Question: Answer ALL questions in this paper. [20 Marks] QUESTION 1 1.1 Explain THREE (3) major goals of financial management. (6 marks) 1.2 In establishing a

![Answer ALL questions in this paper. [20 Marks] QUESTION 1 1.1](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe5326a5fe0_46266fe532643036.jpg)

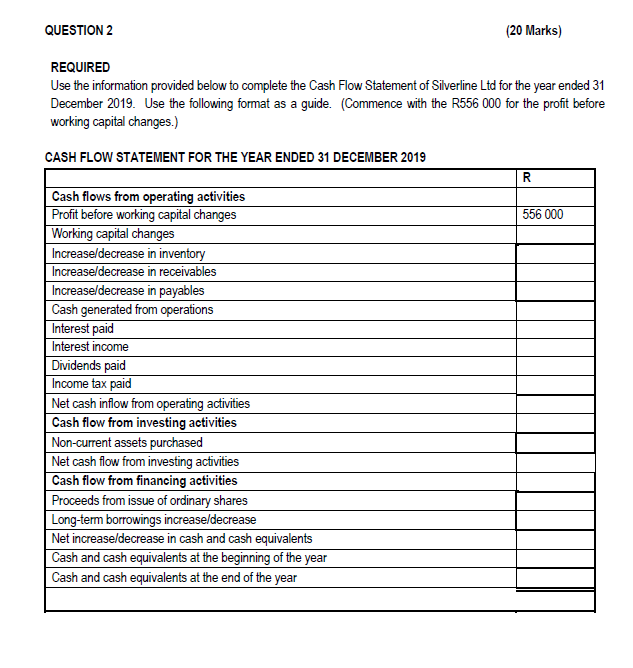

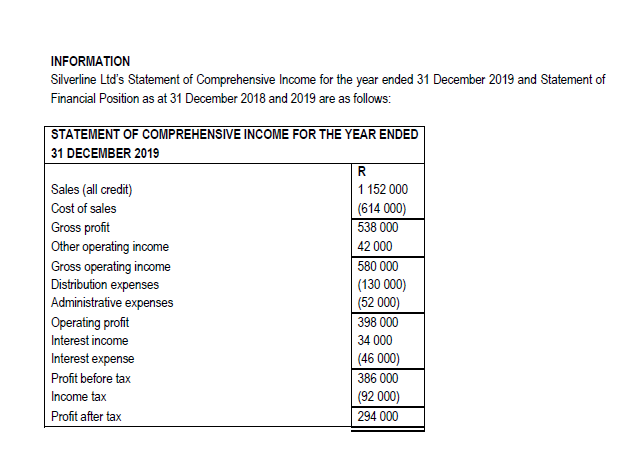

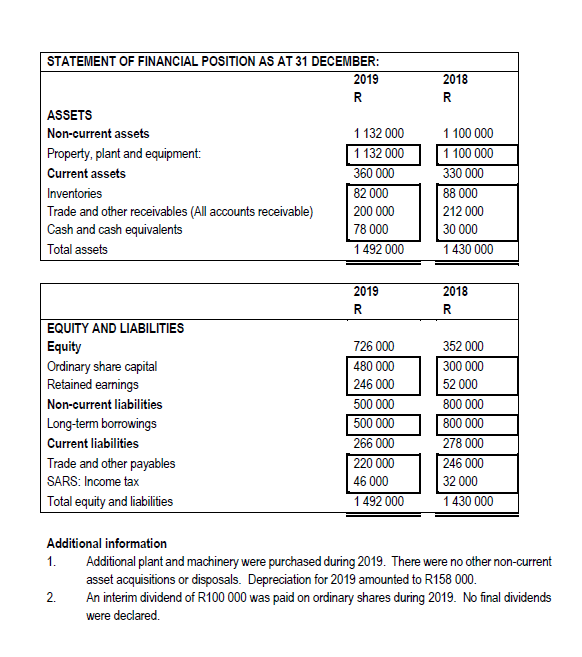

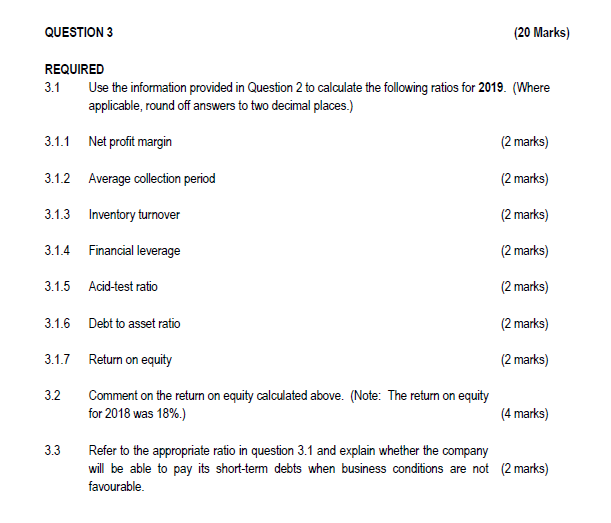

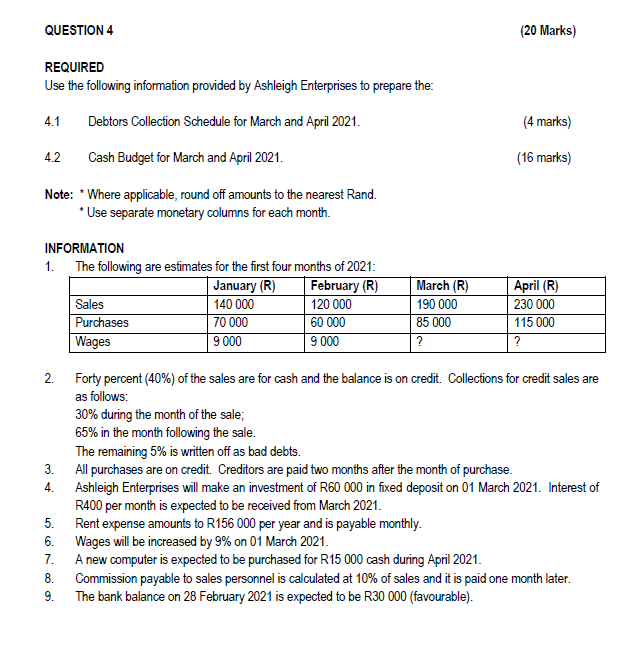

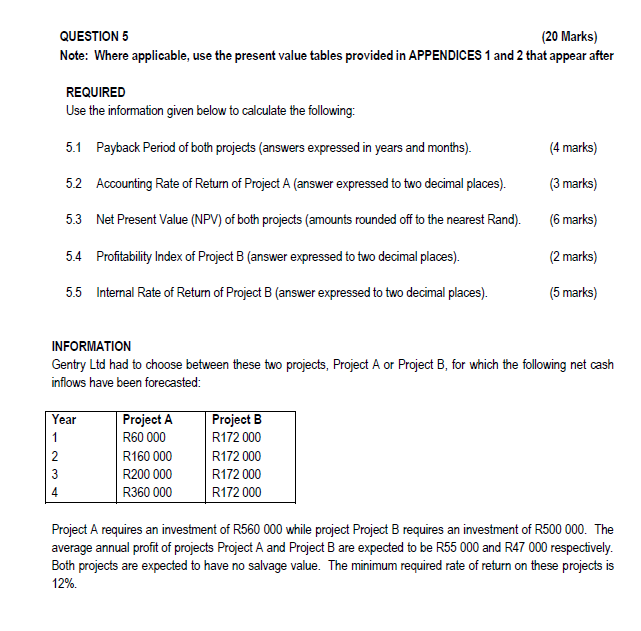

Answer ALL questions in this paper. [20 Marks] QUESTION 1 1.1 Explain THREE (3) major goals of financial management. (6 marks) 1.2 In establishing a sound credit policy, decisions should be taken on at least FIVE (5) factors. Name and explain these factors. (10 marks) 1.3 Discuss debentures as a form of long-term financing for a company. (4 marks) REQUIRED Use the information provided below to complete the Cash Flow Statement of Silverline Ltd for the year ended 31 December 2019. Use the following format as a guide. (Commence with the R556 000 for the profit before working capital changes.) INFORMATION Silverline Ltd's Statement of Comprehensive Income for the year ended 31 December 2019 and Statement of Financial Position as at 31 December 2018 and 2019 are as follows: Additional information 1. Additional plant and machinery were purchased during 2019. There were no other non-current asset acquisitions or disposals. Depreciation for 2019 amounted to R158 000 . 2. An interim dividend of R100 000 was paid on ordinary shares during 2019. No final dividends were declared. REQUIRED 3.1 Use the information provided in Question 2 to calculate the following ratios for 2019. (Where applicable, round off answers to two decimal places.) 3.1.1 Net profit margin 3.1.2 Average collection period 3.1.3 Inventory turnover 3.1.4 Financial leverage 3.1.5 Acid-test ratio 3.1.6 Debt to asset ratio 3.1.7 Return on equity (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) 3.2 Comment on the return on equity calculated above. (Note: The return on equity for 2018 was 18%.) (4 marks) 3.3 Refer to the appropriate ratio in question 3.1 and explain whether the company will be able to pay its short-term debts when business conditions are not ( 2 marks) favourable. QUESTION 4 (20 Marks) REQUIRED Use the following information provided by Ashleigh Enterprises to prepare the: 4.1 Debtors Collection Schedule for March and April 2021. (4 marks) 4.2 Cash Budget for March and April 2021. (16 marks) Note: "Where applicable, round off amounts to the nearest Rand. *Use separate monetary columns for each month. INFORMATION 1. The following are estimates for the first four months of 2021 : 2. Forty percent (40%) of the sales are for cash and the balance is on credit. Collections for credit sales are as follows: 30% during the month of the sale; 65% in the month following the sale. The remaining 5% is written off as bad debts. QUESTION 5 (20 Marks) Note: Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after REQUIRED Use the information given below to calculate the following: 5.1 Payback Period of both projects (answers expressed in years and months). (4 marks) 5.2 Accounting Rate of Return of Project A (answer expressed to two decimal places). (3 marks) 5.3 Net Present Value (NPV) of both projects (amounts rounded off to the nearest Rand). (6 marks) 5.4 Profitability Index of Project B (answer expressed to two decimal places). ( 2 marks) 5.5 Internal Rate of Return of Project B (answer expressed to two decimal places). (5 marks) INFORMATION Gentry Ltd had to choose between these two projects, Project A or Project B, for which the following net cash inflows have been forecasted: Project A requires an investment of R560000 while project Project B requires an investment of R500000. The average annual profit of projects Project A and Project B are expected to be R55 000 and R47000 respectively. Both projects are expected to have no salvage value. The minimum required rate of return on these projects is 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts