Question: answer all these questions please i will give you a like in return :) Required information Exerclse 7.7A (Algo) Effect of recognizing uncollectlble accounts on

![[The followng information applles to the questions displayed below.] Leach Incorporated experlenced](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6718cae95e379_0566718cae8cd90b.jpg)

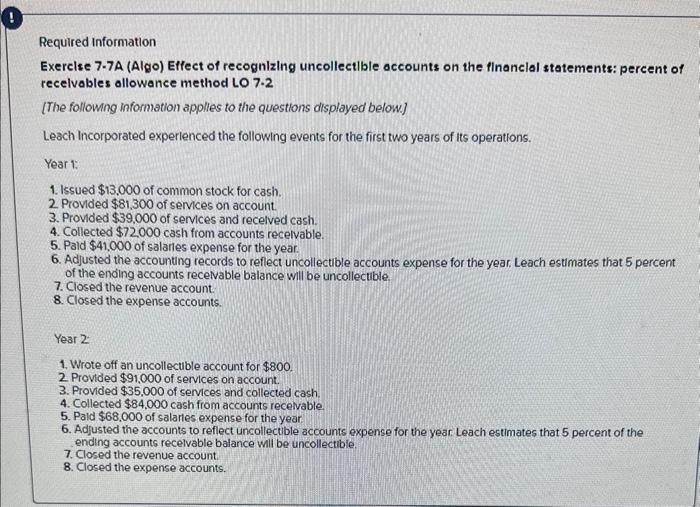

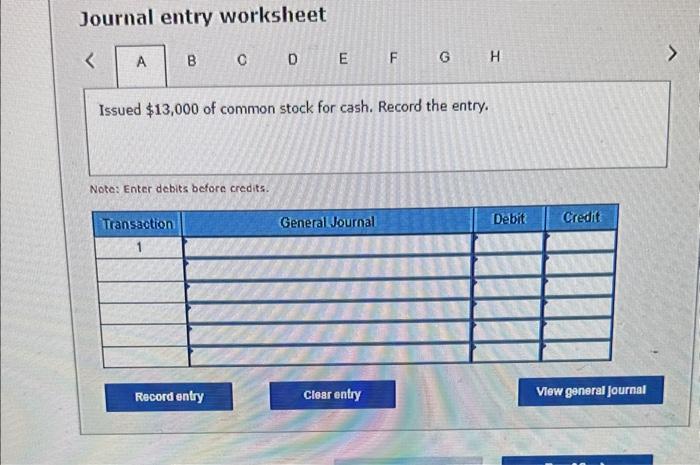

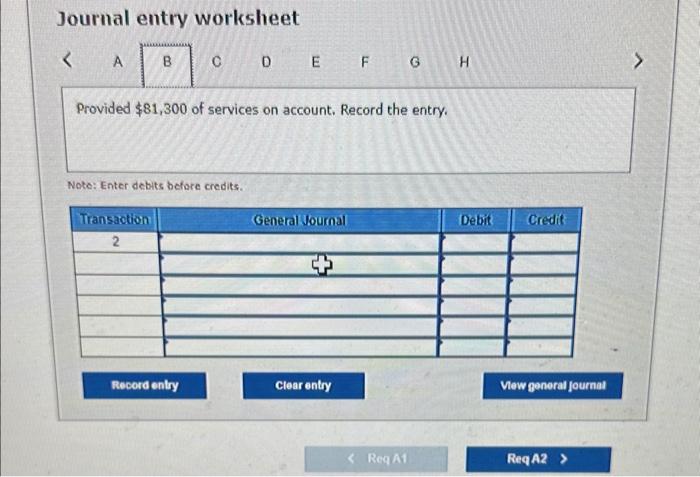

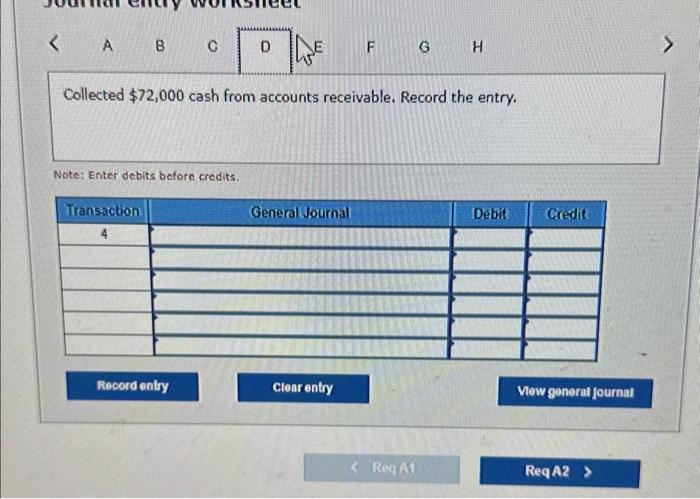

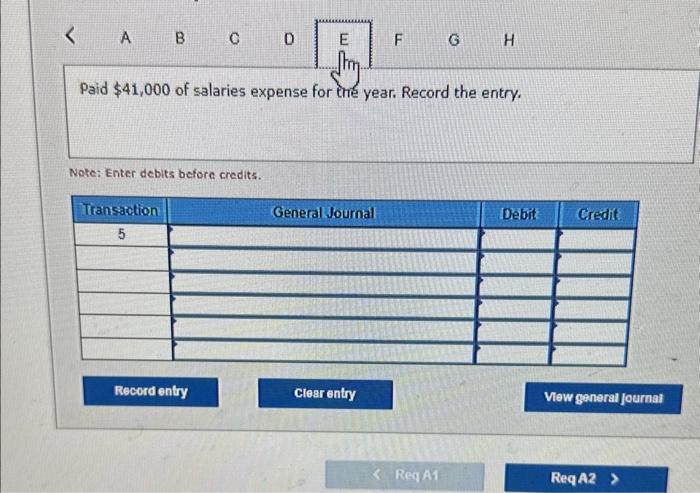

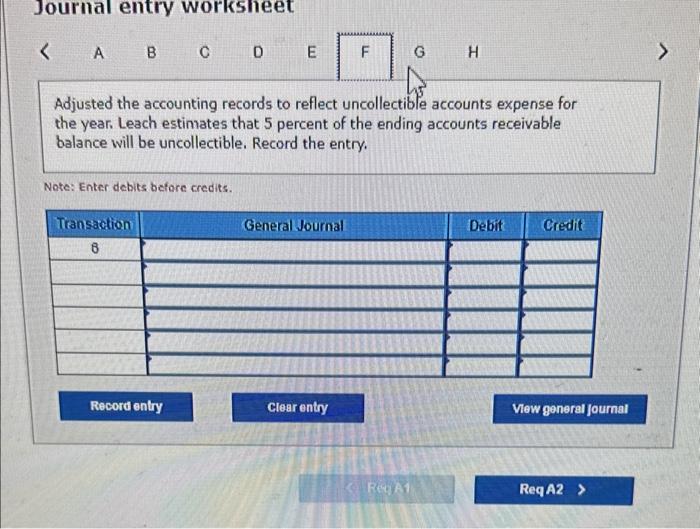

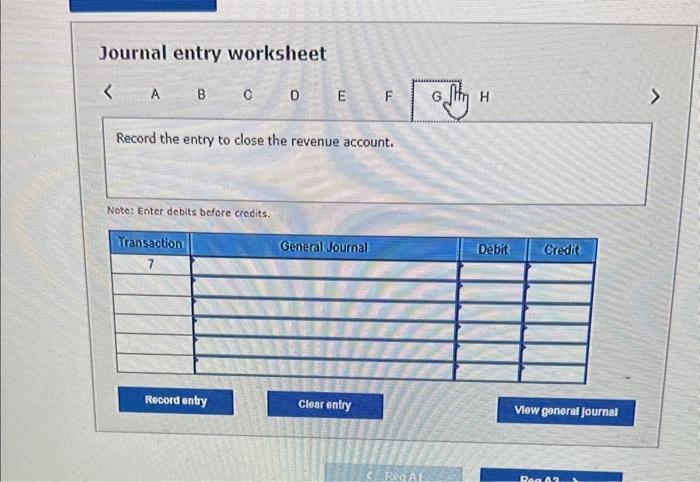

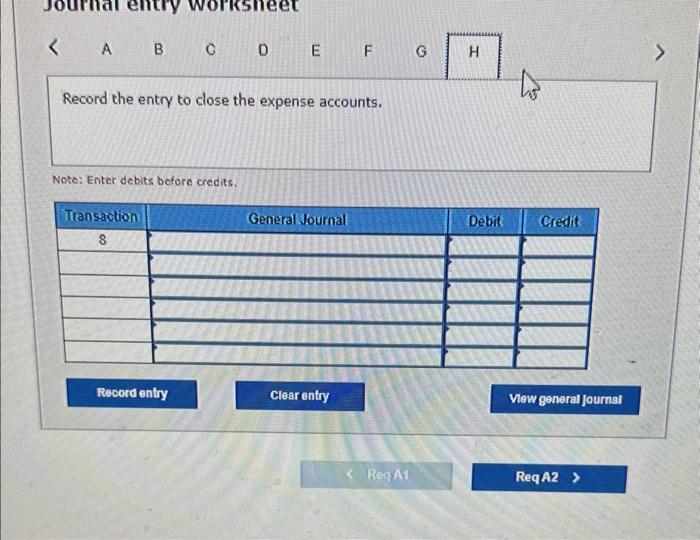

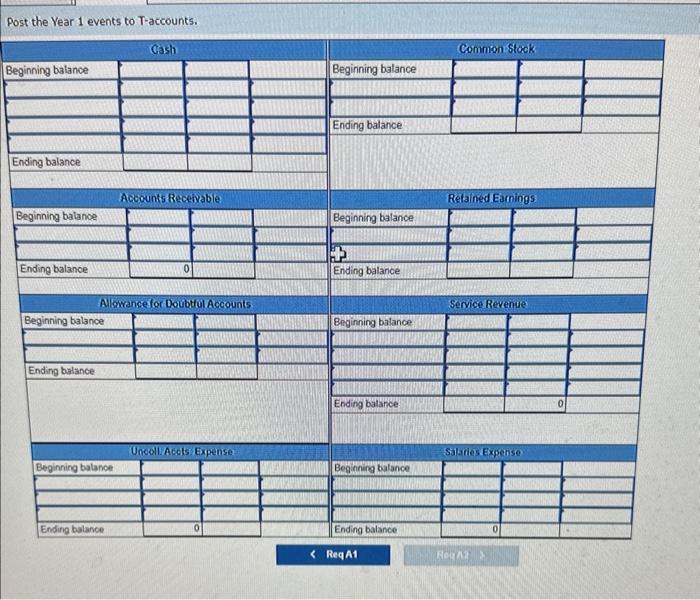

Required information Exerclse 7.7A (Algo) Effect of recognizing uncollectlble accounts on the flnanclal statements: percent of recelvables allowance method LO 7.2 [The followng information applles to the questions displayed below.] Leach Incorporated experlenced the following events for the first two years of its operations. Year 1: 1. Issued $13,000 of common stock for cash. 2 Provided $81,300 of services on account. 3. Provided $39,000 of services and recelved cash. 4. Collected $72000 cash from accounts recelvable. 5. Pald $41,000 of salarles expense for the year. 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 5 percent of the ending accounts recenable balance will be uncollectible. 7. Closed the revenue account. 8. Closed the expense accounts. Year 2 1. Wrote off an uncollecuble account for $800. 2 Provided $91,000 of services on account. 3. Provided $35,000 of services and collected cash. 4. Collected $84,000 cash from accounts receivable. 5. Paid $68,000 of salarles expense for the year: 6. Adjusted the accounts to reflect uncollectible accounts expense for the year Leach estimates that 5 percent of the ending accounts recelvable balance will be uncollectible. 7. Closed the revenue account. 8. Closed the expense accounts. Journal entry worksheet Issued $13,000 of common stock for cash. Record the entry. Note: Enter debits before credits. Journal entry worksheet Provided $81,300 of services on account. Record the entry. Note: Enter debits before credits. Journal entry worksheet Provided $39,000 of services and received cash. Record the entry. Note: Enter debits before credits. Collected $72,000 cash from accounts receivable. Record the entry. Note: Enter debits before credits. Paid $41,000 of salaries expense for the year. Record the entry. Note: Enter debits before credits. Journal entry worksheet Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 5 percent of the ending accounts receivable balance will be uncollectible. Record the entry. Note: Enter debits before credits. Journal entry worksheet Record the entry to close the revenue account. Note: Enter debits before credits. A B C E F Record the entry to close the expense accounts. Note: Enter debits before credits. Pos

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts