Question: Answer all these questions. When inputting an answer, round your answer to the nearest 2 decimal places. If you need to use a calculated number

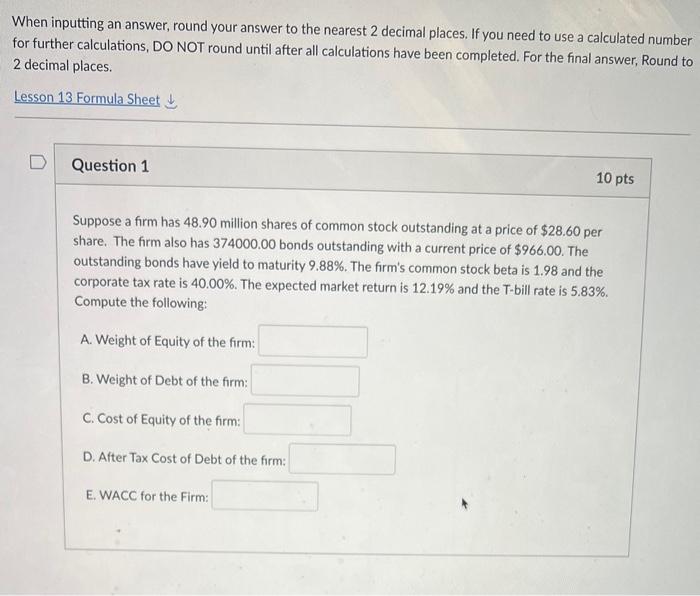

When inputting an answer, round your answer to the nearest 2 decimal places. If you need to use a calculated number for further calculations, DO NOT round until after all calculations have been completed. For the final answer, Round to 2 decimal places. Question 1 Suppose a firm has 48.90 million shares of common stock outstanding at a price of $28.60 per share. The firm also has 374000.00 bonds outstanding with a current price of $966.00. The outstanding bonds have yield to maturity 9.88%. The firm's common stock beta is 1.98 and the corporate tax rate is 40.00%. The expected market return is 12.19% and the T-bill rate is 5.83%. Compute the following: A. Weight of Equity of the firm: B. Weight of Debt of the firm: C. Cost of Equity of the firm: D. After Tax Cost of Debt of the firm: E. WACC for the Firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts