Question: Answer all questions. Or I will dislike your answer , asap 1. Are direct costs always variable? Are indirect costs always fixed? Explain. 2. What

Answer all questions. Or I will dislike your answer , asap

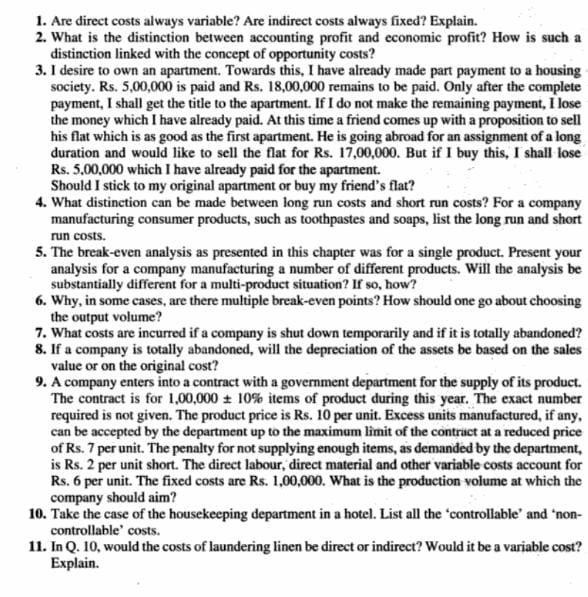

1. Are direct costs always variable? Are indirect costs always fixed? Explain. 2. What is the distinction between accounting profit and economic profit? How is such a distinction linked with the concept of opportunity costs? 3. I desire to own an apartment. Towards this, I have already made part payment to a housing society. Rs. 5,00,000 is paid and Rs. 18,00,000 remains to be paid. Only after the complete payment, I shall get the title to the apartment. If I do not make the remaining payment, I lose the money which I have already paid. At this time a friend comes up with a proposition to sell his flat which is as good as the first apartment. He is going abroad for an assignment of a long duration and would like to sell the flat for Rs. 17,00,000. But if I buy this, I shall lose Rs. 5,00,000 which I have already paid for the apartment. Should I stick to my original apartment or buy my friend's flat? 4. What distinction can be made between long run costs and short run costs? For a company manufacturing consumer products, such as toothpastes and soaps, list the long run and short run costs. 5. The break-even analysis as presented in this chapter was for a single product. Present your analysis for a company manufacturing a number of different products. Will the analysis be substantially different for a multi-product situation? If so, how? 6. Why, in some cases, are there multiple break-even points? How should one go about choosing the output volume? 7. What costs are incurred if a company is shut down temporarily and if it is totally abandoned? 8. If a company is totally abandoned, will the depreciation of the assets be based on the sales value or on the original cost? 9. A company enters into a contract with a government department for the supply of its product. The contract is for 1,00,000 + 10% items of product during this year. The exact number required is not given. The product price is Rs. 10 per unit. Excess units manufactured, if any, can be accepted by the department up to the maximum limit of the contract at a reduced price of Rs.7 per unit. The penalty for not supplying enough items, as demanded by the department, is Rs. 2 per unit short. The direct labour, direct material and other variable costs account for Rs. 6 per unit. The fixed costs are Rs. 1,00,000. What is the production volume at which the company should aim? 10. Take the case of the housekeeping department in a hotel. List all the controllable' and 'non- controllable costs. 11. In Q. 10, would the costs of laundering linen be direct or indirect? Would it be a variable cost? Explain

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock