Question: Answer all questions please. In this chapter, we learned that FICA mandates that employers deduct taxes from employees' pay each pay period to fund the

Answer all questions please.

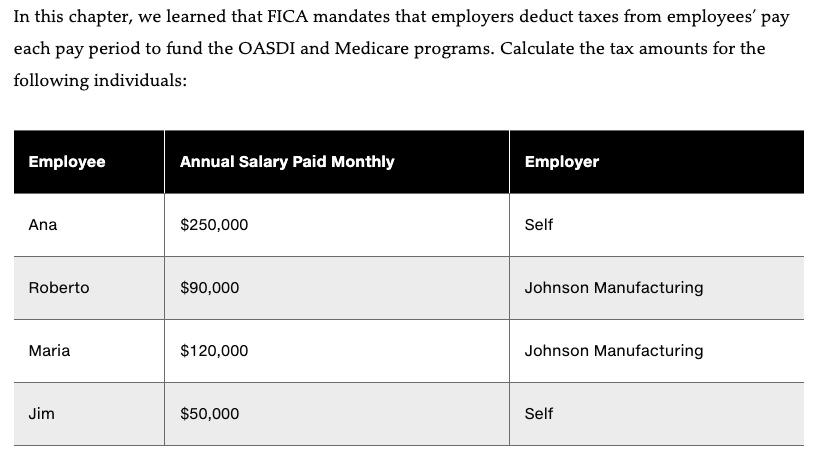

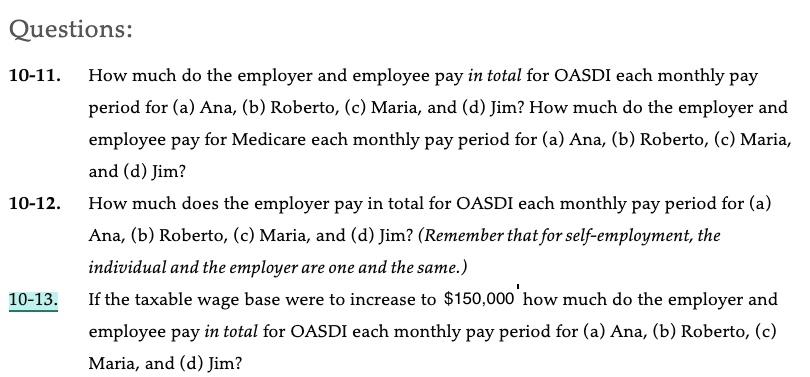

In this chapter, we learned that FICA mandates that employers deduct taxes from employees' pay each pay period to fund the OASDI and Medicare programs. Calculate the tax amounts for the following individuals: Employee Annual Salary Paid Monthly Employer Ana $250,000 Self Roberto $90,000 Johnson Manufacturing Maria $120,000 Johnson Manufacturing Jim $50,000 Self Questions: 10-11. 10-12. How much do the employer and employee pay in total for OASDI each monthly pay period for (a) Ana, (b) Roberto, (c) Maria, and (d) Jim? How much do the employer and employee pay for Medicare each monthly pay period for (a) Ana, (b) Roberto, (c) Maria, and (d) Jim? How much does the employer pay in total for OASDI each monthly pay period for (a) Ana, (b) Roberto, (c) Maria, and (d) Jim? (Remember that for self-employment, the individual and the employer are one and the same.) If the taxable wage base were to increase to $150,000 how much do the employer and employee pay in total for OASDI each monthly pay period for (a) Ana, (b) Roberto, (c) Maria, and (d) Jim? 10-13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts