Question: answer all three requirements please , ive already uses chegg for these and it was still wrong. thank you, will rate asap Feather Friends, Incorporated,

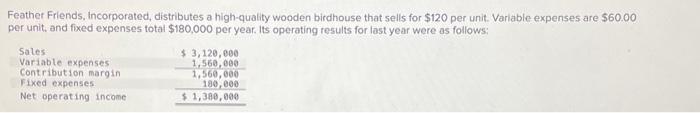

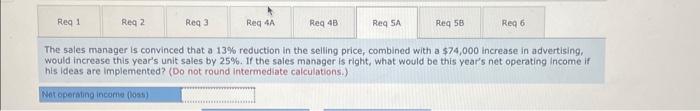

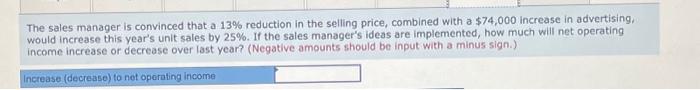

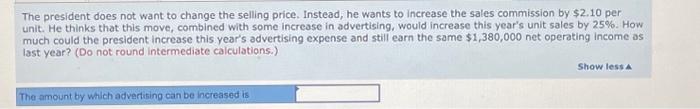

Feather Friends, Incorporated, distributes a high-quality wooden birdhouse that sells for $120 per unit. Variable expenses are $60.00 ser unit, and fixed expenses total $180,000 per year. Its operating results for last year were as follows: The sales menager is convinced that a 13% reduction in the selling price, combined with a $74,000 increase in advertising, would increase this year's unit sales by 25%. If the sales manager is right, what would be this year's net operating income if his ldeas are implemented? (Do not round intermediate calculations.) The sales manager is convinced that a 13% reduction in the selling price, combined with a $74,000 increase in advertising, would increase this year's unit sales by 25%. If the sales manager's ideas are implemented, how much will net operating income increase or decrease over last year? (Negative amounts should be input with a minus sign.) The president does not want to change the selling price, Instead, he wants to increase the sales commission by $2.10 per unit. He thinks that this move, combined with some increase in advertising, would increase this year's unit sales by 25%. How much could the president increase this year's advertising expense and still earn the same $1,380,000 net operating income as last year? (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts