Question: ANSWER ALL QUESTIONS PLEASE CNT BE ANSWER E Company. has two service departments and two operating departments. Operating data for these departments for last year

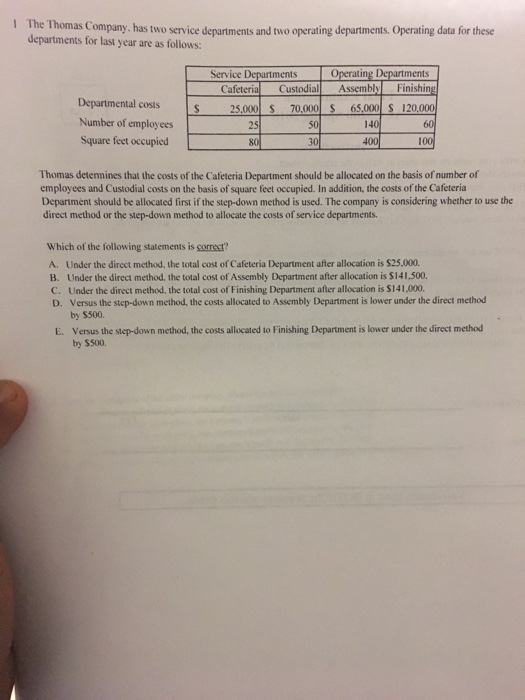

Company. has two service departments and two operating departments. Operating data for these departments for last year are as follows: Operating Departments ments Cafeter Departmental costsS Number of employees Square feet occupied 65,000 S 120,000 25,000 S 70,000 50 25 80 140 400 100 Thomas determines that the costs of the Cafeteria Department should be allocated on the basis of number of employees and Custodial costs on the basis of Deparment should be allocated first if the step-down method is used. The company is considering whether to use the direct method or the step-down method to allocate the costs of service departments. square feet occupied. In addition, the costs of the Cafeteria Which of the following statements is sorrest? A. Under the direct method, the total cost of Cafeteria Department after allocation is $25,000. B. Under the direct method. the total cost of Assembly Department after allocation is $141.500. C. Under the direct method, the total cost of Finishing Department after allocation is $141,000 D. Versus the step-down method, the costs allocated to Assembly Department is lower under the direct method by $500. E. Versus the step-down method, the costs allocated to Finishing Department is lower under the direct method by $500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts