Question: answer all questions please 8. The journal entry to record the sale of equipment in #6 will include: a. Credit to cash for $75,000 b.

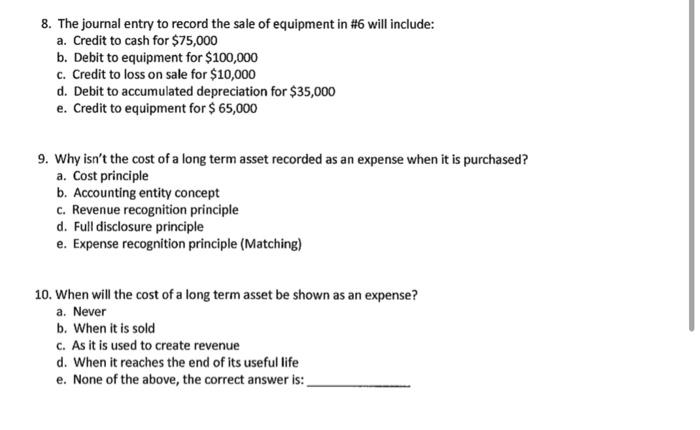

8. The journal entry to record the sale of equipment in #6 will include: a. Credit to cash for $75,000 b. Debit to equipment for $100,000 c. Credit to loss on sale for $10,000 d. Debit to accumulated depreciation for $35,000 e. Credit to equipment for $ 65,000 9. Why isn't the cost of a long term asset recorded as an expense when it is purchased? a. Cost principle b. Accounting entity concept c. Revenue recognition principle d. Full disclosure principle e. Expense recognition principle (Matching) 10. When will the cost of a long term asset be shown as an expense? a. Never b. When it is sold C. As it is used to create revenue d. When it reaches the end of its useful life e. None of the above, the correct answer is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts