Question: ANSWER ALL QUESTIONS FOR 5 STAR REVIEW QUESTION - #1 WILD FISH reported the following results for the year ended December 31, 2020, its first

ANSWER ALL QUESTIONS FOR 5 STAR REVIEW

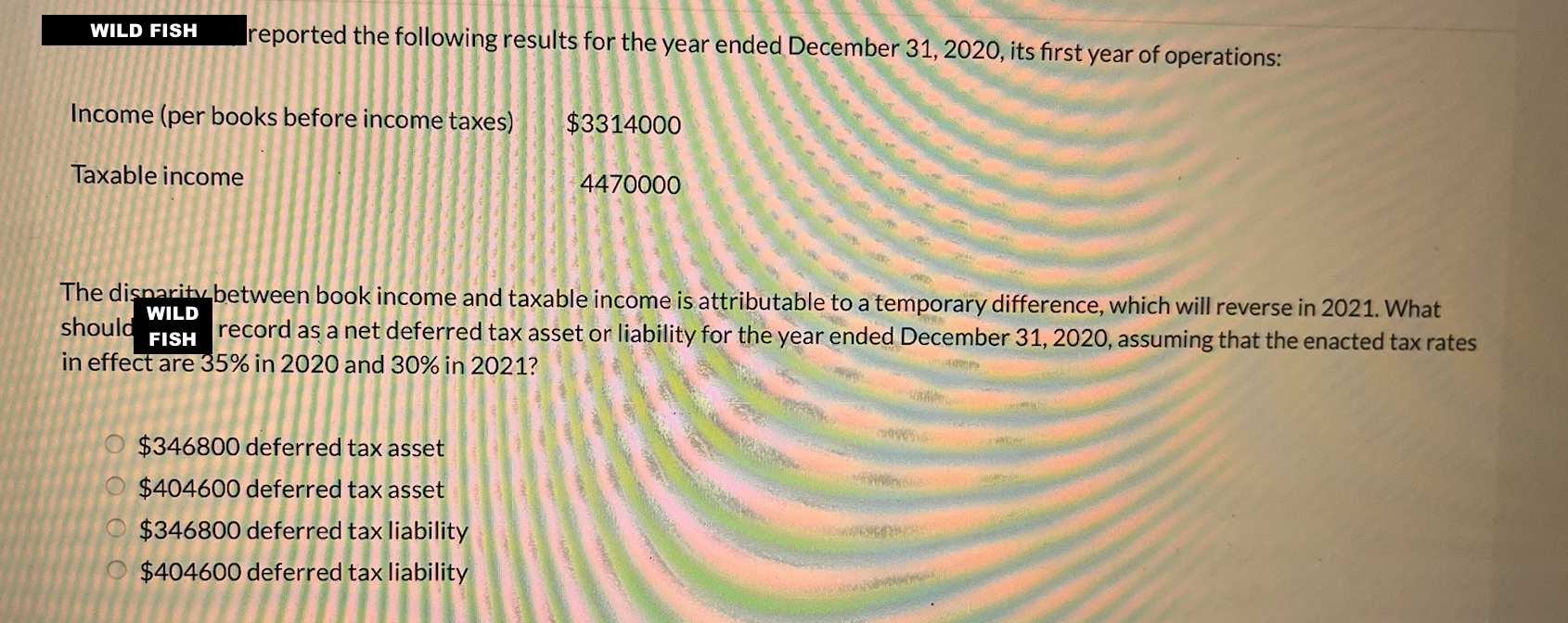

QUESTION - #1

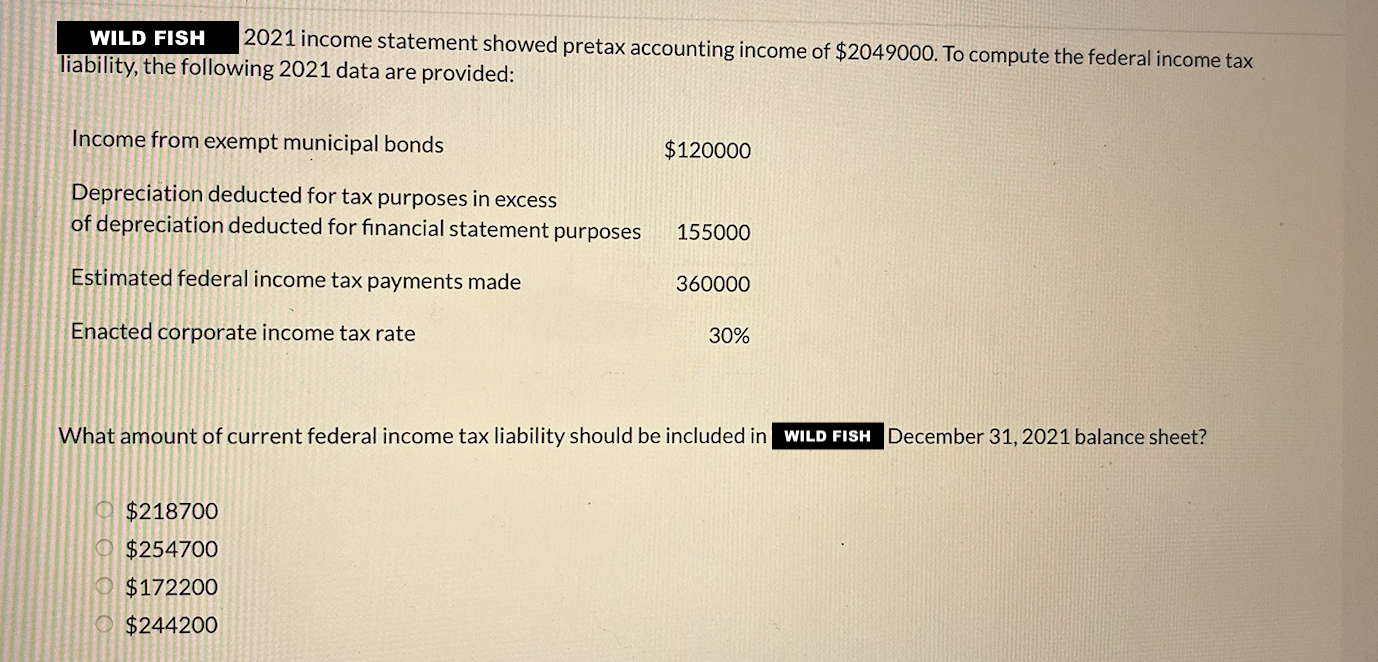

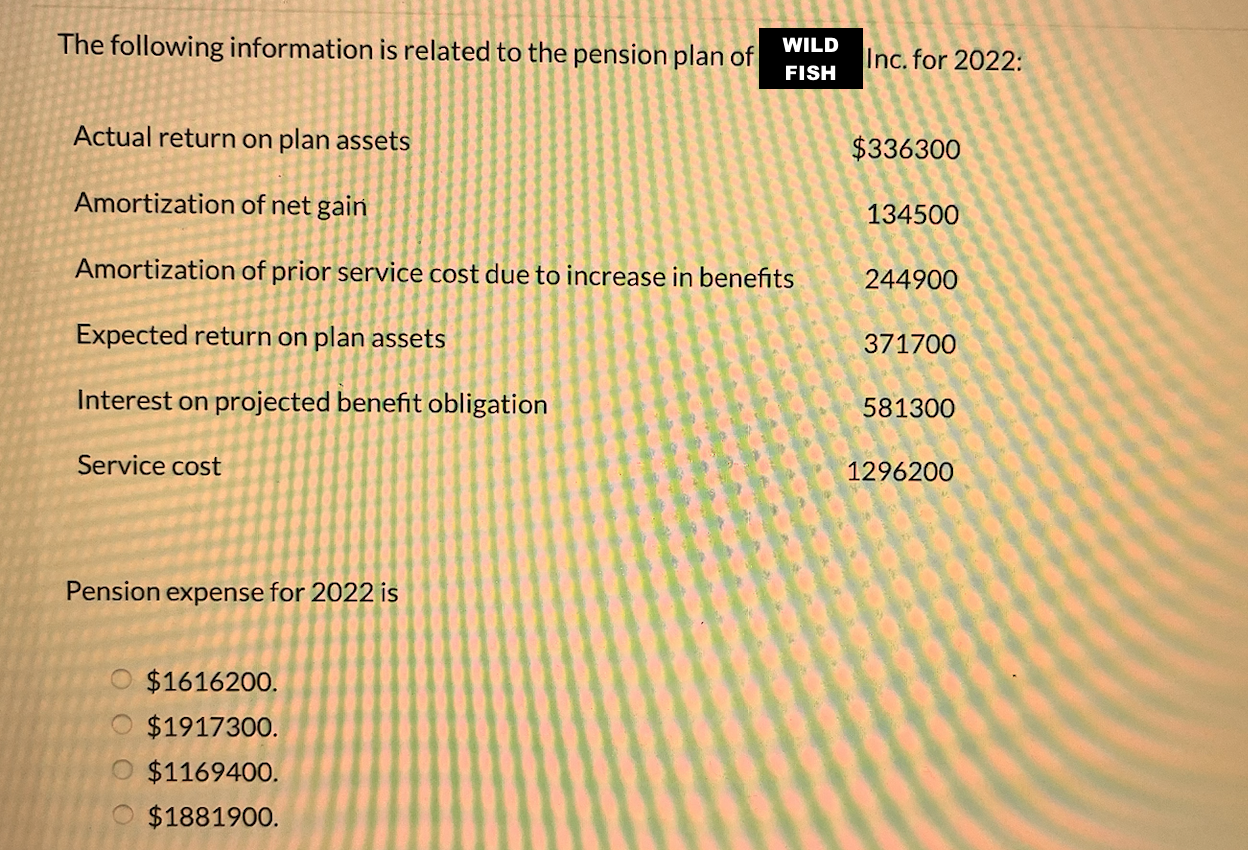

WILD FISH reported the following results for the year ended December 31, 2020, its first year of operations: Income (per books before income taxes) $3314000 Taxable income 4470000 The disparity between book income and taxable income is attributable to a temporary difference, which will reverse in 2021. What WILD should FISH record as a net deferred tax asset or liability for the year ended December 31, 2020, assuming that the enacted tax rates in effect are 35% in 2020 and 30% in 2021? $346800 deferred tax asset $404600 deferred tax asset $346800 deferred tax liability $404600 deferred tax liabilityWILD FISH 2021 income statement showed pretax accounting income of $2049000. To compute the federal income tax liability, the following 2021 data are provided: Income from exempt municipal bonds $120000 Depreciation deducted for tax purposes in excess of depreciation deducted for financial statement purposes 155000 Estimated federal income tax payments made 360000 Enacted corporate income tax rate 30% What amount of current federal income tax liability should be included in WILD FISH December 31, 2021 balance sheet? $218700 $254700 $172200 $244200The following information is related to the pension plan of WILD FISH Inc. for 2022: Actual return on plan assets $336300 Amortization of net gain 134500 Amortization of prior service cost due to increase in benefits 244900 Expected return on plan assets 371700 Interest on projected benefit obligation 581300 Service cost 1296200 Pension expense for 2022 is $1616200. $1917300. O $1169400. $1881900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts