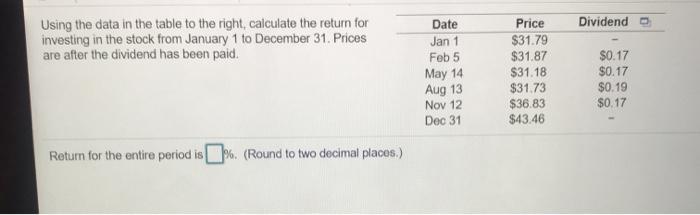

Question: Answer all three clearly please. I keep getting wrong amswers. Please answer questions i keep getting wrong answers Dividend Using the data in the table

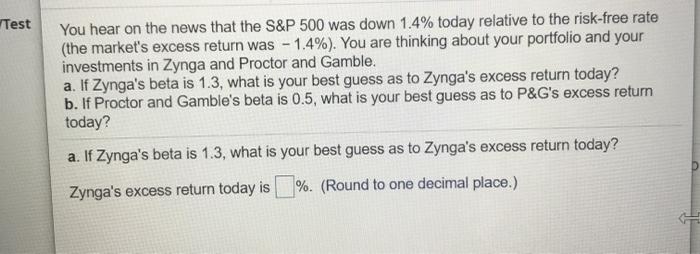

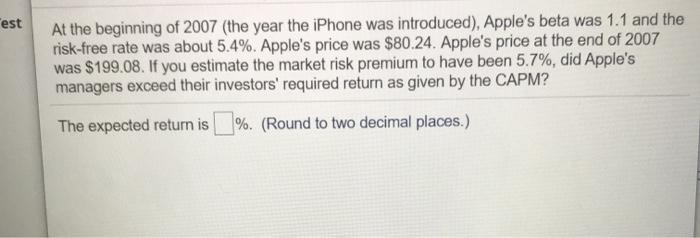

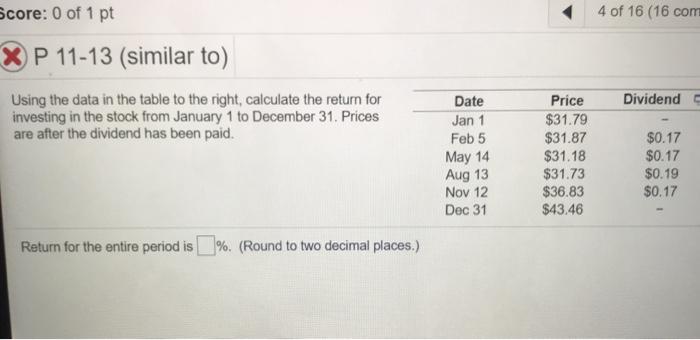

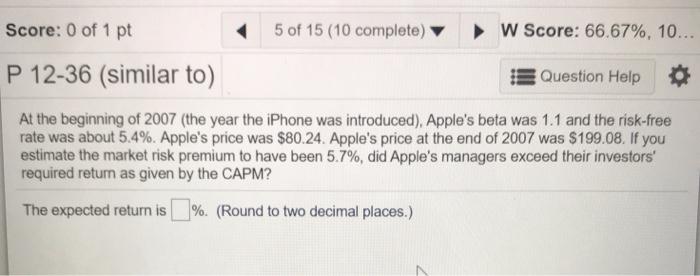

Dividend Using the data in the table to the right, calculate the return for investing in the stock from January 1 to December 31. Prices are after the dividend has been paid. Date Jan 1 Feb 5 May 14 Aug 13 Nov 12 Dec 31 Price $31.79 $31.87 $31.18 $31.73 $36.83 $43.46 $0.17 $0.17 $0.19 $0.17 Return for the entire period is % (Round to two decimal places.) Test You hear on the news that the S&P 500 was down 1.4% today relative to the risk-free rate (the market's excess return was - 1.4%). You are thinking about your portfolio and your investments in Zynga and Proctor and Gamble. a. If Zynga's beta is 1.3, what is your best guess as to Zynga's excess return today? b. If Proctor and Gamble's beta is 0.5, what is your best guess as to P&G's excess return today? a. If Zynga's beta is 1.3, what is your best guess as to Zynga's excess return today? Zynga's excess return today is %. (Round to one decimal place.) 4 of 16 (16 com Score: 0 of 1 pt XP 11-13 (similar to) Dividend Using the data in the table to the right, calculate the return for investing in the stock from January 1 to December 31. Prices are after the dividend has been paid. Date Jan 1 Feb 5 May 14 Aug 13 Nov 12 Dec 31 Price $31.79 $31.87 $31.18 $31.73 $36.83 $43.46 $0.17 $0.17 $0.19 $0.17 Return for the entire period is %. (Round to two decimal places.) Score: 0 of 1 pt 5 of 15 (10 complete) W Score: 66.67%, 10... P 12-36 (similar to) Question Help At the beginning of 2007 (the year the iPhone was introduced), Apple's beta was 1.1 and the risk-free rate was about 5.4%. Apple's price was $80.24. Apple's price at the end of 2007 was $199.08. If you estimate the market risk premium to have been 5.7%, did Apple's managers exceed their investors' required retum as given by the CAPM? The expected return is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts