Question: Answer all the questions relating to the case study in the picture. Thanks in Advance. 1. Calculate the current dollar cost of this interest payment!

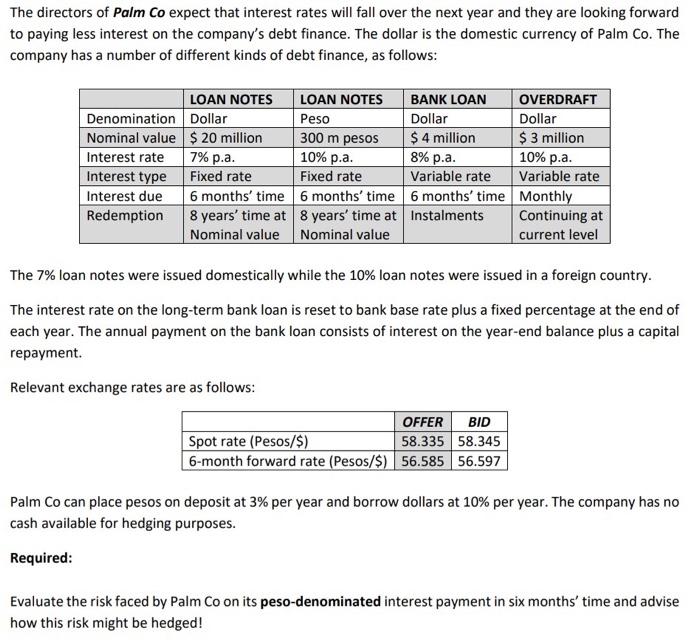

The directors of Palm Co expect that interest rates will fall over the next year and they are looking forward to paying less interest on the company's debt finance. The dollar is the domestic currency of Palm Co. The company has a number of different kinds of debt finance, as follows: LOAN NOTES LOAN NOTES BANK LOAN OVERDRAFT Denomination Dollar Peso Dollar Dollar Nominal value $ 20 million 300 m pesos $ 4 million $ 3 million Interest rate 7% p.a. 10% p.a. 8% p.a. 10% p.a. Interest type Fixed rate Fixed rate Variable rate Variable rate Interest due 6 months' time 6 months' time 6 months' time Monthly Redemption 8 years' time at 8 years' time at Instalments Continuing at Nominal value Nominal value current level The 7% loan notes were issued domestically while the 10% loan notes were issued in a foreign country. The interest rate on the long-term bank loan is reset to bank base rate plus a fixed percentage at the end of each year. The annual payment on the bank loan consists of interest on the year-end balance plus a capital repayment. Relevant exchange rates are as follows: OFFER BID Spot rate (Pesos/$) 58.335 58.345 6-month forward rate (Pesos/$) 56.585 56.597 Palm Co can place pesos on deposit at 3% per year and borrow dollars at 10% per year. The company has no cash available for hedging purposes. Required: Evaluate the risk faced by Palm Co on its peso-denominated interest payment in six months' time and advise how this risk might be hedged! The directors of Palm Co expect that interest rates will fall over the next year and they are looking forward to paying less interest on the company's debt finance. The dollar is the domestic currency of Palm Co. The company has a number of different kinds of debt finance, as follows: LOAN NOTES LOAN NOTES BANK LOAN OVERDRAFT Denomination Dollar Peso Dollar Dollar Nominal value $ 20 million 300 m pesos $ 4 million $ 3 million Interest rate 7% p.a. 10% p.a. 8% p.a. 10% p.a. Interest type Fixed rate Fixed rate Variable rate Variable rate Interest due 6 months' time 6 months' time 6 months' time Monthly Redemption 8 years' time at 8 years' time at Instalments Continuing at Nominal value Nominal value current level The 7% loan notes were issued domestically while the 10% loan notes were issued in a foreign country. The interest rate on the long-term bank loan is reset to bank base rate plus a fixed percentage at the end of each year. The annual payment on the bank loan consists of interest on the year-end balance plus a capital repayment. Relevant exchange rates are as follows: OFFER BID Spot rate (Pesos/$) 58.335 58.345 6-month forward rate (Pesos/$) 56.585 56.597 Palm Co can place pesos on deposit at 3% per year and borrow dollars at 10% per year. The company has no cash available for hedging purposes. Required: Evaluate the risk faced by Palm Co on its peso-denominated interest payment in six months' time and advise how this risk might be hedged

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts