Question: answer all the questions correctly for a like. Question 8 (1 point) Which one of the following is the computation of the risk premium for

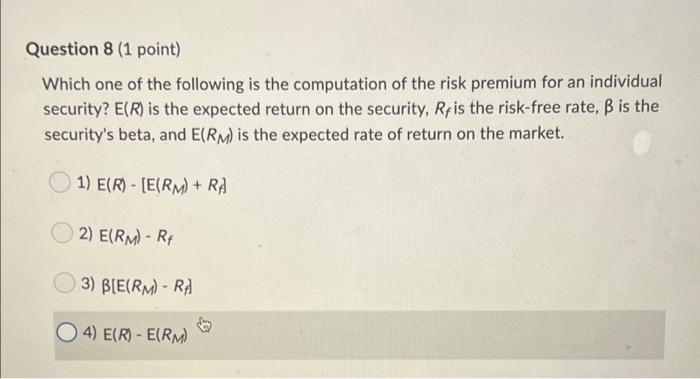

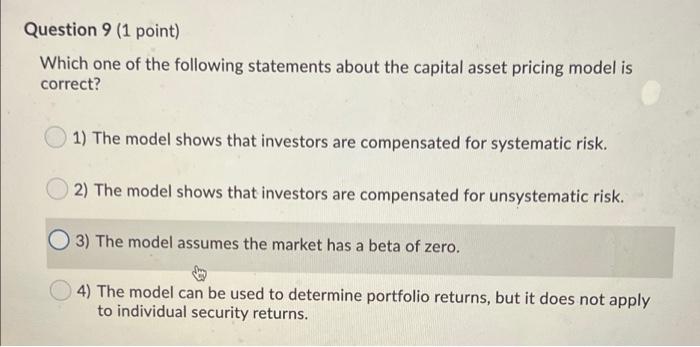

Question 8 (1 point) Which one of the following is the computation of the risk premium for an individual security? E(R) is the expected return on the security, Rt is the risk-free rate, B is the security's beta, and E(RM) is the expected rate of return on the market. 1) E(R) - [E(RM) + RA 2) E(RM) - RF 3) BIE(RM) - RA O4) E(R) - E(RM) Question 9 (1 point) Which one of the following statements about the capital asset pricing model is correct? 1) The model shows that investors are compensated for systematic risk. 2) The model shows that investors are compensated for unsystematic risk. 3) The model assumes the market has a beta of zero. 4) The model can be used to determine portfolio returns, but it does not apply to individual security returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts