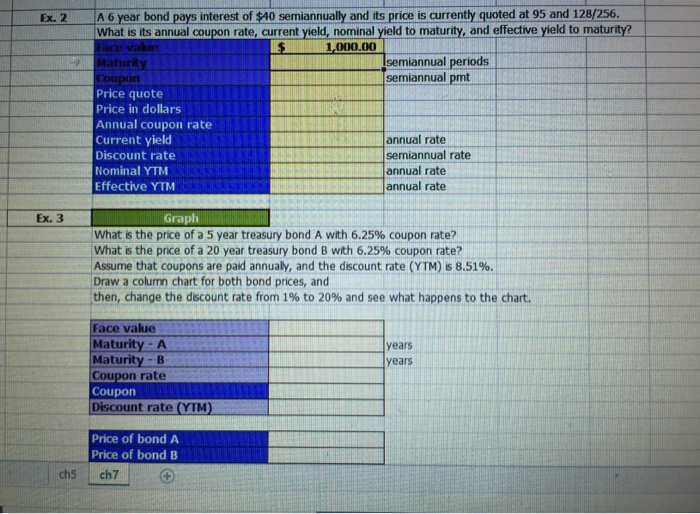

Question: Answer all questions please Ex. 2 A 6 year bond pays interest of $10 semiannually and its price is currently quoted at 95 and 128/256.

Ex. 2 A 6 year bond pays interest of $10 semiannually and its price is currently quoted at 95 and 128/256. What is its annual coupon rate, current yield, nominal yield to maturity, and effective yield to maturity? $ 1,000.00 Isemiannual periods Coupon semiannual pmt Price quote Price in dollars Annual coupon rate Current yield annual rate Discount rate semiannual rate Nominal YTM annual rate Effective YTM annual rate Graph What is the price of a 5 year treasury bond A with 6.25% coupon rate? What is the price of a 20 year treasury bond B with 6.25% coupon rate? Assume that coupons are paid annualy, and the discount rate (YTM) is 8.51%. Draw a column chart for both bond prices, and then, change the discount rate from 1% to 20% and see what happens to the chart. lyears years Face value Maturity - A Maturity - B Coupon rate Coupon Discount rate (YTM) i Price of bond A Price of bond B ch7 ch Ex. 2 A 6 year bond pays interest of $10 semiannually and its price is currently quoted at 95 and 128/256. What is its annual coupon rate, current yield, nominal yield to maturity, and effective yield to maturity? $ 1,000.00 Isemiannual periods Coupon semiannual pmt Price quote Price in dollars Annual coupon rate Current yield annual rate Discount rate semiannual rate Nominal YTM annual rate Effective YTM annual rate Graph What is the price of a 5 year treasury bond A with 6.25% coupon rate? What is the price of a 20 year treasury bond B with 6.25% coupon rate? Assume that coupons are paid annualy, and the discount rate (YTM) is 8.51%. Draw a column chart for both bond prices, and then, change the discount rate from 1% to 20% and see what happens to the chart. lyears years Face value Maturity - A Maturity - B Coupon rate Coupon Discount rate (YTM) i Price of bond A Price of bond B ch7 ch

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts