Question: answer all questions for a thumbs up On August 1, 2011, Bonnle purchased $15.500 of Huber Co's 10%,16-year bonds at face value. Huber Co. has

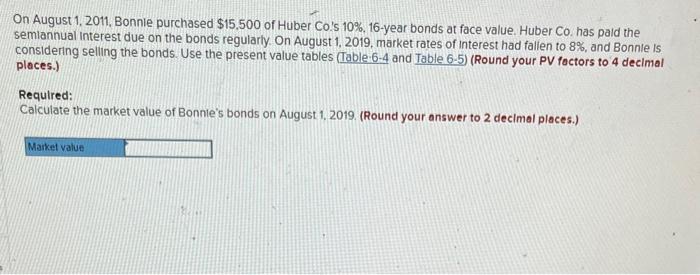

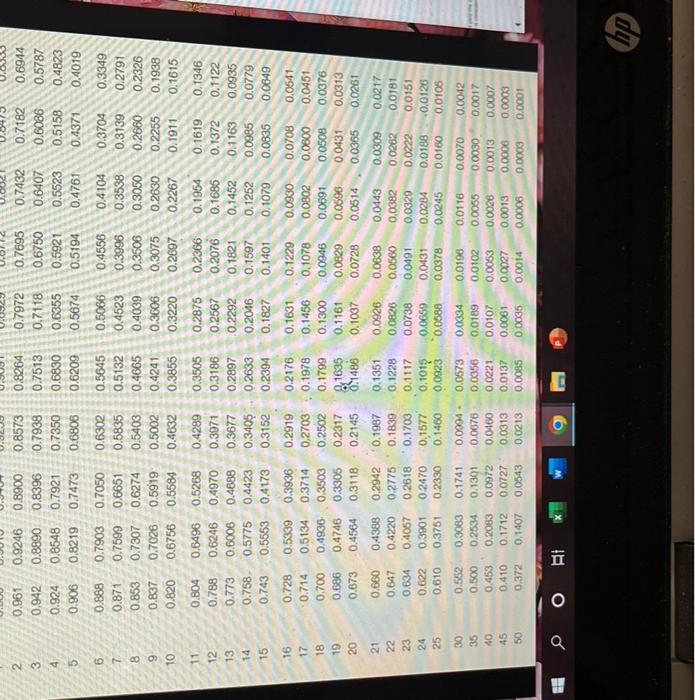

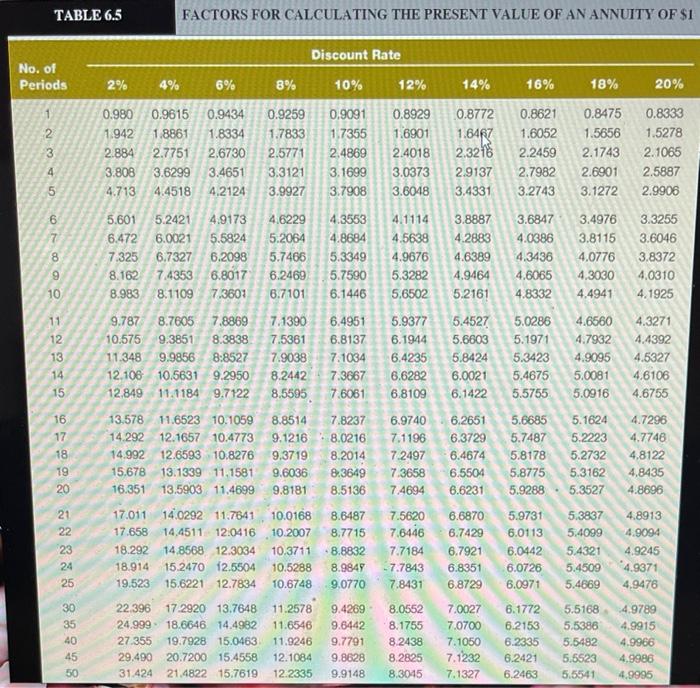

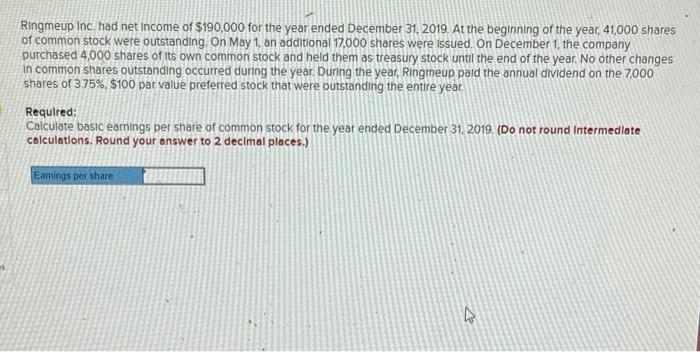

On August 1, 2011, Bonnle purchased $15.500 of Huber Co's 10%,16-year bonds at face value. Huber Co. has paid the semiannual interest due on the bonds regularly. On August 1, 2019, market rates of Interest had fallen to 8%, and Bonnle is considering selling the bonds. Use the present value tables (Table.6-4 and Table 6-5) (Round your PV factors to 4 decimal places.) Required: Calculate the market value of Bonnie's bonds on August 1, 2019. (Round your answer to 2 decimal places.) TABLE 6.5 FACTORS FOR CALCULATING THE PRESENT VALUE OF AN ANNUTTY OF \$1 Ringmeup inc. had net income of $190,000 for the year ended December 31.2019. At the beginning of the year, 41,000 shares of common stock were outstanding. On May 1 , an additional 17,000 shares were issued. On December 1 , the company purchased 4.000 shares of its own common stock and held them as treasury stock until the end of the year. No other changes in common shares outstanding occurred during the year. During the year, Ringmeup pard the annual dividend on the 7,000 shares of 375%,$100 par value preferred stock that were outstanding the entire year. Required: Calculate basic earnings per share of common stock for the year ended December 31, 2019. (Do not round intermedlate calculetions. Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts