Question: answer ALL the questions please 4. Fund Management (TOTAL 10 MARKS) a) Managed funds are often categorised by the type of investments purchased by the

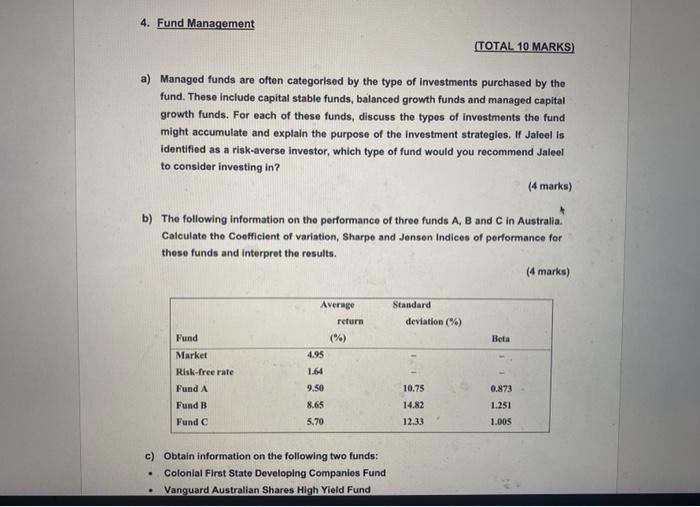

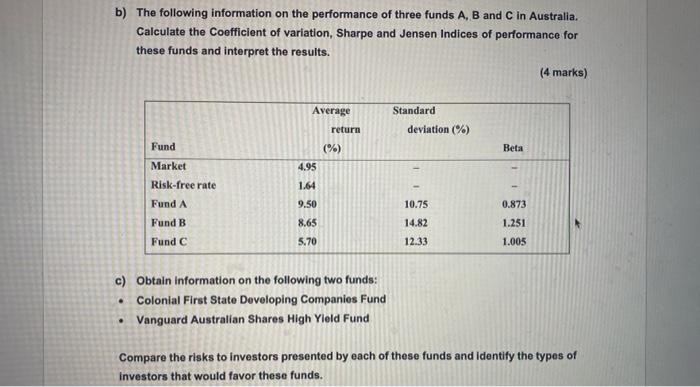

4. Fund Management (TOTAL 10 MARKS) a) Managed funds are often categorised by the type of investments purchased by the fund. These include capital stable funds, balanced growth funds and managed capital growth funds. For each of these funds, discuss the types of investments the fund might accumulate and explain the purpose of the investment strategies. If Jaleel is identified as a risk-averse investor, which type of fund would you recommend Jaleel to consider investing in? (4 marks) b) The following information on the performance of three funds A, B and C in Australia. Calculate the Coefficient of variation, Sharpe and Jensen Indices of performance for these funds and interpret the results. (4 marks) Average Standard deviation (%) Fund Market 4.95 Risk-free rate 1.64 Fund A 9.50 10.75 Fund B 8.65 14.82 Fund C 5.70 12.33 c) Obtain information on the following two funds: . Colonial First State Developing Companies Fund Vanguard Australian Shares High Yield Fund return (%) Beta 0.873 1.251 1.005 b) The following information on the performance of three funds A, B and C in Australia. Calculate the Coefficient of variation, Sharpe and Jensen Indices of performance for these funds and interpret the results. (4 marks) Average Standard deviation (%) Fund Beta Market 4.95 Risk-free rate 1.64 Fund A 9.50 10.75 0.873 Fund B 8.65 14.82 1.251 Fund C 5.70 12.33 1.005 c) Obtain information on the following two funds: Colonial First State Developing Companies Fund . Vanguard Australian Shares High Yield Fund Compare the risks to investors presented by each of these funds and identify the types of investors that would favor these funds. return (%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts