Question: answer all questions step by step 1. 2. 3. Problem 5-20 (Algo) CVP Applications: Break-Even Analysis; Cost Structure; Target Sales [LO5-1, LO5-3, LO5-4, LO5-5, LO5-6,

![LO5-6, LO5-8] Northwood Company manufactures basketballs. The company has a ball that](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67183e70981eb_09667183e7027e01.jpg)

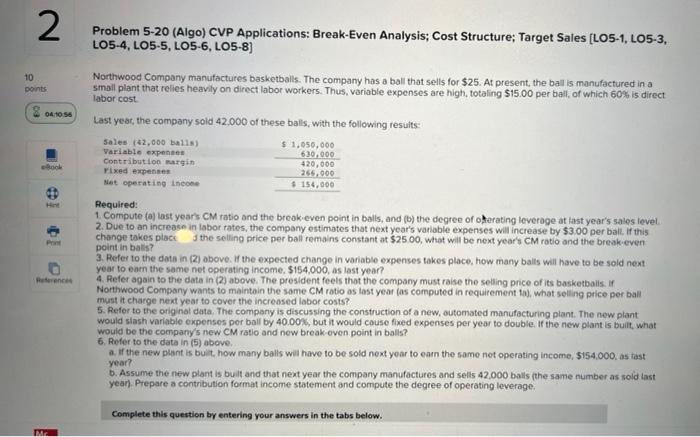

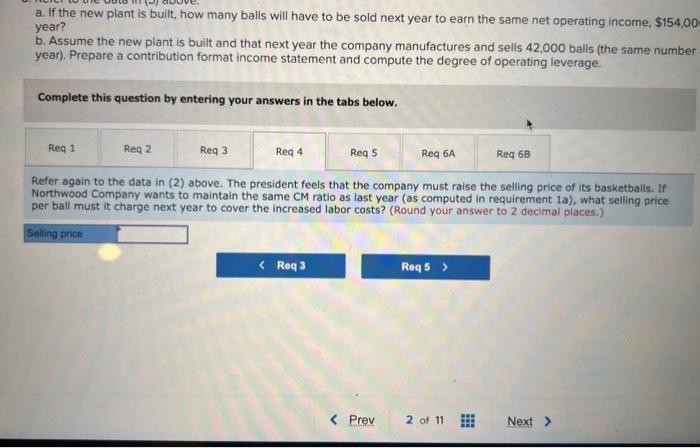

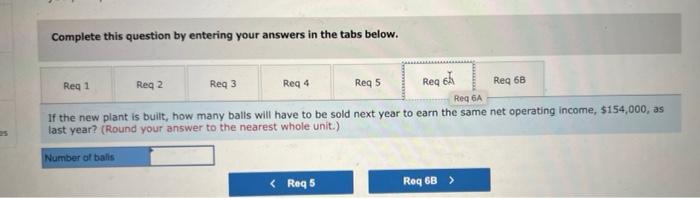

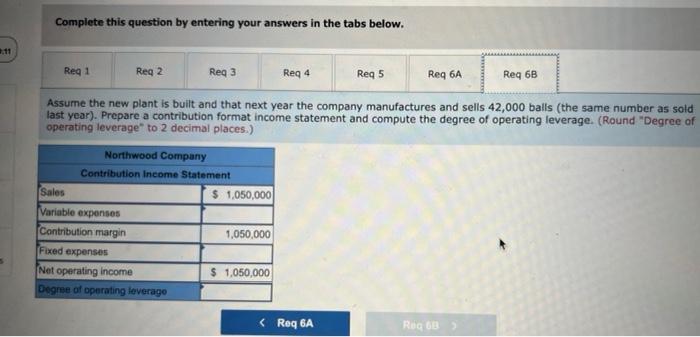

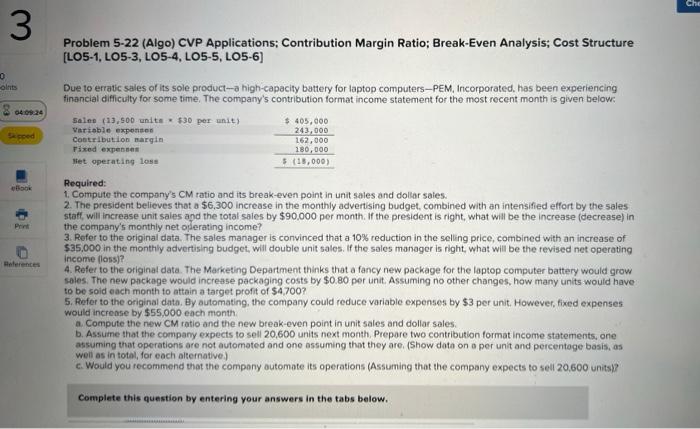

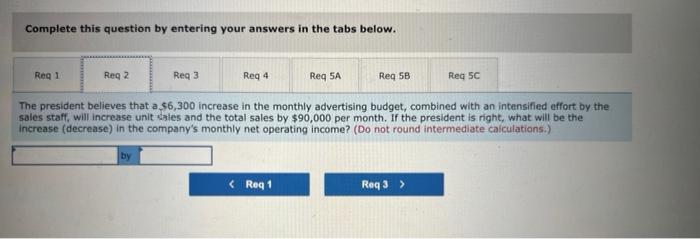

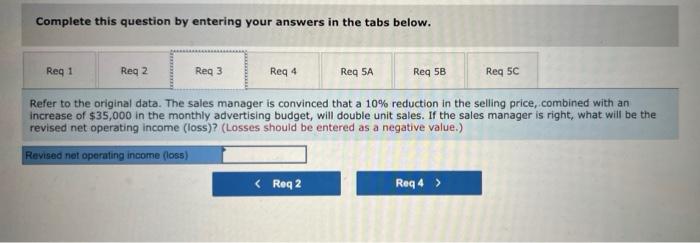

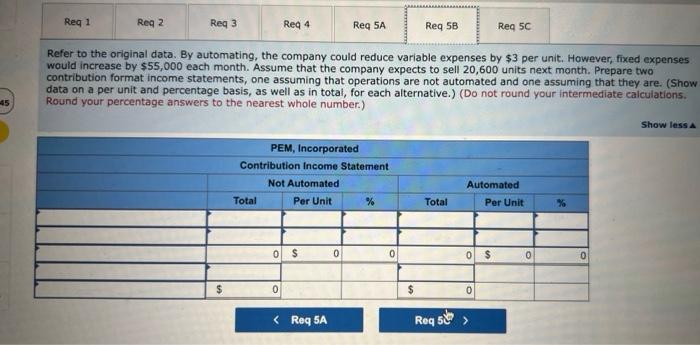

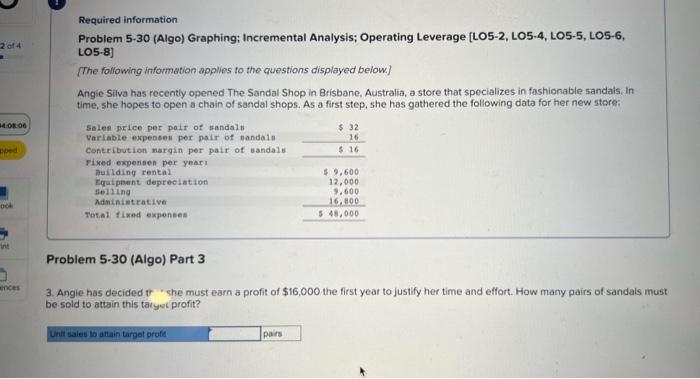

Problem 5-20 (Algo) CVP Applications: Break-Even Analysis; Cost Structure; Target Sales [LO5-1, LO5-3, LO5-4, LO5-5, LO5-6, LO5-8] Northwood Company manufactures basketballs. The company has a ball that sells for $25. At present, the ball is manufactured in a small plant that relies heavily on direct labor workers. Thus, variable expenses are high, totaling $15.00 per ball, of which 60% is direct labor cost. Last yeat, the company sold 42,000 of these balls, with the following resuits: Required: 1. Compute (a) last year's CM ratio and the breok-even point in balls, and (b) the degree of oferating leverage at last year's sales level. 2. Due to an increase in labor tates, the company estimates that next year's variable expenses will increase by $3.00 per bali. If this change takes place I the selling price per ball remains constant at $2500, what will be next year' CM ratio and the break-even point in bats? 3. Refer to the dath in (2) above. If the expected change in variable expenses takes place, how many balts will have to be sold next year to earn the same net operating income. $154,000, as last year? 4. Reler again to the date in (2) above. The president feels thot the company must raise the seiling price of its basketbails. If Northwood Company wants to maintain the same CM ratio as last year (as computed in requirement ta), what selling price per ball must it charge next year to cover the increased labor costs? 5. Refer to the onig nal data. The company is discussing the construction of a new, outomated manufacturing plant. The new plant would slash variable expenses per ball by 40.00%, but it would couse fixed expenses per year to double. If the new plant is built, what would be the compary's new CM ratio and new break-even point in balls? 6. Refer to the data in (5) above. a. If the new plent is buit, how many balls will have to be sold next year to earn the same net operating income, $154.000, as tast year? b. Assume the new plant is built and that next year the company manufactures and sells 42.000 balls (the same number as sold last year). Prepare a contribution format income statement and compute the degree of operating leverage. a. If the new plant is built, how many balls will have to be sold next year to earn the same net operating income, $154,0 year? b. Assume the new plant is built and that next year the company manufactures and sells 42,000 balls (the same numbe) year). Prepare a contribution format income statement and compute the degree of operating leverage. Complete this question by entering your answers in the tabs below. Refer again to the data in (2) above. The president feels that the company must raise the selling price of its basketballs. If Northwood Company wants to maintain the same CM ratio as last year (as computed in requirement la), what seliing price per ball must it charge next year to cover the increased labor costs? (Round your answer to 2 decimal places.) Complete this question by entering your answers in the tabs below. Refer to the original data. The company is discussing the construction of a new, automated manufacturing plant. The new plant would slash variable expenses per ball by 40.00%, but it would cause fixed expenses per year to double. If the new plant is built, what would be the company's new CM ratio and new break-even point in balis? (Round "CM Ratio" to 2 decimal places and "Unit sales to break even" to the nearest whole unit.) Complete this question by entering your answers in the tabs below. If the new plant is built, how many balis will have to be sold next year to earn the same net operating income, $154,000, as last year? (Round your answer to the nearest whole unit.) Complete this question by entering your answers in the tabs below. Assume the new plant is built and that next year the company manufactures and sells 42,000 balls (the same number as sold last year). Prepare a contribution format income statement and compute the degree of operating leverage. (Round "Degree of operating leverage*" to 2 decimal places.) Problem 5-22 (Algo) CVP Applications; Contribution Margin Ratio; Break-Even Analysis; Cost Structure [LO5-1, LO5-3, LO5-4, LO5-5, LO5-6] Due to erratic sales of its sole product-a high-capacity battery for laptop computers-PEM, Incorporated, has been experiencing financial difficulty for some time. The company's contribution format income statement for the most recent month is given below: Required: 1. Compute the company's CM tatio and its break-even point in unit sales and dolar saies. 2. The president believes that a $6,300 increase in the monthly advertising budget, combined with an intensified effort by the sales staff, will increase unit sales apd the total sales by $90.000 per month. If the president is right, what will be the increase (decrease) in the company's monthly net operating income? 3. Refer to the original data. The sales manager is convinced that a 10\% reduction in the seling price, combined with an increase of $35.000 in the monthly advertising budget, will double unit sales. If the sales manager is right, what will be the revised net operating income (loss)? 4. Refer to the original data. The Marketing Department thinks that a fancy new package for the laptop computer battery would grow sales. The new package would increase packaging costs by $0.80 per unit. Assuming no other changes, how many units would have to be soid each month to attain a target profit of $4.700 ? 5. Refer to the original datn. By automating, the company could reduce variable expenses by $3 per unit. However, fixed expenses would increase by $55,000 each month. a. Compute the new CM ratio and the new break-even point in unit sales and dollar sales. b. Assuine that the company expects to sell 20,600 units next month. Prepare two contribution format income statements, one assuming that operations are not automated and one assuming that they are, (Show data on a per unit and percentage basis, as weil as in total, for each alternative.) c. Would you recommend that the company outomate its operations (Assuming that the company expects to sell 20.600 units)? Complete this question by entering your answers in the tabs below. The president believes that as $6,300 increase in the monthly advertising budget, combined with an intensified effort by the sales staff, will increase unit sales and the total sales by $90,000 per month. If the president is right, what will be the increase (decrease) in the company's monthly net operating income? (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Refer to the original data. The sales manager is convinced that a 10% reduction in the selling price, combined with an increase of $35,000 in the monthly advertising budget, will double unit sales. If the sales manager is right, what will be the revised net operating income (loss)? (Losses shouid be entered as a negative value.) Refer to the original data. By automating, the company could reduce variable expenses by $3 per unit. However, fixed expenses would increase by $55,000 each month. Assume that the company expects to sell 20,600 units next month. Prepare two contribution format income statements, one assuming that operations are not automated and one assuming that they are. (Show data on a per unit and percentage basis, as well as in total, for each alternative.) (Do not round your intermediate caiculations. Round your percentage answers to the nearest whole number.) Show less a Required information Problem 5-30 (Algo) Graphing; Incremental Analysis; Operating Leverage [LO5-2, LO5-4, LO5-5, LO5-6, LO5-8] [The following information applies to the questions displayed beiow] Angie Silva has recently opened The Sandal Shop in Brisbane, Australia, a store that specializes in fashionable sandals, in time, she hopes to open a chain of sandal shops. As a first step, she has gathered the following data for her new store: Problem 5-30 (Algo) Part 3 3. Angie has decided it " she must earn a profit of $16.000 the first year to justify her time and effort. How many pairs of sandals must be sold to attain this taryer profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts