Question: Answer all three correct along with correct reasoning to get thumbs up!! 12. A company uses the cost model for non-current assets and is considering

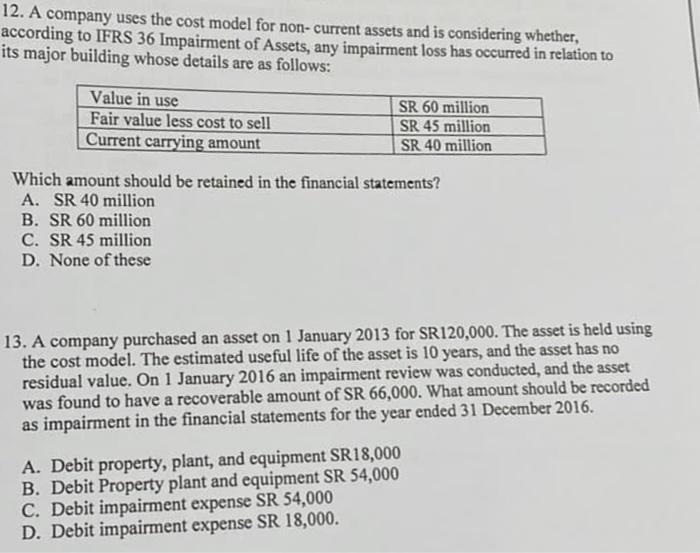

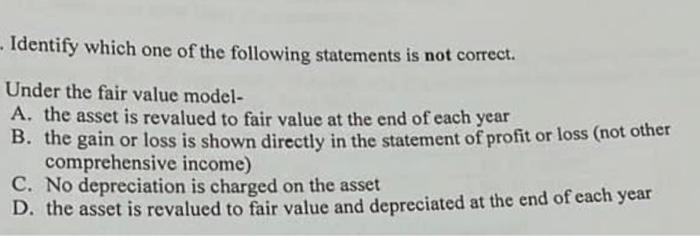

12. A company uses the cost model for non-current assets and is considering whether, according to IFRS 36 Impairment of Assets, any impairment loss has occurred in relation to its major building whose details are as follows: Value in use SR 60 million Fair value less cost to sell SR 45 million Current carrying amount SR 40 million Which amount should be retained in the financial statements? A. SR 40 million B. SR 60 million C. SR 45 million D. None of these 13. A company purchased an asset on 1 January 2013 for SR120,000. The asset is held using the cost model. The estimated useful life of the asset is 10 years, and the asset has no residual value. On 1 January 2016 an impairment review was conducted, and the asset was found to have a recoverable amount of SR 66,000. What amount should be recorded as impairment in the financial statements for the year ended 31 December 2016. A. Debit property, plant, and equipment SR18,000 B. Debit Property plant and equipment SR 54,000 C. Debit impairment expense SR 54,000 D. Debit impairment expense SR 18,000. - Identify which one of the following statements is not correct. Under the fair value model- A. the asset is revalued to fair value at the end of each year B. the gain or loss is shown directly in the statement of profit or loss (not other comprehensive income) C. No depreciation is charged on the asset D. the asset is revalued to fair value and depreciated at the end of each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts