Question: Answer all the Question and state all the formula properly. 4. Consider the decision to purchase either a five-year corporate bond or a five-year municipal

Answer all the Question and state all the formula properly.

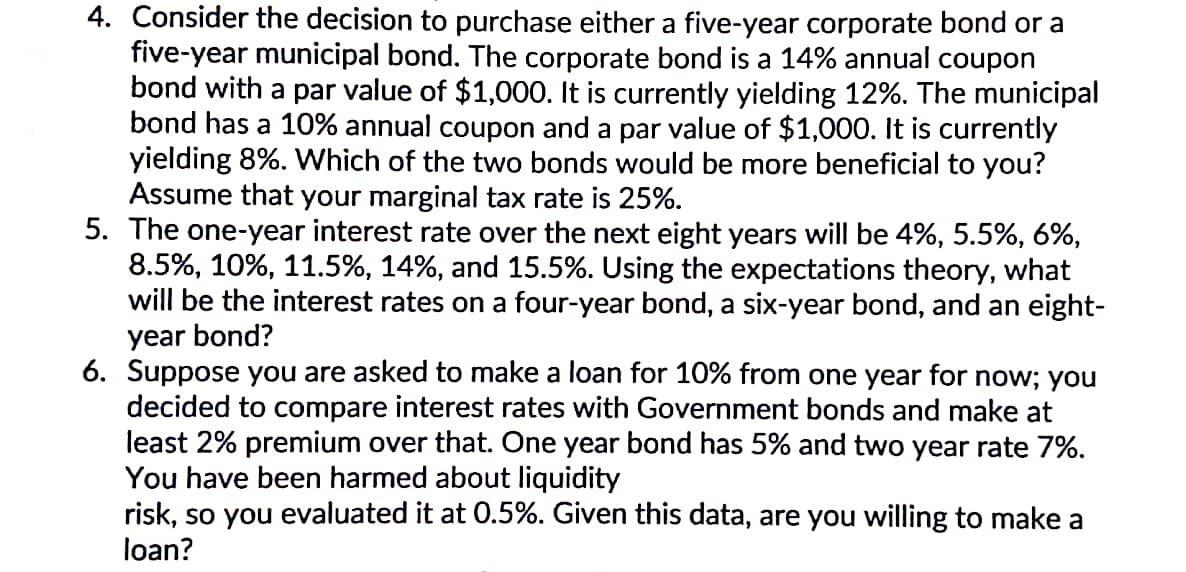

4. Consider the decision to purchase either a five-year corporate bond or a five-year municipal bond. The corporate bond is a 14% annual coupon bond with a par value of $1,000. It is currently yielding 12%. The municipal bond has a 10% annual coupon and a par value of $1,000. It is currently yielding 8%. Which of the two bonds would be more beneficial to you? Assume that your marginal tax rate is 25%. 5. The one-year interest rate over the next eight years will be 4%,5.5%,6%, 8.5%,10%,11.5%,14%, and 15.5%. Using the expectations theory, what will be the interest rates on a four-year bond, a six-year bond, and an eightyear bond? 6. Suppose you are asked to make a loan for 10% from one year for now; you decided to compare interest rates with Government bonds and make at least 2% premium over that. One year bond has 5% and two year rate 7%. You have been harmed about liquidity risk, so you evaluated it at 0.5%. Given this data, are you willing to make a loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts