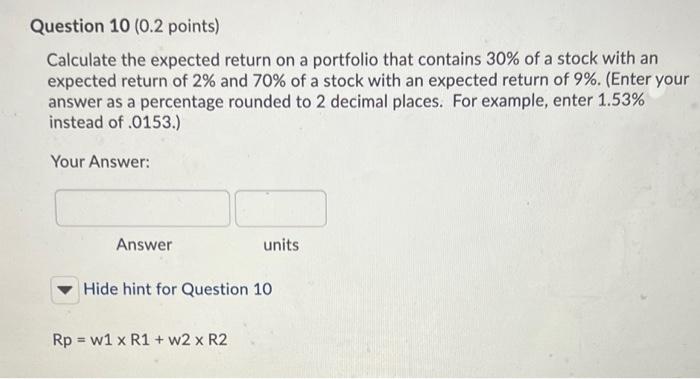

Question 6 (0.2 points) Over the past 75 years, which one of the following investment classes had the lowest volatility of returns? 1) U.S. Treasury bills 2) Long-term government bonds 3) Large-company stocks 4) Small-company stocks Hide hint for Question 6 Debt is less volatile than equity; government debt is less volatile than corporate; large companies are less volatile than small companies. If all else is equal, securities with longer maturities typically have greater volatility. Question 7 (0.2 points) Saved Assume the securities markets are strong form efficient. Given this assumption, you should expect which one of the following to occur? 1) The risk premium on any security in that market will be zero. 2) Each security in the market will have an annual rate of return equal to the risk-free rate. 3) The price of each security in that market will incorporate public and privately available information. 4) The price of any one security in that market will remain constant at its current level. Hide hint for Question 7 Strong form efficiency states that all information in a market, whether public or private, is accounted for in a stock's price. Question 10 (0.2 points) Calculate the expected return on a portfolio that contains 30% of a stock with an expected return of 2% and 70% of a stock with an expected return of 9%. (Enter your answer as a percentage rounded to 2 decimal places. For example, enter 1.53% instead of .0153.) Your Answer: Answer units Hide hint for Question 10 Rp = w1 x R1 + 2 x R2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts