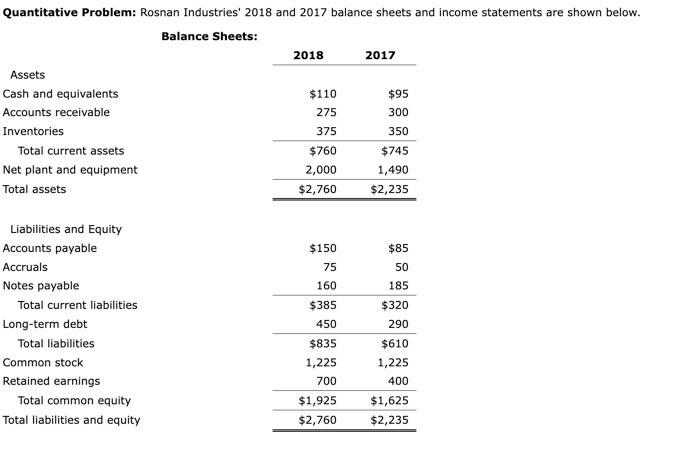

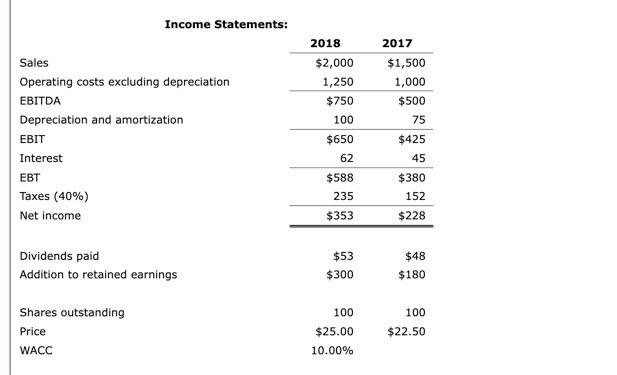

Question: answer all questions correctly Quantitative Problem: Rosnan Industries' 2018 and 2017 balance sheets and income statements are shown below. Income Statements: What is the firm's

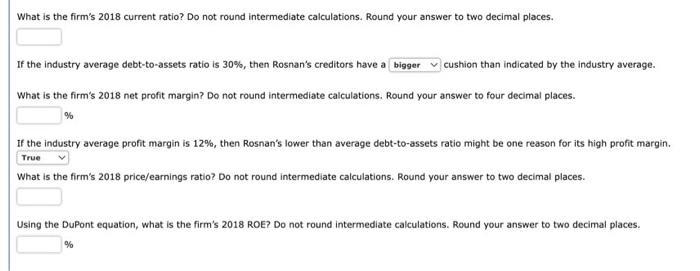

Quantitative Problem: Rosnan Industries' 2018 and 2017 balance sheets and income statements are shown below. Income Statements: What is the firm's 2018 current ratio? Do not round intermediate calculations. Round your answer to two decimal places. If the industry average debt-to-assets ratio is 30%, then Rosnan's creditors have a cushion than indicated by the industry average. What is the firm's 2018 net profit margin? Do not round intermediate calculations. Round your answer to four decimal places. % If the industry average profit margin is 12%, then Rosnan's lower than average debt-to-assets ratio might be one reason for its high profit margin. What is the firm's 2018 price/earnings ratio? Do not round intermediate calculations. Round your answer to two decimal places. Using the DuPont equation, what is the firm's 2018 ROE? Do not round intermediate calculations. Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts