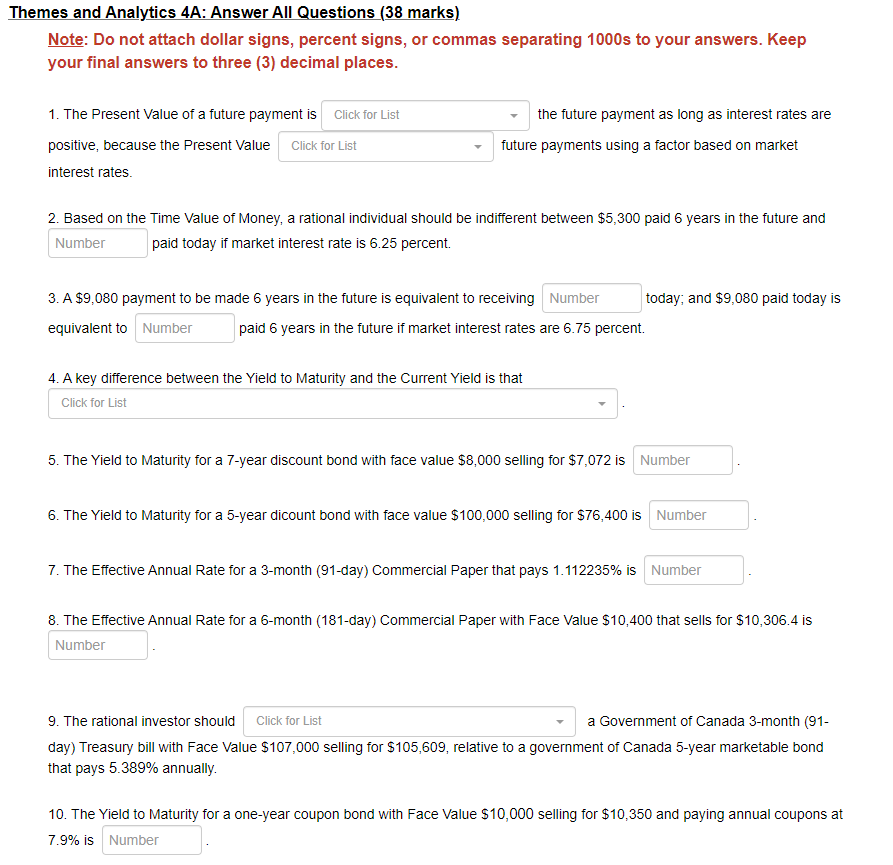

Question: Answer All Questions Note: D o not attach dollar signs, percent signs, o r commas separating 1 0 0 0 s t o your answers.

Answer All Questions

Note: not attach dollar signs, percent signs, commas separating your answers. Keep

your final answers three decimal places.

The Present Value a future payment

the future payment long interest rates are

positive, because the Present Value

future payments using a factor based market

interest rates.

Based the Time Value Money, a rational individual should indifferent between $ paid years the future and

paid today market interest rate percent.

$ payment made years the future equivalent receiving

today; and $ paid today

equivalent

paid years the future market interest rates are percent.

A key difference between the Yield Maturity and the Current Yield that

The Yield Maturity for year discount bond with face value $ selling for $

The Yield Maturity for year dicount bond with face value $ selling for $

The Effective Annual Rate for month day Commercial Paper that pays

The Effective Annual Rate for month day Commercial Paper with Face Value $ that sells for $

The rational investor should

a Government Canada month

day Treasury bill with Face Value $ selling for $ relative a government Canada year marketable bond

that pays annually.

The Yield Maturity for a oneyear coupon bond with Face Value $ selling for $ and paying annual coupons

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock