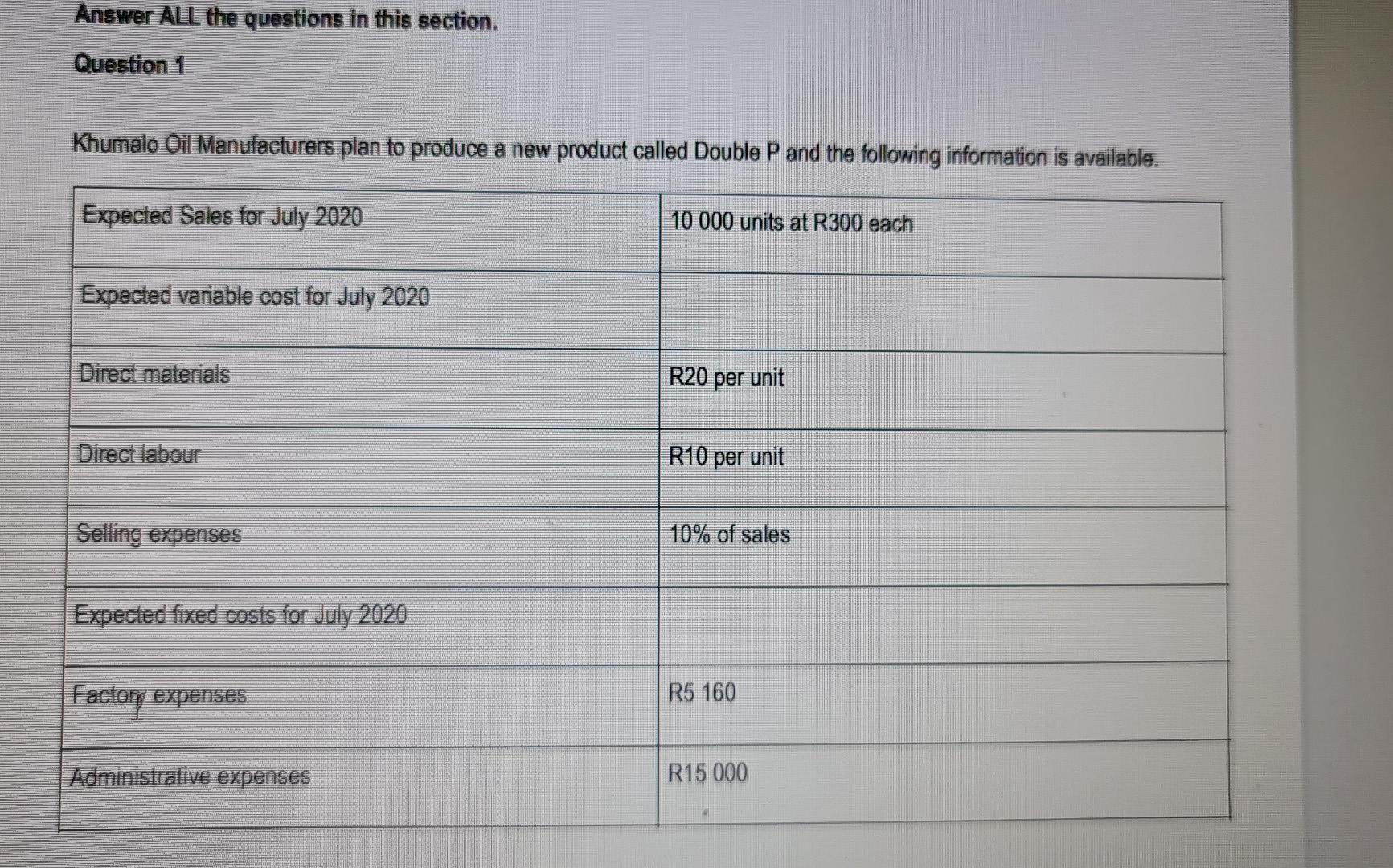

Question: Answer ALL the questions in this section. Question 1 Khumalo Oil Manufacturers plan to produce a new product called Double P and the following

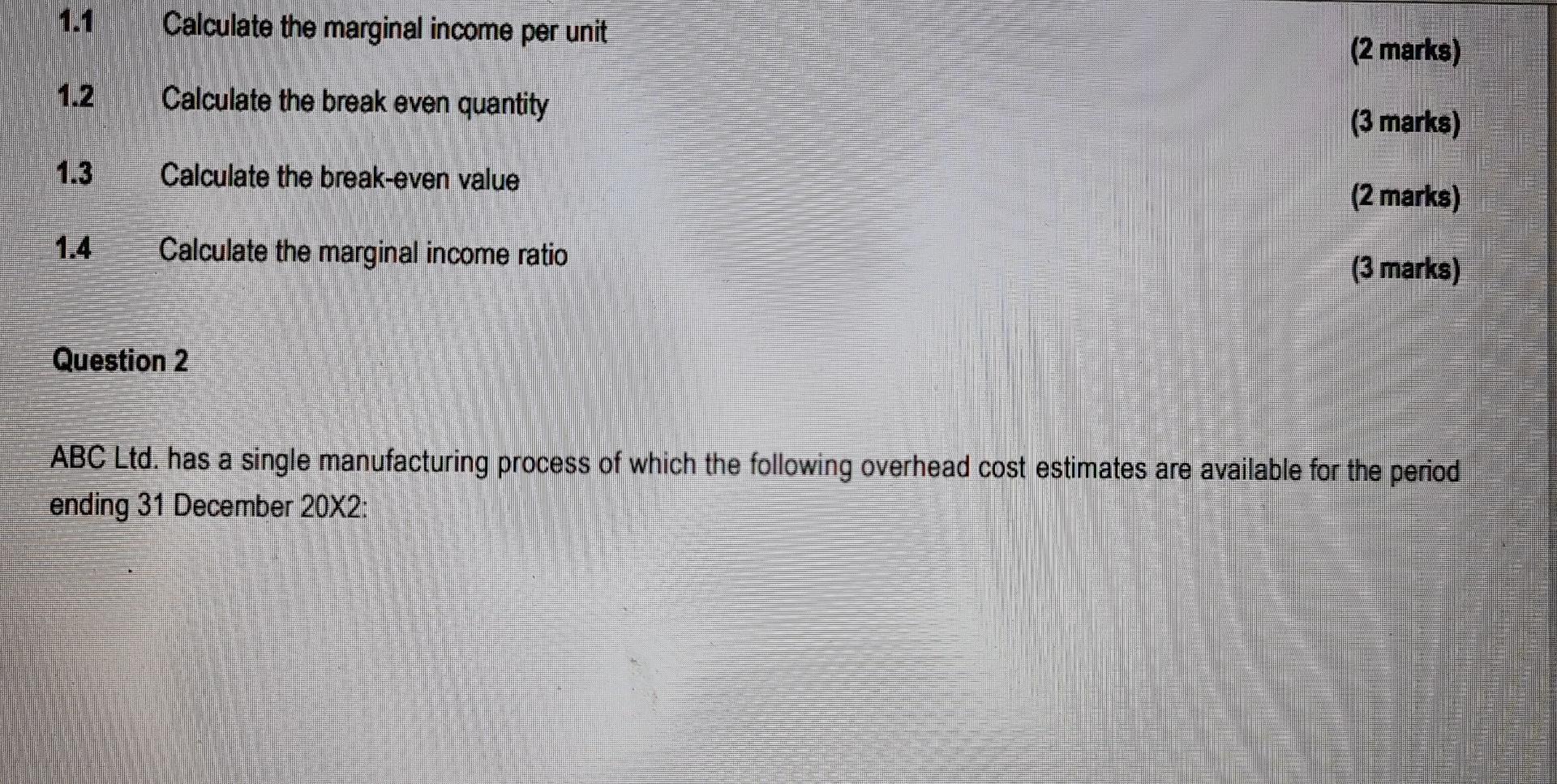

Answer ALL the questions in this section. Question 1 Khumalo Oil Manufacturers plan to produce a new product called Double P and the following information is available. Expected Sales for July 2020 10 000 units at R300 each Expected variable cost for July 2020 Direct materials R20 per unit Direct labour R10 per unit Selling expenses 10% of sales Expected fixed costs for July 2020 R5 160 Factory expenses Administrative expenses R15 000 1.1 Calculate the marginal income per unit (2 marks) 1.2 Calculate the break even quantity (3 marks) 1.3 Calculate the break-even value (2 marks) 1.4 Calculate the marginal income ratio (3 marks) Question 2 ABC Ltd. has a single manufacturing process of which the following overhead cost estimates are available for the period ending 31 December 20X2:

Step by Step Solution

3.36 Rating (146 Votes )

There are 3 Steps involved in it

A 11 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 14 24 A 1 11 2 3 4 5 6 7 8 9 10 ... View full answer

Get step-by-step solutions from verified subject matter experts