Question: ANSWER ALL QUESTIONS IN AN EXCEL SPREADSHEET (ONE SHEET ONLY).YOU MUST SHOW ALL WORKING AND EXPLAIN YOUR ANSWERS CLEARLY [12 marks] A firm is considering

ANSWER ALL QUESTIONS IN AN EXCEL SPREADSHEET (ONE SHEET ONLY).YOU MUST SHOW ALL WORKING AND EXPLAIN YOUR ANSWERS CLEARLY

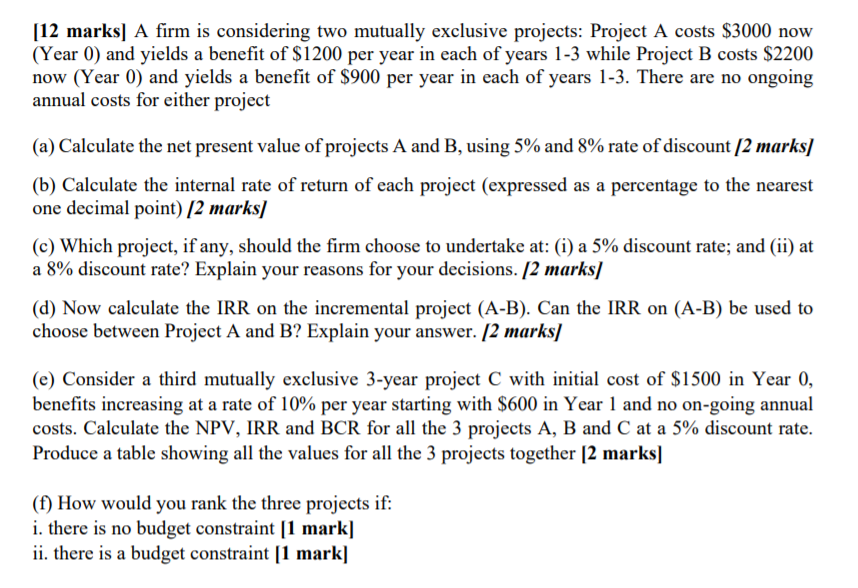

[12 marks] A firm is considering two mutually exclusive projects: Project A costs $3000 now (Year 0) and yields a benefit of $1200 per year in each of years 1-3 while Project B costs $2200 now (Year () and yields a benefit of $900 per year in each of years 1-3. There are no ongoing annual costs for either project (a) Calculate the net present value of projects A and B, using 5% and 8% rate of discount [2 marks] (b) Calculate the internal rate of return of each project (expressed as a percentage to the nearest one decimal point) (2 marks] (c) Which project, if any, should the firm choose to undertake at: (i) a 5% discount rate; and (ii) at a 8% discount rate? Explain your reasons for your decisions. [2 marks] (d) Now calculate the IRR on the incremental project (A-B). Can the IRR on (A-B) be used to choose between Project A and B? Explain your answer. [2 marks] (e) Consider a third mutually exclusive 3-year project C with initial cost of $1500 in Year 0, benefits increasing at a rate of 10% per year starting with $600 in Year 1 and no on-going annual costs. Calculate the NPV, IRR and BCR for all the 3 projects A, B and C at a 5% discount rate. Produce a table showing all the values for all the 3 projects together [2 marks] (f) How would you rank the three projects if: i. there is no budget constraint [1 mark] ii. there is a budget constraint [1 mark]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts