Question: Answer all the required question for a rate. Please show the solutions. Problem 1 On April 30, 2017. Pop Corporation issued 30,000 shares of its

Answer all the required question for a rate. Please show the solutions.

Answer all the required question for a rate. Please show the solutions.

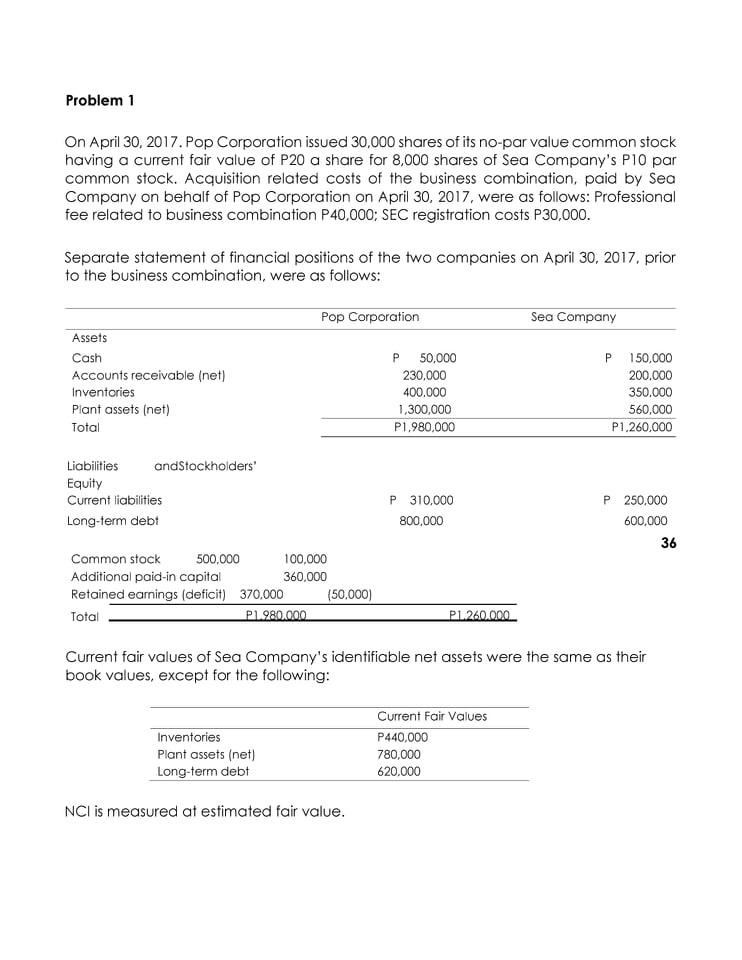

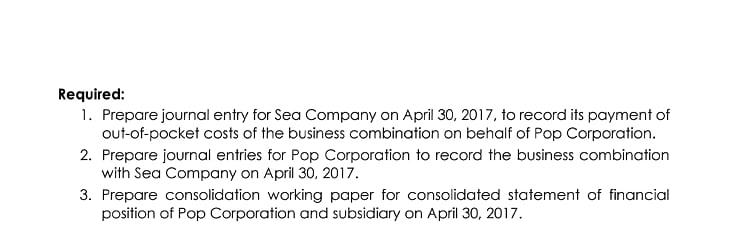

Problem 1 On April 30, 2017. Pop Corporation issued 30,000 shares of its no par value common stock having a current fair value of P20 a share for 8,000 shares of Sea Company's P10 par common stock. Acquisition related costs of the business combination, paid by Sea Company on behalf of Pop Corporation on April 30, 2017, were as follows: Professional fee related to business combination P40,000; SEC registration costs P30,000. Separate statement of financial positions of the two companies on April 30, 2017. prior to the business combination, were as follows: Pop Corporation Sea Company Assets Cash Accounts receivable (net) Inventories Plant assets (net) Total P50,000 230,000 400.000 1,300,000 P1.980,000 P 150.000 200.000 350.000 560,000 P1.260,000 Liabilities andStockholders' Equity Current liabilities Long-term debt P 310.000 800,000 P250,000 600,000 36 Common stock 500,000 100.000 Additional paid-in capital 360,000 Retained earnings (deficit) 370,000 (50,000) Total P2.980.000 PL 260.000 Current fair values of Sea Company's identifiable net assets were the same as their book values, except for the following: Inventories Plant assets (net) Long-term debt Current Fair Values P440,000 780,000 620.000 NCI is measured at estimated fair value. Required: 1. Prepare journal entry for Sea Company on April 30, 2017, to record its payment of out-of-pocket costs of the business combination on behalf of Pop Corporation. 2. Prepare journal entries for Pop Corporation to record the business combination with Sea Company on April 30, 2017. 3. Prepare consolidation working paper for consolidated statement of financial position of Pop Corporation and subsidiary on April 30, 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts