Question: Answer ALL questions in this section. Show all your calculations. Round your answers up to 2 decimal places. Question 1 (20 marks) Mr. Yamaha writes

Answer ALL questions in this section.

Show all your calculations. Round your answers up to 2 decimal places.

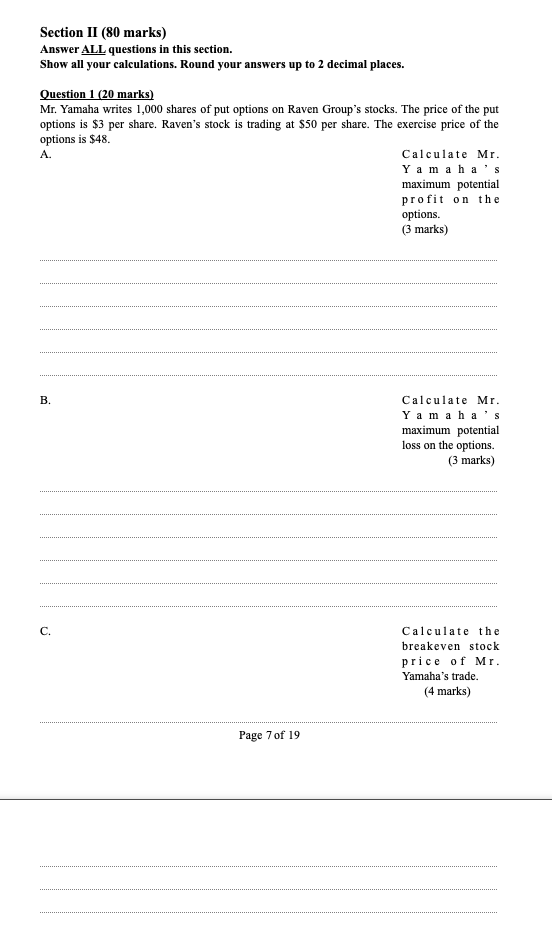

Question 1 (20 marks)

Mr. Yamaha writes 1,000 shares of put options on Raven Groups stocks. The price of the put options is $3 per share. Ravens stock is trading at $50 per share. The exercise price of the options is $48.

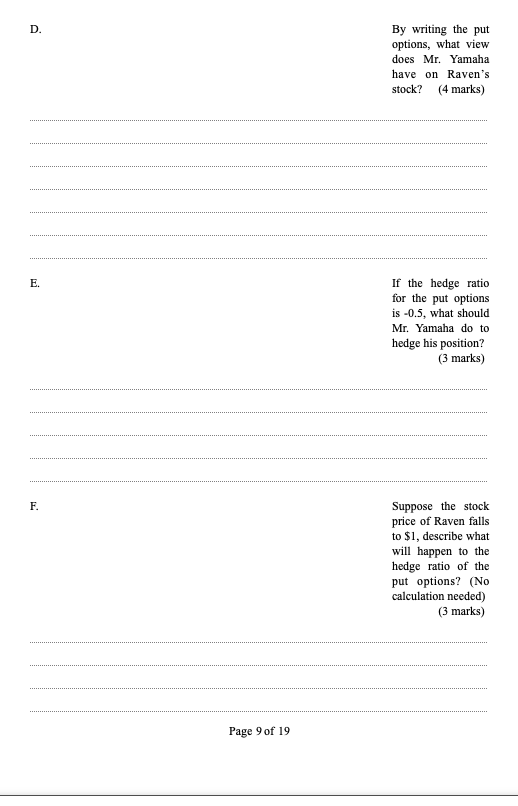

Section II (80 marks) Answer ALL questions in this section. Show all your calculations. Round your answers up to 2 decimal places. Question 1 (20 marks) Mr. Yamaha writes 1,000 shares of put options on Raven Group's stocks. The price of the put options is $3 per share. Raven's stock is trading at $50 per share. The exercise price of the options is $48. A Calculate Mr. Y a m a ha's maximum potential profit on the options. (3 marks) B. Calculate Mr. Y a ma ha's maximum potential loss on the options. (3 marks) C. Calculate the breakeven stock price of Mr. Yamaha's trade. (4 marks) Page 7 of 19 D. By writing the put options, what view does Mr. Yamaha have on Raven's stock? (4 marks) E. If the hedge ratio for the put options is -0.5, what should Mr. Yamaha do to hedge his position? (3 marks) F. Suppose the stock price of Raven falls to $1, describe what will happen to the hedge ratio of the put options? (No calculation needed) (3 marks) Page 9 of 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts