Question: ANSWER ALL QUESTIONS RELATED TO THE PROBLEM TO FULLY SOLVE!! ALL ACCOUNT NAMES SHOULD BE PROVIDED WITH THE CORRECT NAME!!!! DO NOT USE AN ACCOUNT

ANSWER ALL QUESTIONS RELATED TO THE PROBLEM TO FULLY SOLVE!! ALL ACCOUNT NAMES SHOULD BE PROVIDED WITH THE CORRECT NAME!!!! DO NOT USE AN ACCOUNT NAME THAT IS NOT LISTED!!!

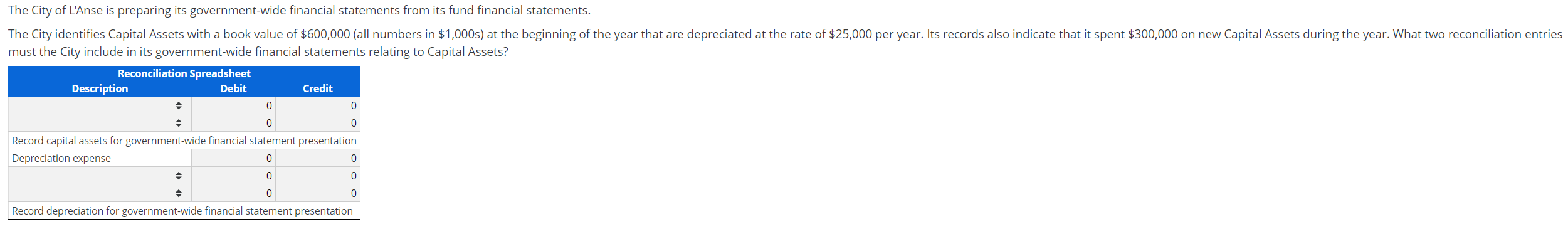

The City of L'Anse is preparing its government-wide financial statements from its fund financial statements. The City identifies Capital Assets with a book value of $600,000 (all numbers in $1,000s) at the beginning of the year that are depreciated at the rate of $25,000 per year. Its records also indicate that it spent $300,000 on new Capital Assets during the year. What two reconciliation entries must the City include in its government-wide financial statements relating to Capital Assets? Reconciliation Spreadsheet Description Debit Credit 0 0 0 0 Record capital assets for government-wide financial statement presentation Depreciation expense 0 0 | 0 0 0 0 Record depreciation for government-wide financial statement presentation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts