Question: Answer all the questions. (5&6) 5. I have given you some data about two different stocks. E(R) = 10 0 = 10 W. = 25

Answer all the questions. (5&6)

Answer all the questions. (5&6)

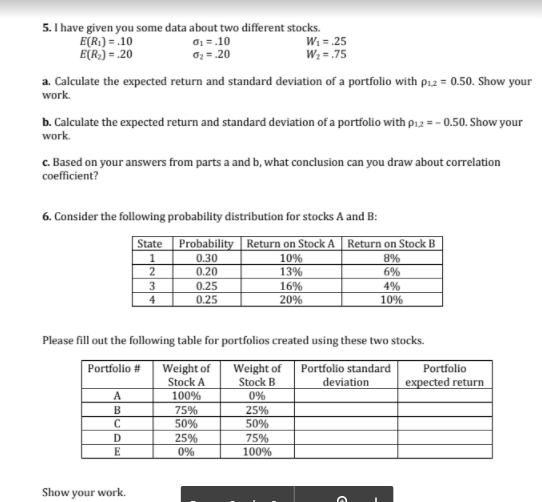

5. I have given you some data about two different stocks. E(R) = 10 0 = 10 W. = 25 E[R.) = 20 0.20 W = .75 a. Calculate the expected return and standard deviation of a portfolio with P12 = 0.50. Show your work. b. Calculate the expected return and standard deviation of a portfolio with P12 = -0.50. Show your work c. Based on your answers from parts a and b, what conclusion can you draw about correlation coefficient? 6. Consider the following probability distribution for stocks A and B: State Probability Return on Stock A Return on Stock B 1 0.30 10% 8% 2 0.20 13% 6% 3 0.25 16% 4% 4 0.25 20% 10% Please fill out the following table for portfolios created using these two stocks. Portfolio # Weight of Weight of Portfolio standard Portfolio Stock A Stock B deviation expected return A 100% 0% B 75% 25% 50% 50% D 25% 75% E 0% 100% Show your work. C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts