Question: ANSWER ALL QUESTIONS RELATED TO THE PROBLEM TO FULLY SOLVE!! Journal entries for a series of transactions Prepare journal entries in the General Fund for

ANSWER ALL QUESTIONS RELATED TO THE PROBLEM TO FULLY SOLVE!!

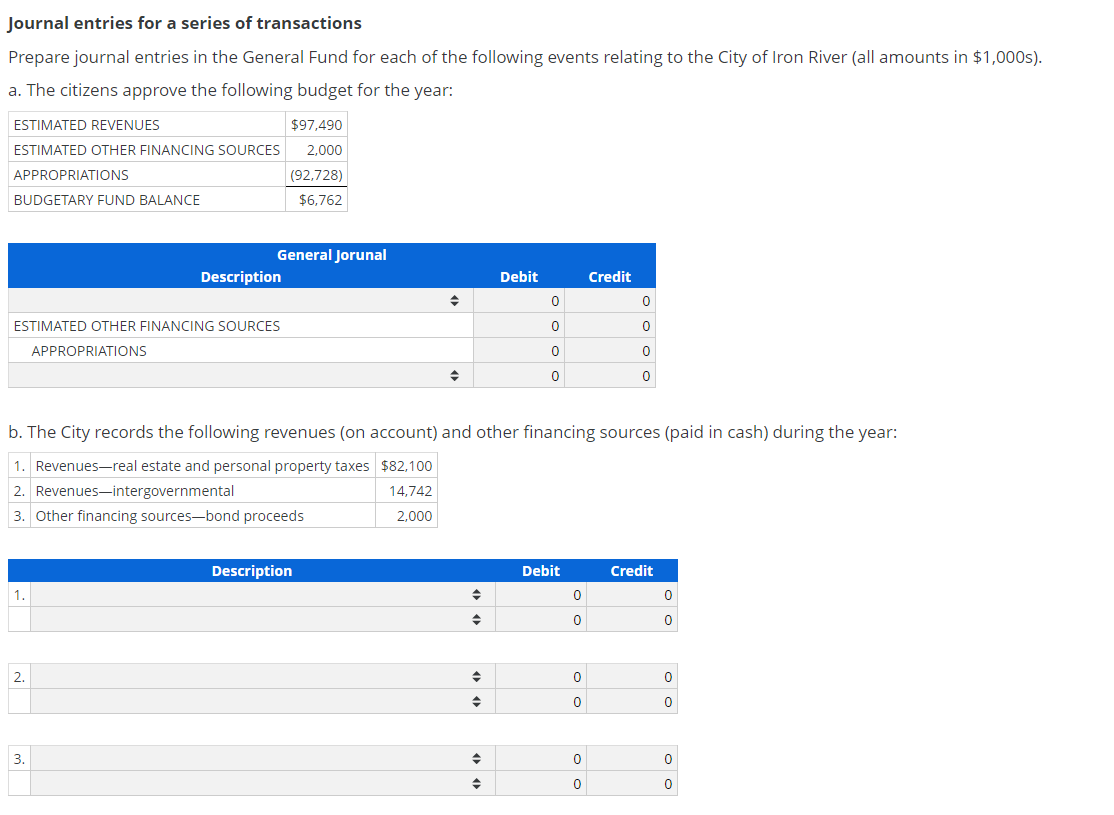

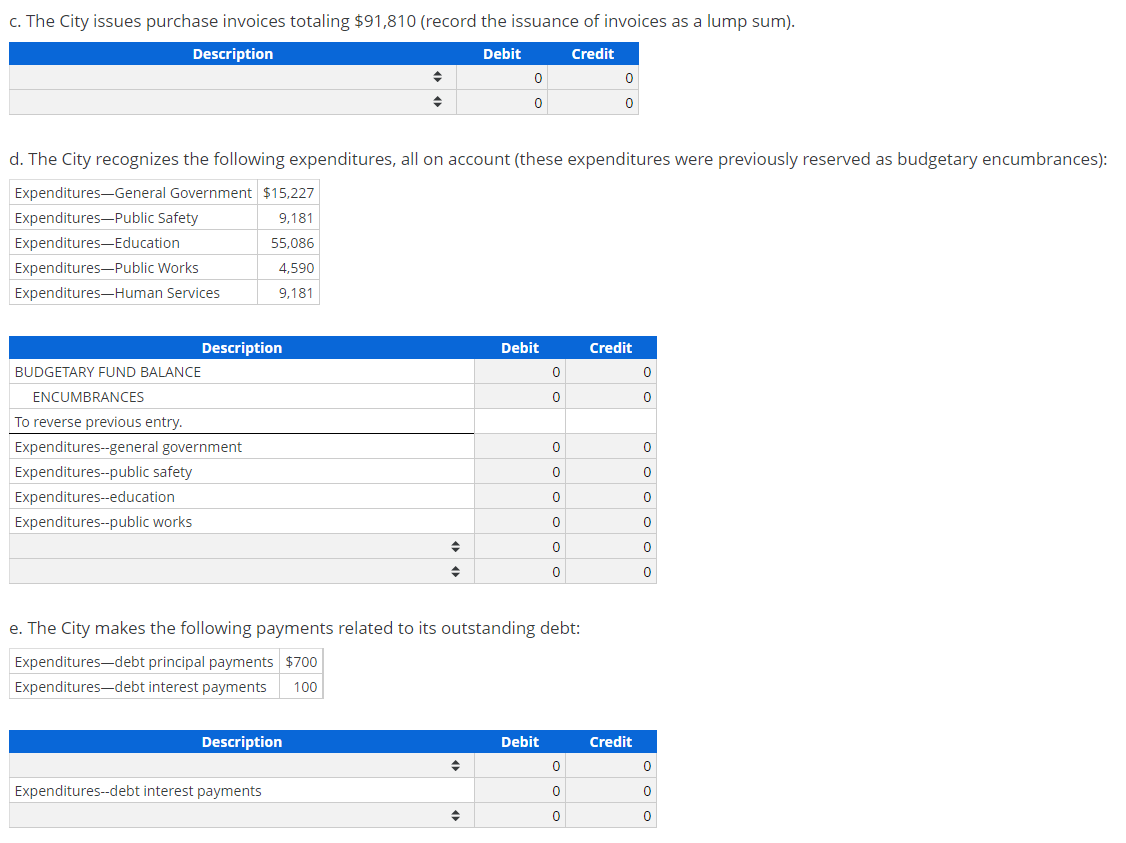

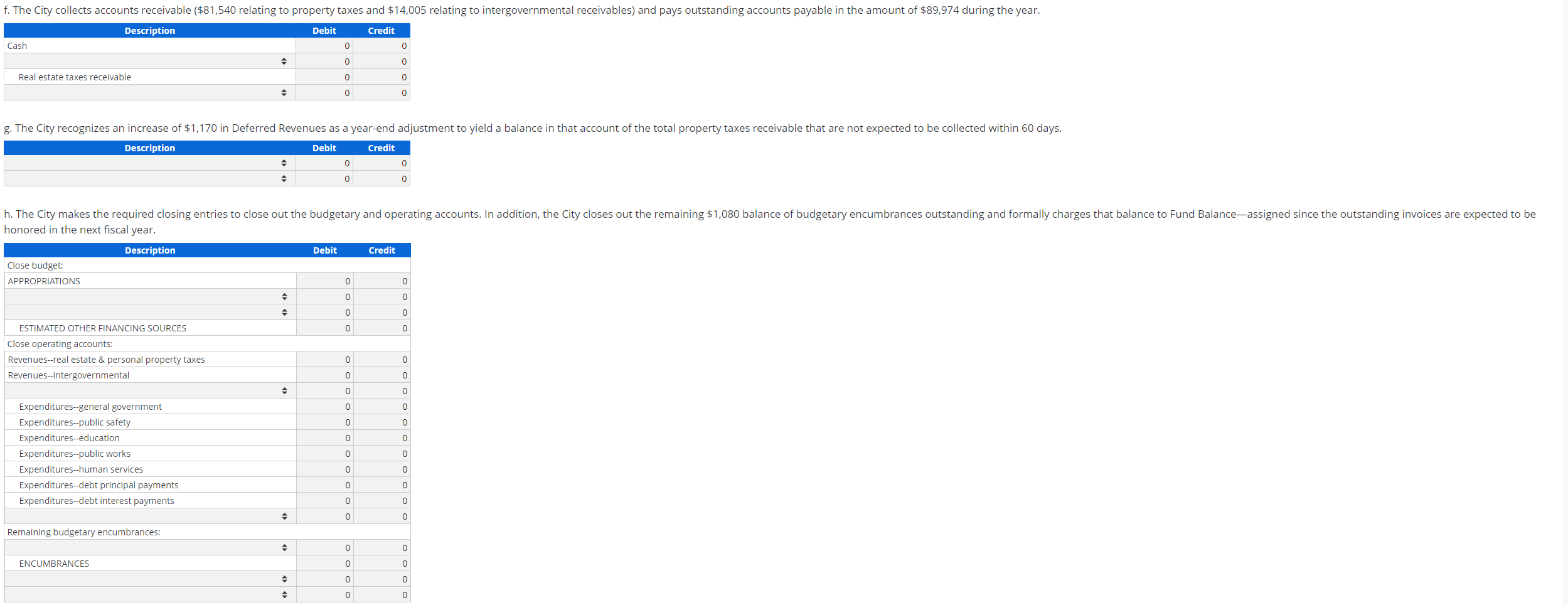

Journal entries for a series of transactions Prepare journal entries in the General Fund for each of the following events relating to the City of Iron River (all amounts in $1,000s). a. The citizens approve the following budget for the year: $97,490 2,000 ESTIMATED REVENUES ESTIMATED OTHER FINANCING SOURCES APPROPRIATIONS BUDGETARY FUND BALANCE (92,728) $6,762 General Jorunal Description Debit Credit 0 0 0 0 ESTIMATED OTHER FINANCING SOURCES APPROPRIATIONS 0 0 0 0 b. The City records the following revenues (on account) and other financing sources (paid in cash) during the year: 1. Revenues-real estate and personal property taxes $82,100 2. Revenues-intergovernmental 14,742 3. Other financing sources-bond proceeds 2,000 Description Debit Credit 1. 0 0 0 0 2. 0 0 0 0 3. 0 0 0 0 c. The City issues purchase invoices totaling $91,810 (record the issuance of invoices as a lump sum). Description Debit Credit 0 0 0 0 d. The City recognizes the following expenditures, all on account (these expenditures were previously reserved as budgetary encumbrances): Expenditures-General Government $15,227 ExpendituresPublic Safety 9,181 Expenditures-Education 55,086 Expenditures-Public Works 4,590 Expenditures-Human Services 9.181 Debit Credit 0 0 0 0 Description BUDGETARY FUND BALANCE ENCUMBRANCES To reverse previous entry. Expenditures--general government Expenditures--public safety Expenditures--education Expenditures--public works 0 0 0 0 0 0 0 0 0 0 0 0 e. The City makes the following payments related to its outstanding debt: Expendituresdebt principal payments $700 Expenditures-debt interest payments 100 Description Debit Credit 0 0 Expenditures--debt interest payments 0 0 0 0 f. The City collects accounts receivable ($81,540 relating to property taxes and $14,005 relating to intergovernmental receivables) and pays outstanding accounts payable in the amount of $89,974 during the year. Description Debit Credit Cash 0 0 0 0 Real estate taxes receivable 0 0 0 0 g. The City recognizes an increase of $1,170 in Deferred Revenues as a year-end adjustment to yield a balance in that account of the total property taxes receivable that are not expected to be collected within 60 days. Description Debit Credit 0 0 0 h. The City makes the required closing entries to close out the budgetary and operating accounts. In addition, the City closes out the remaining $1,080 balance of budgetary encumbrances outstanding and formally charges that balance to Fund Balance-assigned since the outstanding invoices are expected to be honored in the next fiscal year. Description Debit Credit Close budget: APPROPRIATIONS 0 0 0 0 0 0 ESTIMATED OTHER FINANCING SOURCES 0 0 Close operating accounts: Revenues--real estate & personal property taxes Revenues--intergovernmental 0 0 0 0 0 0 0 0 0 0 0 0 Expenditures--general government Expenditures--public safety Expenditures--education Expenditures--public works Expenditures--human services Expenditures--debt principal payments Expenditures--debt interest payments 0 0 0 0 0 0 0 0 0 0 Remaining budgetary encumbrances: 0 0 ENCUMBRANCES 0 0 0 0 0 0 Journal entries for a series of transactions Prepare journal entries in the General Fund for each of the following events relating to the City of Iron River (all amounts in $1,000s). a. The citizens approve the following budget for the year: $97,490 2,000 ESTIMATED REVENUES ESTIMATED OTHER FINANCING SOURCES APPROPRIATIONS BUDGETARY FUND BALANCE (92,728) $6,762 General Jorunal Description Debit Credit 0 0 0 0 ESTIMATED OTHER FINANCING SOURCES APPROPRIATIONS 0 0 0 0 b. The City records the following revenues (on account) and other financing sources (paid in cash) during the year: 1. Revenues-real estate and personal property taxes $82,100 2. Revenues-intergovernmental 14,742 3. Other financing sources-bond proceeds 2,000 Description Debit Credit 1. 0 0 0 0 2. 0 0 0 0 3. 0 0 0 0 c. The City issues purchase invoices totaling $91,810 (record the issuance of invoices as a lump sum). Description Debit Credit 0 0 0 0 d. The City recognizes the following expenditures, all on account (these expenditures were previously reserved as budgetary encumbrances): Expenditures-General Government $15,227 ExpendituresPublic Safety 9,181 Expenditures-Education 55,086 Expenditures-Public Works 4,590 Expenditures-Human Services 9.181 Debit Credit 0 0 0 0 Description BUDGETARY FUND BALANCE ENCUMBRANCES To reverse previous entry. Expenditures--general government Expenditures--public safety Expenditures--education Expenditures--public works 0 0 0 0 0 0 0 0 0 0 0 0 e. The City makes the following payments related to its outstanding debt: Expendituresdebt principal payments $700 Expenditures-debt interest payments 100 Description Debit Credit 0 0 Expenditures--debt interest payments 0 0 0 0 f. The City collects accounts receivable ($81,540 relating to property taxes and $14,005 relating to intergovernmental receivables) and pays outstanding accounts payable in the amount of $89,974 during the year. Description Debit Credit Cash 0 0 0 0 Real estate taxes receivable 0 0 0 0 g. The City recognizes an increase of $1,170 in Deferred Revenues as a year-end adjustment to yield a balance in that account of the total property taxes receivable that are not expected to be collected within 60 days. Description Debit Credit 0 0 0 h. The City makes the required closing entries to close out the budgetary and operating accounts. In addition, the City closes out the remaining $1,080 balance of budgetary encumbrances outstanding and formally charges that balance to Fund Balance-assigned since the outstanding invoices are expected to be honored in the next fiscal year. Description Debit Credit Close budget: APPROPRIATIONS 0 0 0 0 0 0 ESTIMATED OTHER FINANCING SOURCES 0 0 Close operating accounts: Revenues--real estate & personal property taxes Revenues--intergovernmental 0 0 0 0 0 0 0 0 0 0 0 0 Expenditures--general government Expenditures--public safety Expenditures--education Expenditures--public works Expenditures--human services Expenditures--debt principal payments Expenditures--debt interest payments 0 0 0 0 0 0 0 0 0 0 Remaining budgetary encumbrances: 0 0 ENCUMBRANCES 0 0 0 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts