Question: Answer ALL questions from this section. QUESTION 1 True or False? Explain briefly. i. The CAPM implies that the expected return on an investment with

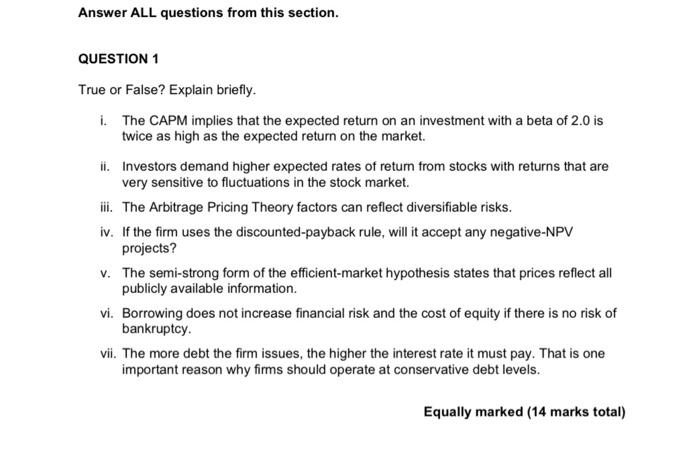

Answer ALL questions from this section. QUESTION 1 True or False? Explain briefly. i. The CAPM implies that the expected return on an investment with a beta of 2.0 is twice as high as the expected return on the market. ii. Investors demand higher expected rates of retum from stocks with returns that are very sensitive to fluctuations in the stock market. iii. The Arbitrage Pricing Theory factors can reflect diversifiable risks. iv. If the firm uses the discounted-payback rule, will it accept any negative-NPV projects? V. The semi-strong form of the efficient-market hypothesis states that prices reflect all publicly available information. vi. Borrowing does not increase financial risk and the cost of equity if there is no risk of bankruptcy vii. The more debt the firm issues, the higher the interest rate it must pay. That is one important reason why firms should operate at conservative debt levels. Equally marked (14 marks total)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts