Question: answer all questions correctly for a like. Question 7 (0.2 points) The cash flows associated with an investment project are an immediate cost of $2700

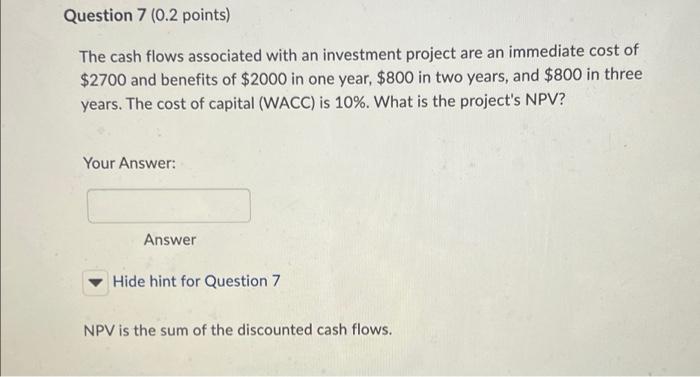

Question 7 (0.2 points) The cash flows associated with an investment project are an immediate cost of $2700 and benefits of $2000 in one year, $800 in two years, and $800 in three years. The cost of capital (WACC) is 10%. What is the project's NPV? Your Answer: Answer Hide hint for Question 7 NPV is the sum of the discounted cash flows. Question 11 (0.2 points) Calculate the net debt of a firm with a market capitalization (market value of equity) of $50 Billion, market value of debt of $30 Billion, and $2 Billion in cash and equivalents. [Note: Enter your answer in Billions; for example, if you calculate the net debt to be $10 Billion, then enter just 10 in the answer box.) Your Answer: Answer Hide hint for Question 11 net debt = market value of debt - cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts