Question: answer all sections please Required information [The following information applies to the questions displayed below.] On January 1, 2024, Rain Technology purchased at par $89,000,7

![questions displayed below.] On January 1, 2024, Rain Technology purchased at par](https://s3.amazonaws.com/si.experts.images/answers/2024/07/6690cb7dc299d_3096690cb7d598c8.jpg)

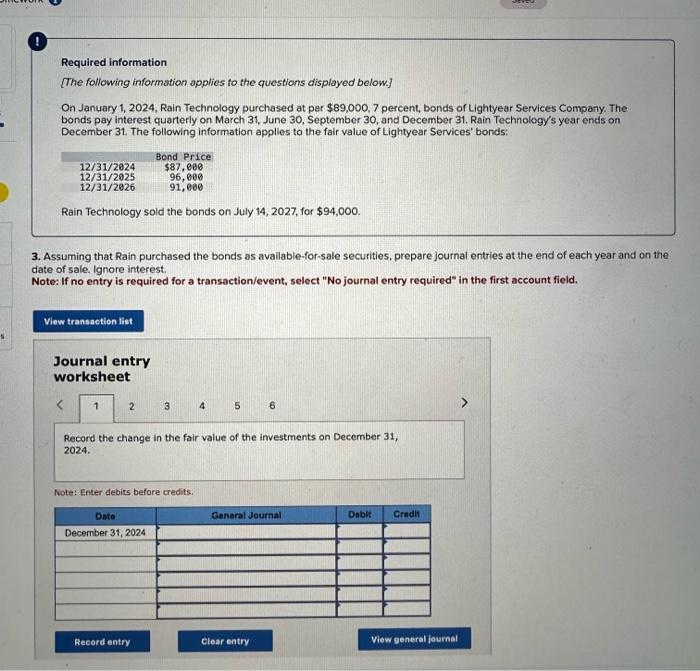

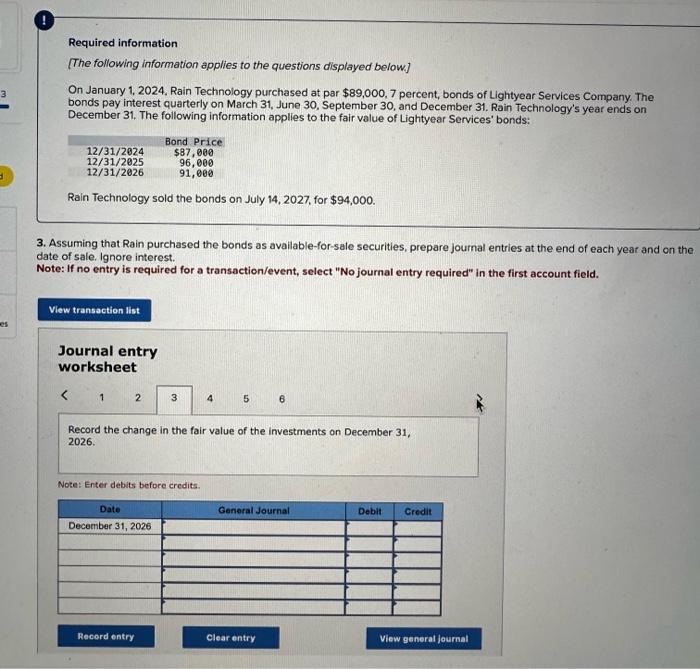

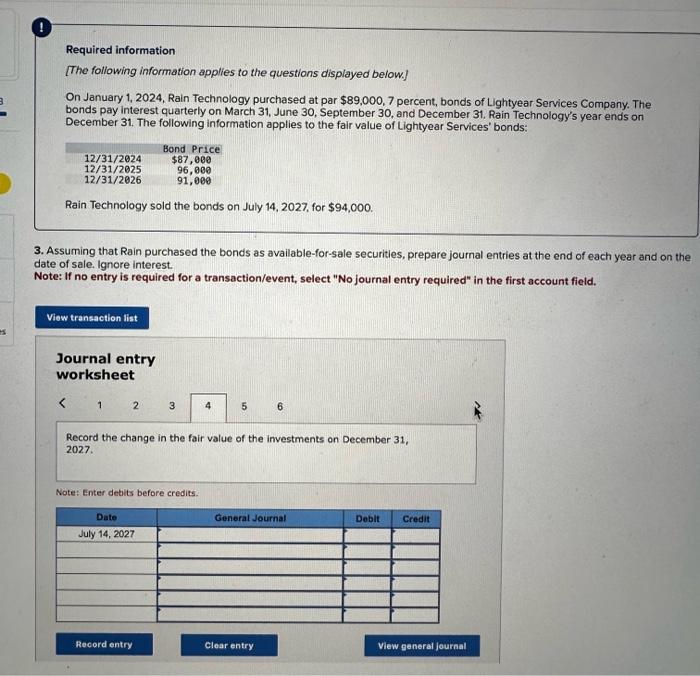

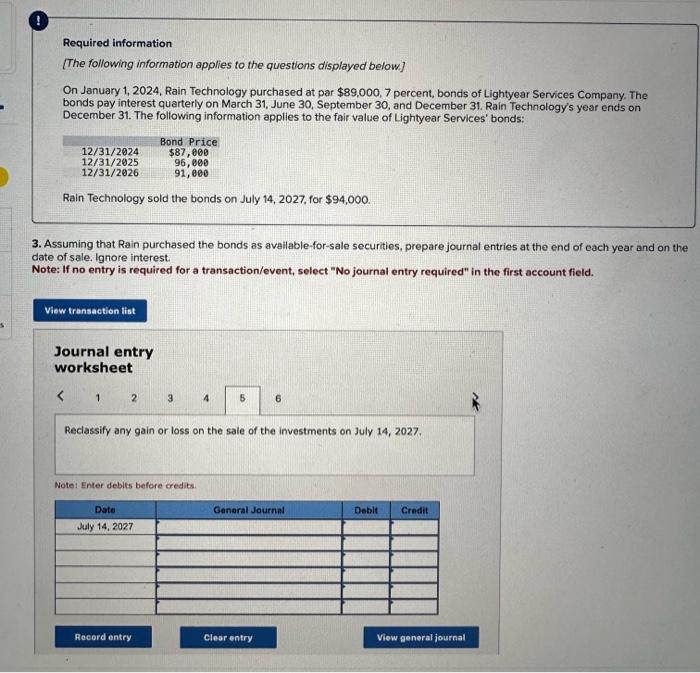

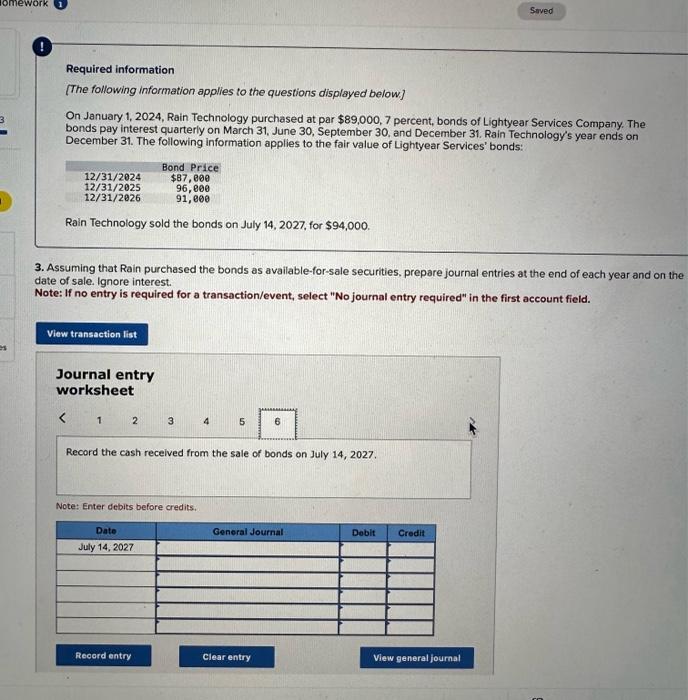

Required information [The following information applies to the questions displayed below.] On January 1, 2024, Rain Technology purchased at par $89,000,7 percent, bonds of Lightyear Services Company. The bonds pay interest quarterly on March 31, June 30, September 30, and December 31. Rain Technology's year ends on December 31. The following information applies to the fair value of Lightyear Services' bonds: Rain Technology sold the bonds on July 14, 2027, for $94,000. 3. Assuming that Rain purchased the bonds as available-for-sale securities, prepare journal entries at the end of each year and on the date of sale. Ignore interest. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 3456 Record the change in the fair value of the investments on December 31 , 2024. Note: Enter debits before credits. Required information [The following information applles to the questions displayed below.] On January 1, 2024, Rain Technology purchased at par $89,000,7 percent, bonds of Lightyear Services Company. The bonds pay interest quarterly on March 31, June 30, September 30, and December 31. Rain Technology's year ends on December 31. The following information applies to the fair value of Lightyear Services' bonds: Rain Technology sold the bonds on July 14, 2027, for $94,000. 3. Assuming that Rain purchased the bonds as available-for-sale securities, prepare journal entries at the end of each ycar and on the date of sale. Ignore interest. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the change in the fair value of the investments on December 31 , 2025. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below] On January 1, 2024. Rain Technology purchased at par $89,000,7 percent, bonds of Lightyear Services Company. The bonds pay interest quarterly on March 31, June 30, September 30, and December 31. Rain Technology's year ends on December 31. The following information applies to the fair value of Lightyear Services' bonds: Rain Technology sold the bonds on July 14, 2027, for $94,000. Assuming that Rain purchased the bonds as available-for-sale securities, prepare journal entries at the end of each year and on the ate of sale. Ignore interest. lote: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the change in the fair value of the investments on December 31 , 2026. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] On January 1, 2024, Rain Technology purchased at par $89,000,7 percent, bonds of Lightyear Services Company. The bonds pay interest quarterly on March 31, June 30, September 30, and December 31. Rain Technology's year ends on December 31 . The following information applies to the fair value of Lightyear Services' bonds: Rain Technology sold the bonds on July 14,2027 , for $94,000. 3. Assuming that Rain purchased the bonds as available-for-sale securities, prepare journal entries at the end of each year and on the date of sale. Ignore interest. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts