Question: answer all the question for thumbs up 6. Michael Scott Corporation owned 40,000 shares of Somehow I Manage Corporation. These shares were purchased in 2014

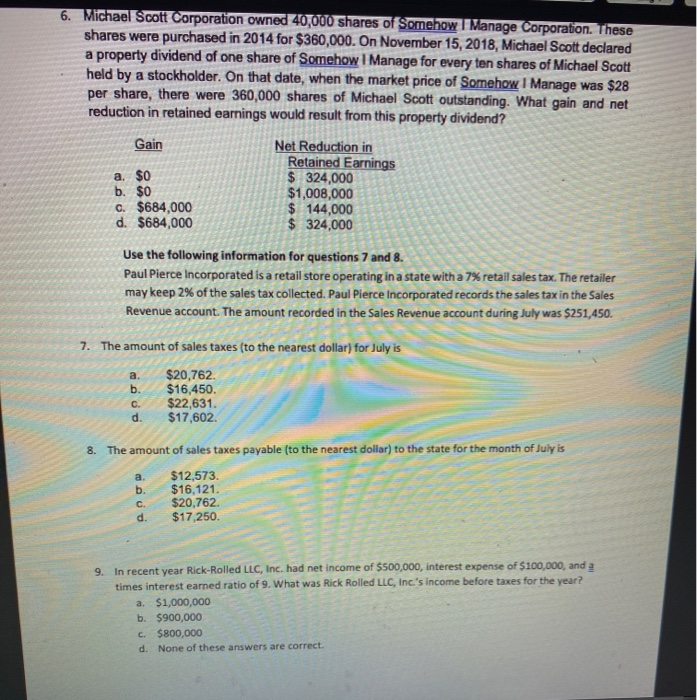

6. Michael Scott Corporation owned 40,000 shares of Somehow I Manage Corporation. These shares were purchased in 2014 for $360,000. On November 15, 2018, Michael Scott declared a property dividend of one share of Somehow I Manage for every ten shares of Michael Scott held by a stockholder. On that date, when the market price of Somehow I Manage was $28 per share, there were 360,000 shares of Michael Scott outstanding. What gain and net reduction in retained earnings would result from this property dividend? Gain Net Reduction in Retained Earnings a. $0 $ 324,000 b. $0 $1,008,000 C. $684,000 $ 144,000 d. $684,000 $ 324,000 Use the following information for questions 7 and 8. Paul Pierce Incorporated is a retail store operating in a state with a 7% retail sales tax. The retailer may keep 2% of the sales tax collected. Paul Pierce Incorporated records the sales tax in the Sales Revenue account. The amount recorded in the Sales Revenue account during July was $251,450. 7. The amount of sales taxes (to the nearest dollar) for July is $20,762 $16,450 $22,631. d. $17,602 a b. c. 8. The amount of sales taxes payable (to the nearest dollar) to the state for the month of July is a $12,573. b. $16,121. C $20,762 d. $17.250. 9 In recent year Rick-Rolled LLC, Inc. had net income of $500,000, interest expense of $100,000, and a times interest earned ratio of 9. What was Rick Rolled LLC, Inc.'s income before taxes for the year? a $1,000,000 b. $900,000 $800,000 d. None of these answers are correct. C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts