Question: ANSWER ALL QUESTIONS RELATED TO THE PROBLEM TO FULLY SOLVE!! Alfonso began the year with a tax basis in his partnership interest of $29,000. His

ANSWER ALL QUESTIONS RELATED TO THE PROBLEM TO FULLY SOLVE!!

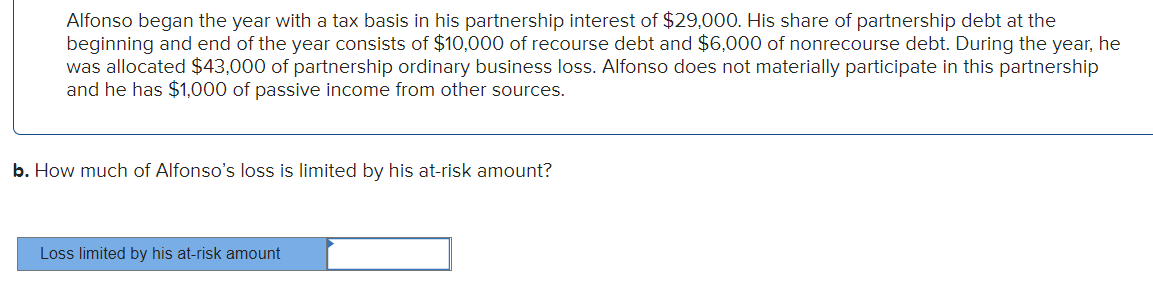

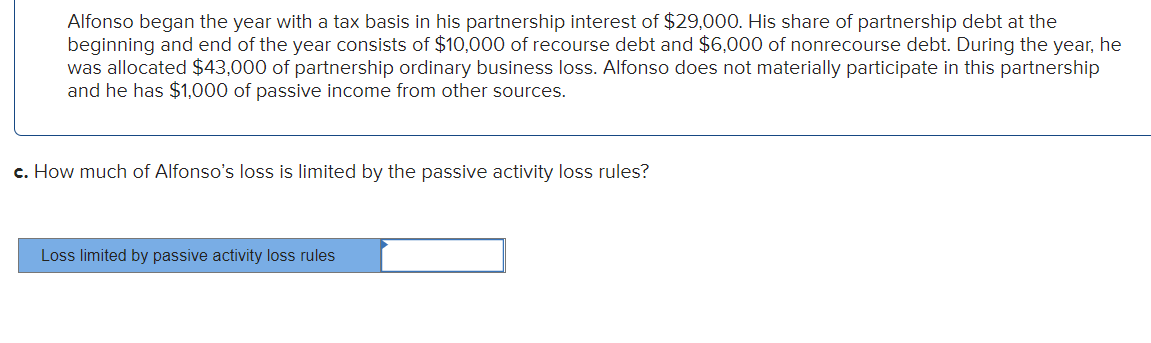

Alfonso began the year with a tax basis in his partnership interest of $29,000. His share of partnership debt at the beginning and end of the year consists of $10,000 of recourse debt and $6,000 of nonrecourse debt. During the year, he was allocated $43,000 of partnership ordinary business loss. Alfonso does not materially participate in this partnership and he has $1,000 of passive income from other sources. b. How much of Alfonso's loss is limited by his at-risk amount? Loss limited by his at-risk amount Alfonso began the year with a tax basis in his partnership interest of $29,000. His share of partnership debt at the beginning and end of the year consists of $10,000 of recourse debt and $6,000 of nonrecourse debt. During the year, he was allocated $43,000 of partnership ordinary business loss. Alfonso does not materially participate in this partnership and he has $1,000 of passive income from other sources. c. How much of Alfonso's loss is limited by the passive activity loss rules? Loss limited by passive activity loss rules

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts