Question: answer all questions, i will give u a thumb! 3. You observe the following three Government of Canada noncallable bonds in the market Coupon Rate

answer all questions, i will give u a thumb!

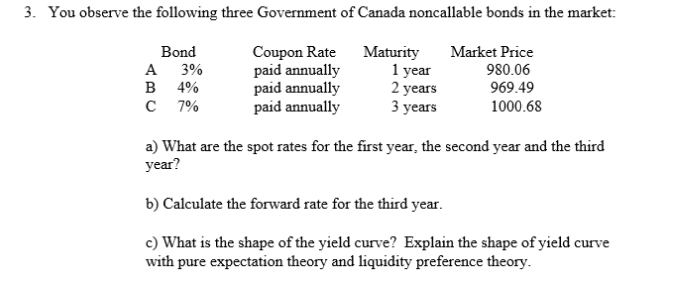

3. You observe the following three Government of Canada noncallable bonds in the market Coupon Rate paid annually paid annually paid annually Bond Maturity 1 year 2 years 3 years Market Price A 3% 980.06 4% C 7% 969.49 1000.68 a) What are the spot rates for the first year, the second year and the third year? b) Calculate the forward rate for the third year e) What is the shape of the yield curve? Explain the shape of yield curve with pure expectation theory and liquidity preference theory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts